Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Infrastructure Development and Urbanization

The rapid urbanization and large-scale infrastructure projects across the Middle East and Africa are significantly driving the property insurance market. Countries like the UAE, Saudi Arabia, and Egypt are investing heavily in smart cities, transportation networks, and commercial developments, increasing the demand for property insurance. As of 2023, approximately 84.95% of Saudi Arabia's population resides in urban areas, reflecting the nation's ongoing trend towards urbanization. Mega projects such as Saudi Arabia’s NEOM city, Dubai’s Expo 2020 legacy projects, and Egypt’s New Administrative Capital are pushing developers and investors to secure insurance coverage for their assets.In Africa, the rise of urban centers, particularly in Nigeria, South Africa, and Kenya, is leading to greater property ownership, necessitating insurance protection. With governments prioritizing economic diversification beyond oil and natural resources, investments in real estate, tourism infrastructure, and industrial zones are expected to sustain the market’s growth. The increasing number of residential and commercial buildings also raises the risk of damages due to fire, natural disasters, and other hazards, reinforcing the need for comprehensive property insurance policies.

Key Market Challenges

Low Insurance Penetration and Limited Awareness

One of the biggest challenges in the Middle East and Africa property insurance market is the low insurance penetration rate, particularly in African countries. Many individuals and businesses remain unaware of the benefits of property insurance or perceive it as an unnecessary expense. This is especially true in regions where informal property ownership is widespread, and financial literacy is low. In countries like Nigeria, Kenya, and Ethiopia, insurance adoption is hindered by cultural and economic factors, with many people relying on informal risk-sharing mechanisms rather than formal insurance products.Even in the Middle East, where financial awareness is relatively higher, there is a tendency to underinsure properties, particularly in non-mandatory insurance segments. Additionally, many small and medium-sized enterprises (SMEs) struggle to afford insurance due to high premium costs, leading to minimal market expansion. Insurers face the challenge of educating potential customers about the long-term financial protection offered by property insurance while also designing affordable and flexible insurance products tailored to regional needs. Without increased awareness and improved financial inclusion, insurance penetration will continue to remain low, limiting the market’s growth potential.

Key Market Trends

Expansion of Parametric Insurance Solutions

A significant trend in the Middle East and Africa property insurance market is the growing adoption of parametric insurance solutions, particularly for mitigating risks associated with natural disasters. Unlike traditional indemnity-based insurance, parametric insurance provides payouts based on predefined triggers such as earthquake magnitude, rainfall levels, or wind speeds, ensuring faster claim settlements. This model is gaining traction in Africa, where extreme weather events like floods, droughts, and cyclones are increasing in frequency. Countries like Kenya and South Africa are exploring parametric policies to protect property owners and businesses from climate-related losses.Similarly, in the Middle East, insurers are introducing parametric products to cover damages from sandstorms, heatwaves, and seismic activity, particularly in Gulf Cooperation Council (GCC) countries. The speed and transparency of parametric insurance make it an attractive option for governments and corporations seeking reliable risk mitigation strategies. Insurers are also partnering with data analytics firms to develop sophisticated models that improve accuracy in risk assessments, enabling them to offer more affordable and effective parametric insurance products across both urban and rural markets.

Key Market Players

- Oman Insurance Company

- AXA Gulf

- RSA Insurance

- Qatar Insurance Company

- SANAD Cooperative Insurance and Reinsurance Company

- Abu Dhabi National Insurance Company (ADNIC)

- Alliance Insurance

- Orient Insurance Company

- Al Sagr National Insurance Company

- Abu Dhabi National Takaful Company

Report Scope:

In this report, the Middle East and Africa Property Insurance Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Middle East and Africa Property Insurance Market, By Coverage:

- Fire and Theft

- House Damage

- Floods and Earthquakes

- Personal Property

Middle East and Africa Property Insurance Market, By Application:

- Personal

- Enterprise

Middle East and Africa Property Insurance Market, By End User:

- Landlords

- Homeowners

- Renters

Middle East and Africa Property Insurance Market, By Country:

- Saudi Arabia

- UAE

- Egypt

- Qatar

- Oman

- South Africa

- Turkey

- Nigeria

- Rest of Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Middle East and Africa Property Insurance Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Oman Insurance Company

- AXA Gulf

- RSA Insurance

- Qatar Insurance Company

- SANAD Cooperative Insurance and Reinsurance Company

- Abu Dhabi National Insurance Company (ADNIC)

- Alliance Insurance

- Orient Insurance Company

- Al Sagr National Insurance Company

- Abu Dhabi National Takaful Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | February 2025 |

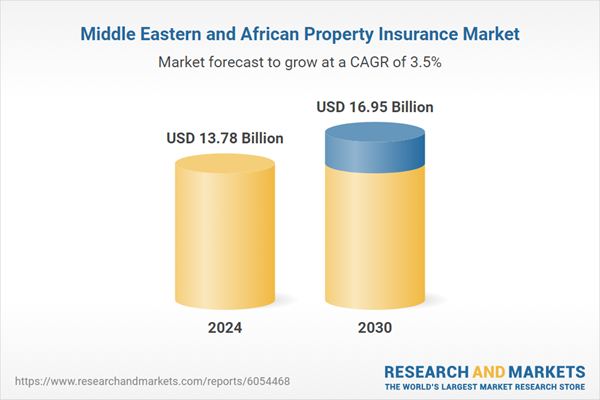

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13.78 Billion |

| Forecasted Market Value ( USD | $ 16.95 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 10 |