Global Alkaline Silicate Market - Key Trends and Drivers Summarized

Why Is Alkaline Silicate Gaining Importance Across Industries?

Alkaline silicate, commonly referred to as water glass or sodium silicate, is becoming increasingly important across a variety of industries due to its versatile properties and wide range of applications. This compound, typically formed by combining silica with alkali metals such as sodium or potassium, has found uses in sectors ranging from construction and agriculture to detergents and water treatment. One of its most significant attributes is its adhesive and binding ability, which makes it valuable in industries like construction, where it is used in cement and refractory materials. In addition, its chemical stability and resistance to high temperatures have made alkaline silicates a preferred choice in fireproofing applications and as a binder in foundries for casting molds. Its role in coatings and surface treatments, where it provides protective layers resistant to chemicals and weathering, further underscores its importance. As industries increasingly seek multifunctional materials that offer cost-effectiveness and sustainability, alkaline silicate is becoming a go-to solution due to its versatility, availability, and effectiveness.What Technological Innovations Are Enhancing the Applications of Alkaline Silicate?

Recent technological advancements have significantly broadened the range of applications for alkaline silicate, particularly in industries requiring enhanced material performance and sustainability. Innovations in the formulation of silicate compounds have enabled the production of more refined, pure forms of sodium and potassium silicates, enhancing their performance in specific applications such as waterproofing and sealing. For instance, modified silicate-based coatings are now being used to improve the durability and corrosion resistance of metals, offering long-lasting protection in harsh environments like marine or industrial settings. These coatings also provide environmental benefits, as they are often water-based and free from harmful volatile organic compounds (VOCs), making them more sustainable alternatives to traditional chemical treatments. Another major innovation is the use of alkaline silicates in geopolymers, which are emerging as a sustainable alternative to traditional cement. Alkaline silicate serves as a binder in the formation of geopolymer concrete, offering similar or even superior structural properties to conventional cement while significantly reducing carbon emissions. This development is particularly relevant as the construction industry seeks to reduce its environmental footprint. Additionally, advancements in nanotechnology have allowed for the creation of silicate nanoparticles, which are being incorporated into advanced materials for enhanced performance in areas such as insulation, coatings, and even biomedical applications.How Are Shifting Industry Demands Shaping the Alkaline Silicate Market?

The demand for alkaline silicate is being driven by shifting industry trends, particularly the growing focus on sustainability, environmental regulations, and the need for more efficient and cost-effective materials. In the construction industry, the rising demand for eco-friendly building materials is leading to increased use of alkaline silicate-based products, such as silicate-based cements and coatings. These products are gaining popularity not only because of their durability and fire-resistant properties but also because they offer a lower environmental impact compared to traditional materials. The push toward sustainable construction practices, including the use of greener alternatives like geopolymer concrete, is a major factor in the increasing adoption of alkaline silicate in this sector. In the agriculture industry, alkaline silicates are being utilized in fertilizers and soil conditioners, where their ability to improve soil structure and increase crop resilience to pests and diseases is highly valued. The rising demand for more sustainable agricultural practices is further driving the use of silicates, which are seen as environmentally friendly compared to synthetic chemicals. Similarly, in the detergent and water treatment industries, alkaline silicate's non-toxic and biodegradable nature makes it an appealing choice for products designed to meet stricter environmental standards.What Key Factors Are Fueling Expansion of the Alkaline Silicate Market?

The growth in the alkaline silicate market is driven by several factors, particularly the increasing demand for sustainable and environmentally friendly materials across various industries. One of the primary drivers is the construction industry's shift toward eco-friendly solutions, with alkaline silicate playing a key role in the development of sustainable building materials like geopolymer concrete and silicate-based coatings. These materials offer significant environmental benefits by reducing carbon emissions and improving the energy efficiency of buildings. In addition, the use of alkaline silicate in fireproofing and insulation has grown as regulations regarding fire safety become more stringent globally, further boosting demand for the compound in construction and infrastructure projects. Another major growth driver is the rising use of alkaline silicate in the water treatment and detergent industries. The compound's ability to act as a water softener and its environmentally benign characteristics make it a popular choice in eco-friendly cleaning products and wastewater treatment processes. The increasing global focus on water conservation and reducing chemical pollution has spurred the adoption of silicate-based solutions in these sectors. The agricultural sector is also contributing to market growth, with alkaline silicate gaining popularity as an additive in fertilizers and soil treatments due to its benefits in improving crop yield and resilience. Technological advancements in nanotechnology and material science are further driving market expansion, particularly as new applications for alkaline silicates emerge in advanced coatings, adhesives, and even biomedical materials. The push toward industrial sustainability, regulatory compliance, and cost-effectiveness across various sectors is also leading to greater investment in research and development of new silicate-based products. As industries increasingly prioritize environmental impact alongside performance, the alkaline silicate market is expected to witness sustained growth, driven by innovation and the rising demand for multifunctional, sustainable materials.Report Scope

The report analyzes the Alkaline Silicate market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Mining, Tunneling, Construction Repair, Water Retaining Structures, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Mining Application segment, which is expected to reach US$92.9 Million by 2030 with a CAGR of a 8%. The Tunneling Application segment is also set to grow at 8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $45.8 Million in 2024, and China, forecasted to grow at an impressive 10.6% CAGR to reach $63.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Alkaline Silicate Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Alkaline Silicate Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Alkaline Silicate Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

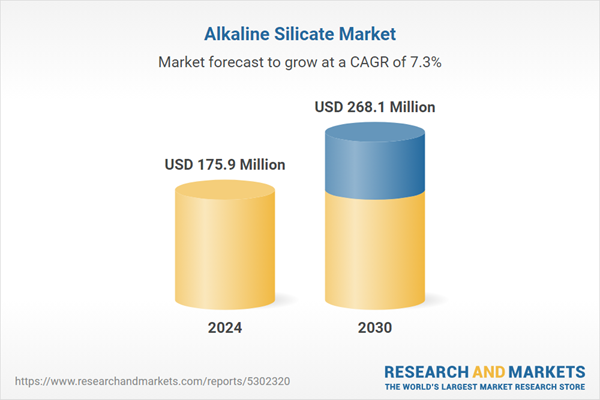

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, ADL Insulflex, Inc., Almatis GmbH, BNZ Materials, Inc., Cellaris Ltd and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Alkaline Silicate market report include:

- 3M Company

- ADL Insulflex, Inc.

- Almatis GmbH

- BNZ Materials, Inc.

- Cellaris Ltd

- Hi-Temp Insulation

- Insulcon Group

- Isolite Insulating Products Co. Ltd.

- M.E. Schupp Industriekeramik

- Microtherm N.V.

- Mitsubishi Plastics Inc.

- Morgan Thermal Ceramics

- Pacor, Inc.

- Promat International

- Pyrotek Incorporated

- Shandong Luyang Share Co. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- ADL Insulflex, Inc.

- Almatis GmbH

- BNZ Materials, Inc.

- Cellaris Ltd

- Hi-Temp Insulation

- Insulcon Group

- Isolite Insulating Products Co. Ltd.

- M.E. Schupp Industriekeramik

- Microtherm N.V.

- Mitsubishi Plastics Inc.

- Morgan Thermal Ceramics

- Pacor, Inc.

- Promat International

- Pyrotek Incorporated

- Shandong Luyang Share Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 175.9 Million |

| Forecasted Market Value ( USD | $ 268.1 Million |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |