Global Industrial Actuator Services Market - Key Trends & Drivers Summarized

Why Are Industrial Actuator Services Becoming Essential for Enhancing Operational Efficiency and Safety?

Industrial actuator services are becoming essential for enhancing operational efficiency and safety due to the critical role actuators play in the automation and control of industrial processes. Actuators are responsible for moving and controlling mechanisms or systems, converting energy into motion to operate valves, dampers, conveyors, and other equipment in industries such as oil and gas, power generation, manufacturing, and water treatment. These devices are integral to automation, enabling precise control over process variables such as flow, pressure, and temperature. As industries increasingly adopt automation to improve productivity and reduce operational costs, the demand for services that ensure the optimal performance, reliability, and longevity of actuators is growing rapidly. Industrial actuator services, which include installation, maintenance, calibration, repair, and retrofitting, are crucial for minimizing downtime, preventing unexpected failures, and maintaining the safety and integrity of industrial operations.The complex and demanding environments in which industrial actuators operate necessitate regular servicing and expert support to keep them functioning optimally. In industries like oil and gas or chemical processing, where actuators are often exposed to extreme temperatures, corrosive materials, and high pressures, any malfunction or failure can lead to costly production disruptions and pose serious safety risks. Regular maintenance and calibration services help detect early signs of wear and tear, ensuring that actuators operate within specified tolerances and deliver accurate control. Additionally, as industries strive to meet stringent regulatory standards and enhance workplace safety, the need for reliable actuator services that support compliance and safety requirements has become more pronounced. By investing in professional actuator services, companies can safeguard their equipment, enhance system efficiency, and ensure the continuity of operations even under challenging conditions.

How Are Technological Advancements Transforming the Industrial Actuator Services Market?

Technological advancements are transforming the industrial actuator services market by introducing smarter, more efficient, and predictive maintenance solutions. One of the most significant innovations is the integration of Industrial Internet of Things (IIoT) technology into actuators, enabling real-time monitoring and remote diagnostics. IIoT-enabled actuators are equipped with sensors that continuously monitor key performance parameters such as position, torque, temperature, and vibration. This data is transmitted to centralized control systems or cloud-based platforms, where it is analyzed using advanced analytics and machine learning algorithms. The ability to access real-time data allows service providers to detect anomalies, predict potential failures, and schedule maintenance activities proactively, reducing downtime and maintenance costs. Predictive maintenance, enabled by IIoT and AI, is transforming the traditional approach of reactive maintenance into a more proactive strategy, enhancing the reliability and lifespan of industrial actuators.Another transformative trend in the industrial actuator services market is the adoption of digital twin technology. A digital twin is a virtual replica of a physical actuator that simulates its performance and behavior under various conditions. By using data collected from the physical actuator, digital twins can provide insights into how the equipment will perform in real-world scenarios, allowing service providers to optimize maintenance strategies, simulate the impact of operational changes, and even predict equipment failure. This capability not only improves the effectiveness of maintenance services but also enables more informed decision-making when retrofitting or upgrading actuators. The use of augmented reality (AR) and virtual reality (VR) tools is also gaining traction in actuator services, as these technologies enable technicians to visualize complex systems, troubleshoot issues remotely, and conduct training in a safe, simulated environment. As these technologies continue to advance, they are making industrial actuator services more efficient, cost-effective, and capable of supporting the increasing complexity of modern industrial systems.

What Role Do Regulatory Compliance and Safety Standards Play in Driving Demand for Industrial Actuator Services?

Regulatory compliance and safety standards play a critical role in driving demand for industrial actuator services. Industries such as oil and gas, chemicals, power generation, and water treatment are subject to stringent regulations that govern equipment safety, operational efficiency, and environmental impact. Compliance with these standards requires companies to implement rigorous maintenance and inspection programs for all critical equipment, including actuators, to ensure they operate safely and efficiently. For instance, regulations such as the International Electrotechnical Commission's IEC 61508 and the American Petroleum Institute's API 621 specify safety and performance requirements for actuators used in hazardous environments. Regular servicing and certification of actuators are necessary to demonstrate compliance with these standards, prevent accidents, and avoid potential penalties or operational shutdowns.Additionally, the growing focus on safety and risk management in industrial settings is boosting the demand for services that enhance the reliability and integrity of actuators. Actuators are often used to control safety-critical processes, such as emergency shutdown systems, pressure relief valves, and flow control in hazardous areas. Any malfunction in these components can have severe consequences, including equipment damage, environmental contamination, or loss of life. Industrial actuator services help mitigate these risks by ensuring that actuators are properly installed, calibrated, and maintained to meet safety and operational standards. Service providers also conduct safety audits, risk assessments, and compliance testing, helping companies identify potential vulnerabilities and implement corrective measures before issues escalate. As industries face increasing scrutiny and pressure to adhere to regulatory and safety standards, the demand for professional actuator services that support compliance and risk management is expected to grow significantly.

What Factors Are Driving the Growth of the Global Industrial Actuator Services Market?

The growth in the global industrial actuator services market is driven by several factors, including the expansion of industrial automation, the rising emphasis on equipment reliability and efficiency, and the increasing adoption of IIoT and smart technologies. One of the primary growth drivers is the rapid advancement of industrial automation, which is leading to a surge in the deployment of actuators across various sectors such as manufacturing, energy, and transportation. As industries automate more of their processes to improve productivity and reduce operational costs, the number of actuators in use is growing, thereby increasing the need for maintenance, calibration, and repair services. The expansion of critical infrastructure projects in emerging markets is also contributing to the demand for industrial actuator services, as newly installed systems require regular servicing to ensure optimal performance and compliance with safety standards.The growing focus on equipment reliability and operational efficiency is another key factor driving market growth. Industries are under constant pressure to minimize downtime, maximize asset utilization, and reduce maintenance costs. Regular servicing and predictive maintenance of actuators play a crucial role in achieving these goals by preventing unexpected failures and optimizing equipment performance. The integration of IIoT technologies into actuators is further enhancing the scope of services by enabling remote monitoring, real-time diagnostics, and data-driven maintenance strategies. The ability to predict and address potential issues before they result in costly breakdowns is leading to increased adoption of predictive maintenance services, which are expected to drive market growth in the coming years.

The increasing adoption of smart technologies and digital solutions is also transforming the industrial actuator services market. Service providers are leveraging digital tools such as AI-driven analytics, digital twins, and remote support platforms to offer more comprehensive and efficient services. These technologies enable faster diagnosis, better decision-making, and enhanced service delivery, making them attractive options for companies looking to optimize their maintenance operations. Additionally, the growing emphasis on energy efficiency and sustainability is driving the demand for retrofitting and upgrading services that enhance the performance and energy efficiency of existing actuators. Companies are seeking services that can help them modernize their equipment, reduce energy consumption, and meet sustainability targets. This trend is particularly prominent in industries like water treatment, where energy-efficient actuators can contribute significantly to overall operational efficiency.

Moreover, the rise of Industry 4.0 and the increasing focus on smart manufacturing are creating new opportunities for service providers in the actuator market. As more industries transition to digitalized and interconnected ecosystems, the need for advanced actuator services that support smart control systems and automation strategies is expected to grow. The increasing complexity of industrial processes and the growing demand for high-performance actuators are driving the need for specialized services that can address the challenges of modern industrial environments. As these factors converge, the global industrial actuator services market is poised for robust growth, supported by technological advancements, the rising adoption of smart technologies, and the ongoing evolution of industrial automation and maintenance strategies across various sectors.

Report Scope

The report analyzes the Industrial Actuators Services market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Repair, Maintenance & Consulting Services, Commissioning & Calibration Services, Retrofit Services).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Repair, Maintenance & Consulting Services Application segment, which is expected to reach US$856.1 Million by 2030 with a CAGR of 4.9%. The Commissioning & Calibration Services Application segment is also set to grow at 4.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $356.3 Million in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $381.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Actuators Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Actuators Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Actuators Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Alfa Laval AB, Emerson Electric Co., Flowserve Corporation, Honeywell International, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Industrial Actuators Services market report include:

- ABB Ltd.

- Alfa Laval AB

- Emerson Electric Co.

- Flowserve Corporation

- Honeywell International, Inc.

- KITZ Corporation

- KSB Group

- Pentair Plc

- Rotork Plc

- Valvitalia SPA

- Weir Group PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Alfa Laval AB

- Emerson Electric Co.

- Flowserve Corporation

- Honeywell International, Inc.

- KITZ Corporation

- KSB Group

- Pentair Plc

- Rotork Plc

- Valvitalia SPA

- Weir Group PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 292 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

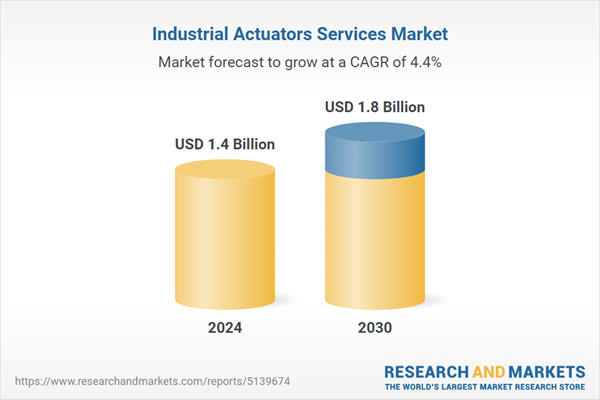

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 1.8 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |