The COVID-19 pandemic has impacted the African biological organic fertilizer market, resulting in the slow growth of the market during the forecast period. COVID-19 had a negative impact on the supply chains. Due to the restrictions in the movement of raw materials, the manufacturing industry suffered initially in terms of supply and cash flow. Effective policies from the government and the implementation of suitable practices can help companies to gain profits post the immediate effects of the pandemic.

Focus on organic cultivation and the need for sustainable farming practices are the major reasons for the increasing consumption of organic fertilizers in Africa. Various government subsidies and initiatives in developing countries for sustainable organic farming are expected to maintain continuous growth in the market. Less awareness among the farmers is restraining the growth of the market. The developing and untapped markets in Africa would provide substantial growth opportunities for the market.

Africa Biological Organic Fertilizers Market Trends

Popularity for the Organic Farming Drives the Market

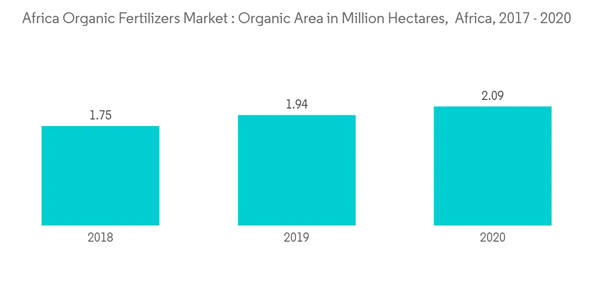

Africa has the highest population with the largest arable land. For instance, the Sub-Saharan African region has 13% of the world population and has approximately 20% of the global agricultural land. However, the region is facing severe food insecurity, which is primarily attributed to inadequate food production. The lack of access to mechanization in farming and limited use of fertilizers due to less farmer buying power are driving the demand for alternative cost-effective fertilizers, such as organic fertilizers in the region.Organic farming in Africa has been increasing at a significant rate. According to FAO, the area under organic cultivation was 1.9 million hectares in 2017, which was 0.1 million hectares more than the previous year. There are more than 1.2 million hectares of certified organic agricultural land in Africa, which constitutes about 3% of the world’s organic agricultural land. There are more than 574,000 organic producers. Uganda has the largest organic area (231,000 hectares) and the most organic producers. As organic cultivation only uses biological organic fertilizers, increasing organic farming boosts the market in Africa.

South Africa Dominates the Biofertilizers Segment of the Market

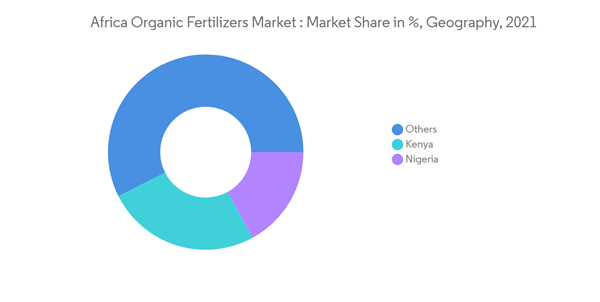

South Africa is the top country among all the African countries in terms of the revenue generated from the biofertilizer segment. Factors like environmental concerns, increasing awareness among the farmers, and degrading soil quality, are the major market drivers in the region.According to FAO, the consumption of fertilizers in South Africa increased from 60 Kg per hectare in 2016 to 72.8 Kg per hectare in 2020. The more consumption of chemical fertilizers than recommended levels over the years has led to soil acidification. Thus, more organic fertilizers are needed to correct the PH value of the soil. Production needs to be increased on low fertile soil that needs a high amount of organic fertilizers. This enhances the nutrient availability of crop plants (by processes like fixing atmosphere N or dissolving P present in the soil), thus, imparting better health to crops and soil, thereby enhancing crop yields, which, in turn, may drive the organic fertilizer market during the forecast period. Regional and global players manufacturing the biofertilizers in South Africa are also one of the major factors boosting the market in South Africa.

Africa Biological Organic Fertilizers Market Competitor Analysis

The African organic fertilizer market is highly fragmented, with the top five market players accounting for about 20-30% of the market. There are many local players operating in the region, mainly because of the unregulated market. The major players in the African organic fertilizers market are Rizobacter Argentina SA, Novozymes AS, Symborg, International Panaacea Limited, and MBFI. Collaborations with government organizations and expansion in the market, along with product innovation, are some of the strategies adopted by the companies.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Rizobacter Argentina SA

- Novozymes AS

- Company C

- International Panaacea Limited

- MBFI

- T Stanes & Company Limited

- Camson Bio Technologies Limited

- Biomax

- Agri Life

- Bio Protan