Global Aerospace Additive Manufacturing Market - Key Trends & Drivers Summarized

What Materials Power Aerospace Additive Manufacturing?

Aerospace additive manufacturing is redefining the design and production of aerospace components by leveraging advanced materials. Metal alloy materials, such as titanium and nickel-based superalloys, are at the forefront due to their high strength-to-weight ratio and exceptional performance in extreme conditions. These alloys are critical for engine parts and structural components in aircraft and spacecraft. Plastic materials, including high-performance thermoplastics like PEEK and PEKK, provide lightweight alternatives for less load-bearing applications, offering ease in handling and assembly. Meanwhile, rubber materials cater to specific functional requirements like seals and gaskets, where flexibility and durability are essential. Emerging innovations in other materials, such as composites and ceramics, further expand the possibilities, enabling highly customized solutions for both performance enhancement and weight reduction. The choice of materials is integral to meeting the aerospace industry's stringent safety and efficiency standards.How Are Platforms Evolving with Additive Manufacturing?

The application of additive manufacturing spans across diverse aerospace platforms, each showcasing its unique demands and opportunities. The aircraft platform benefits immensely, especially in the production of lightweight structural components and intricate engine parts that improve fuel efficiency and reduce emissions. In the domain of unmanned aerial vehicles (UAVs), additive manufacturing facilitates the rapid prototyping and production of highly tailored parts, enabling agility in design iterations. It also supports weight optimization, which is crucial for UAVs' operational range and payload capacity. Spacecraft platforms, arguably the most challenging segment, leverage additive manufacturing to fabricate complex structures capable of withstanding extreme environments, such as zero-gravity and high-radiation conditions. Moreover, additive manufacturing is increasingly being used to create parts directly in space, paving the way for on-demand manufacturing in extraterrestrial environments.Where Does Aerospace Additive Manufacturing Find Its Applications?

The versatility of additive manufacturing technology is evident in its wide-ranging applications within aerospace. Engine applications are a major area, where intricate geometries of fuel nozzles, turbine blades, and heat exchangers are produced with enhanced efficiency and reduced waste. The ability to create highly complex parts that are both lightweight and robust has led to significant advancements in propulsion systems. Structural applications, including airframe components and brackets, benefit from the lightweight nature of 3D-printed materials, directly improving the payload capacity and performance of aerial platforms. Beyond these, other applications such as cabin interiors and custom tooling solutions have seen substantial integration of additive manufacturing. This flexibility allows aerospace manufacturers to address diverse operational needs while achieving cost savings through reduced material usage and streamlined production processes.What Factors Are Driving the Growth in the Aerospace Additive Manufacturing Market?

The growth in the aerospace additive manufacturing market is driven by several factors, rooted in advancements in technology, evolving applications, and the dynamic demands of end-users. First, the technological advancements in additive manufacturing systems have enabled greater precision, scalability, and material compatibility, making the technology indispensable for critical aerospace applications. Second, the need for weight reduction and enhanced fuel efficiency in aerospace platforms aligns perfectly with the capabilities of additive manufacturing to produce lightweight yet durable components. Third, the rise of customized production and rapid prototyping has fueled adoption, as it allows manufacturers to reduce lead times and quickly iterate designs without the need for costly tooling changes. Additionally, the increased emphasis on sustainability is a key driver, with additive manufacturing minimizing material wastage and enabling recycling of certain materials. The growing demand for next-generation aircraft, UAVs, and space exploration vehicles further propels the market, with governments and private entities investing heavily in R&D and adoption of this transformative technology. Together, these factors underscore a paradigm shift, establishing aerospace additive manufacturing as a cornerstone of innovation in the industry.Report Scope

The report analyzes the Aerospace Additive Manufacturing market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Metal Alloy Material, Rubber Material, Plastic Material, Other Materials); Platform (Aircraft Platform, Unmanned Aerial Vehicle (UAV) Platform, Spacecraft Platform); Application (Engine Application, Structural Application, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Engine Application segment, which is expected to reach US$8.5 Billion by 2030 with a CAGR of 19.5%. The Structural Application segment is also set to grow at 18.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 20.6% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aerospace Additive Manufacturing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aerospace Additive Manufacturing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aerospace Additive Manufacturing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3D Systems, Inc., Arconic Inc., Colibrium Additive, CRP Technology S.r.l, EOS GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 63 companies featured in this Aerospace Additive Manufacturing market report include:

- 3D Systems, Inc.

- Arconic Inc.

- Colibrium Additive

- CRP Technology S.r.l

- EOS GmbH

- GKN Aerospace Services Limited

- Optomec, Inc.

- Stratasys Ltd.

- The ExOne Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3D Systems, Inc.

- Arconic Inc.

- Colibrium Additive

- CRP Technology S.r.l

- EOS GmbH

- GKN Aerospace Services Limited

- Optomec, Inc.

- Stratasys Ltd.

- The ExOne Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 402 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

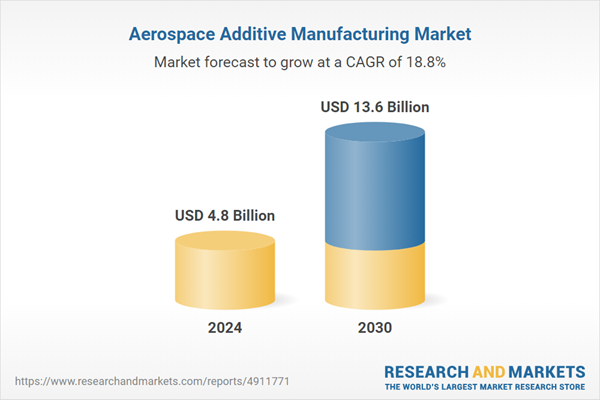

| Estimated Market Value ( USD | $ 4.8 Billion |

| Forecasted Market Value ( USD | $ 13.6 Billion |

| Compound Annual Growth Rate | 18.8% |

| Regions Covered | Global |