Speak directly to the analyst to clarify any post sales queries you may have.

MARKET TRENDS & OPPORTUNITIES

Growing Popularity for Modern Architecture

The growing popularity of modern architecture is a key driver for expanding the global curtain wall market. Modern architectural trends prioritize sleek, transparent, and energy-efficient designs, and curtain walls align seamlessly with these preferences. These non-structural façades enhance aesthetic appeal by allowing natural light, providing expansive views, and incorporating innovative design elements. Additionally, curtain walls contribute to sustainable building practices, offering energy efficiency and thermal performance solutions. As architects and developers increasingly embrace contemporary designs, the demand for curtain walls rises, fueling the growth of the global market as it becomes an integral component of modern building construction.Rising Disposable Income

The rising disposable income worldwide plays a pivotal role in propelling the growth of the global curtain wall market. With increased affluence, there is a heightened demand for aesthetically pleasing and technologically advanced buildings, both in the residential and commercial sectors. Higher disposable income allows individuals and businesses to invest in modern architectural designs that often incorporate curtain walls for their sleek and sophisticated appearance. Moreover, the preference for energy-efficient and visually appealing structures aligns with the features offered by curtain walls, making them a popular choice in construction projects catering to a more financially empowered clientele. As a result, global affluence contributes significantly to the increasing adoption of curtain walls in construction endeavors.INDUSTRY RESTRAINTS

High Upfront Cost

The high upfront cost associated with installing curtain walls is a significant constraint on the growth of the global curtain wall market. While curtain walls offer long-term benefits such as energy efficiency and enhanced aesthetics, the initial investment required for materials, engineering, and installation can be substantial. This financial barrier can dissuade some construction projects, particularly those with budget constraints, from opting for curtain wall systems. Despite the long-term advantages, the high upfront costs may limit the widespread adoption of curtain walls, hindering the market's growth and accessibility, especially in regions or sectors where cost considerations are paramount in decision-making, such as the APAC region.SEGMENTATION INSIGHTS

INSIGHTS BY MATERIAL

The global curtain wall market by material is segmented into glass, metal, stone, and composite. Glass dominates the market, holding a share of over 55% due to its transparency, aesthetic appeal, and ability to contribute to energy efficiency. Metal, particularly aluminum, remains widely used for its lightweight properties and durability. Stone curtain walls, though less common, provide a distinctive aesthetic and are chosen for high-end projects. Composite materials, combining elements like fiberglass and carbon fiber, are gaining traction due to their versatility and ability to balance strength and weight. Thus, the composite subsegment is expected to grow at the highest CAGR of 7%-8%. The market's material segmentation balances aesthetic preferences, performance requirements, and sustainability considerations, offering diverse options to cater to the evolving needs of the construction industry globally.Segmentation by Material

- Glass

- Metal

- Stone

- Composite

INSIGHTS BY INSTALLATION

The unitized systems installation segment dominated the global curtain wall market in 2023. The growth trajectory of the unitized curtain walls segment is marked by several key factors, emphasizing efficiency, cost-effectiveness, and a projected surge in demand, particularly in regions where rapid and large-scale construction is prevalent. Furthermore, a primary advantage of unitized curtain walls is the efficiency of their installation process. Factory assembly of curtain wall units allows for off-site fabrication and on-site installation, drastically reducing construction timelines. Large sections of the curtain wall can be installed simultaneously, providing a streamlined approach to construction. This efficiency is especially advantageous for projects with ambitious timelines, contributing to the growth of the unitized curtain walls segment.Segmentation by Installation

- Unitized

- Stick-built

- Semi-unitized

INSIGHTS BY END-USER

The global curtain wall market by end-users is segmented into commercial and residential. A primary catalyst propelling the growth of commercial curtain walls is the heightened emphasis on corporate branding and aesthetics. In retail, buildings serve as potent visual representations of a company's identity and values. The sleek, modern, and customizable facades offered by curtain walls become a crucial element in shaping the external image of commercial structures. As businesses increasingly focus on creating distinctive brand identities, the demand for aesthetically pleasing and customizable curtain wall solutions is anticipated to experience substantial growth.Segmentation by End-user

- Commercial

- Residential

INSIGHTS BY APPLICATION

The global curtain wall market by application is segmented into new construction and retrofit. New construction holds a majority share, and the market experiences substantial growth driven by the global urbanization and infrastructure development boom, where architects and builders prioritize innovative facade solutions for contemporary structures. However, the retrofit segment is also gaining prominence. It thus is expected to grow substantially at a higher CAGR of over 7.5% as existing structures seek upgrades for energy efficiency, aesthetics, and compliance with modern building standards. The versatility of curtain walls in addressing the distinct needs of both new and retrofit applications supports their widespread adoption in the construction industry, contributing to the overall expansion of the market.Segmentation by Application

- New Construction

- Retrofit

GEOGRAPHICAL ANALYSIS

North America holds the most prominent global curtain wall market share, accounting for over 35% of 2023 global revenue. The market in North America is a dynamic and evolving landscape shaped by a blend of innovative design, technological advancements, and a commitment to energy efficiency. From the towering skyscrapers of New York City to the sleek urban developments of Toronto, the demand for curtain wall systems in North America is characterized by a pursuit of both architectural excellence and sustainability. Further, a notable trend in the North American curtain wall industry is the increasing adoption of high-performance, energy-efficient designs. The One World Trade Center in New York City exemplifies this trend with its state-of-the-art curtain wall system. North American cities are increasingly focusing on curtain walls that enhance the aesthetic appeal of structures and contribute to LEED certifications and energy conservation efforts, aligning with the continent's emphasis on sustainable construction.Segmentation by Geography

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Italy

- Spain

- Russia

- Rest of Europe

- APAC

- China

- India

- Indonesia

- Japan

- South Korea

- Australia

- Singapore

- Rest of APAC

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Kuwait

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

COMPETITIVE LANDSCAPE

The global curtain wall market features a competitive landscape of key players striving for market dominance. Prominent companies such as Arconic, Schüco International, HansenGroup, and many others are notable contributors to the industry. These players emphasize technological innovation, sustainable solutions, and strategic partnerships to gain a competitive edge. The global curtain wall market is characterized by a mix of established multinational firms and regional players catering to diverse construction needs. Intense competition prompts continuous advancements in design, materials, and performance attributes, focusing on meeting the evolving demands for energy efficiency, aesthetics, and structural integrity. Factors like product differentiation, pricing strategies, and a keen responsiveness to regional market requirements further shape the competitive dynamics. Overall, the global curtain wall market remains dynamic, with critical players striving for industry share through innovation and strategic initiatives.Key Company Profiles

- Alumil

- Apogee Enterprises

- Arconic

- HansenGroup

- Reynaers Group

- Schüco International

Other Prominent Vendors

- ALUK

- Aluprof

- APA Facade Systems

- Fangda Group

- Comar Architectural Aluminium Systems

- EFCO

- Elicc Group

- Enclos

- Forster Profile Systems

- James Glass & Aluminium

- Hwarrior Curtain Wall & Decoration Engineering (Guangdong)

- Jangho Creation Group

- Shandong Jinxiang Aluminum Group

- Oldcastle BuildingEnvelope

- Permasteelisa

- Ponzio

- RAICO Bautechnik

- TOSTEM India

- VirtualExpo Group

- WICONA

- YKK

KEY QUESTIONS ANSWERED:

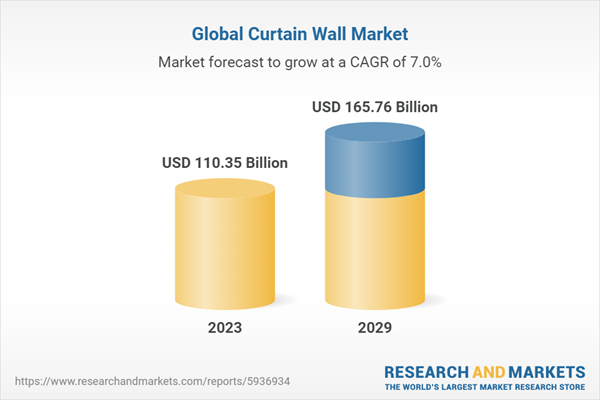

1. How big is the curtain wall market?2. What is the growth rate of the global curtain wall market?

3. Which region dominates the global curtain wall market share?

4. What are the significant trends in the curtain wall industry?

5. Who are the key players in the global curtain wall market?

Table of Contents

Companies Mentioned

- Alumil

- Apogee Enterprises

- Arconic

- HansenGroup

- Reynaers Group

- Schüco International

- ALUK

- Aluprof

- APA Facade Systems

- Fangda Group

- Comar Architectural Aluminium Systems

- EFCO

- Elicc Group

- Enclos

- Forster Profile Systems

- James Glass & Aluminium

- Hwarrior Curtain Wall & Decoration Engineering (Guangdong)

- Jangho Creation Group

- Shandong Jinxiang Aluminum Group

- Oldcastle BuildingEnvelope

- Permasteelisa

- Ponzio

- RAICO Bautechnik

- TOSTEM India

- VirtualExpo Group

- WICONA

- YKK

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 300 |

| Published | February 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 110.35 Billion |

| Forecasted Market Value ( USD | $ 165.76 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |