Why Are Animal Blood Plasma Products and Derivatives Increasingly Important in Modern Applications?

Animal blood plasma products and derivatives are gaining significant attention across various industries, driven by their functional and nutritional benefits. These products, derived primarily from livestock like cattle and pigs, are used extensively in sectors such as animal feed, pharmaceuticals, food, and cosmetics. In the animal feed industry, plasma proteins are highly valued for their ability to promote growth and improve the immune response in livestock, making them an essential component of feed for young animals, particularly in weaning piglets. In the food industry, plasma derivatives are utilized as emulsifiers, gelling agents, and water-binding agents, enhancing the texture and nutritional profile of processed foods. As consumer demand for high-quality animal protein products grows, so does the need for these derivatives, which improve both product performance and sustainability in food production.What Technological Advances Are Shaping the Animal Blood Plasma Market?

Technological innovations are playing a key role in expanding the uses and applications of animal blood plasma products and derivatives. Advancements in fractionation technology, for instance, have made it possible to isolate specific proteins and bioactive compounds from plasma, which can be used in various specialized applications. In the pharmaceutical industry, plasma-derived proteins are increasingly being used in the development of novel therapeutics for immune disorders and wound healing. The emergence of biotechnological processes to enhance the functionality of these proteins has opened new doors in the fields of regenerative medicine and biopharmaceuticals. Furthermore, improvements in the preservation and transportation of plasma products are enhancing their stability and usability across global markets, leading to wider adoption in sectors that require high-quality, bioactive ingredients.What Are the Regulatory Challenges Facing the Animal Blood Plasma Market?

The animal blood plasma products and derivatives market is highly regulated, particularly in the food and pharmaceutical sectors, where safety and quality are paramount. Regulatory agencies such as the FDA, EFSA, and USDA have strict guidelines governing the collection, processing, and use of animal-derived plasma products to ensure they are safe for both human and animal consumption. One of the key challenges in this market is ensuring traceability and transparency in the supply chain, as well as maintaining high standards of hygiene and biosafety during plasma extraction and processing. As consumers become more conscious of the ethical and health implications of animal-derived products, regulations concerning animal welfare, sustainability, and product labeling are also becoming more stringent. This regulatory framework is pushing manufacturers to adopt better practices in plasma collection and product development, which, while challenging, also fosters innovation in the industry.What Factors Are Driving the Growth of the Animal Blood Plasma Products and Derivatives Market?

The growth in the animal blood plasma products and derivatives market is driven by several factors, including increasing demand for high-quality animal feed, growing applications in the pharmaceutical and food industries, and advancements in plasma processing technologies. In the animal feed sector, the need to improve livestock health and productivity, especially in young and weaning animals, is fueling demand for plasma proteins. The food industry is seeing increased use of plasma derivatives as functional ingredients that enhance product quality and shelf life. The rising awareness of the nutritional benefits of these derivatives in human health supplements is also expanding their use in the nutraceutical sector. Furthermore, the pharmaceutical industry's focus on developing biologically active ingredients for immune modulation and tissue repair is opening new avenues for the application of plasma-derived products, contributing to the market's robust growth trajectory.Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cell Culture Media Application segment, which is expected to reach US$908.8 Million by 2030 with a CAGR of a 6.7%. The Food Industry Application segment is also set to grow at 5.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, which was valued at $438.4 Million in 2023, and China, forecasted to grow at an impressive 6.1% CAGR to reach $386.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Animal Blood Plasma Products and Derivatives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Animal Blood Plasma Products and Derivatives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Animal Blood Plasma Products and Derivatives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2023 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of major players such as Anzco Foods, Auckland BioSciences Ltd., Bovogen Biologicals Pty Ltd., and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 44 Featured):

- Anzco Foods

- Auckland BioSciences Ltd.

- Bovogen Biologicals Pty Ltd.

- Kraeber & Co. GmbH

- Lake Immunogenics, Inc.

- LAMPIRE Biological Laboratories, Inc.

- MilliporeSigma

- Thermo Fisher Scientific, Inc.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Anzco Foods

- Auckland BioSciences Ltd.

- Bovogen Biologicals Pty Ltd.

- Kraeber & Co. GmbH

- Lake Immunogenics, Inc.

- LAMPIRE Biological Laboratories, Inc.

- MilliporeSigma

- Thermo Fisher Scientific, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | February 2026 |

| Forecast Period | 2023 - 2030 |

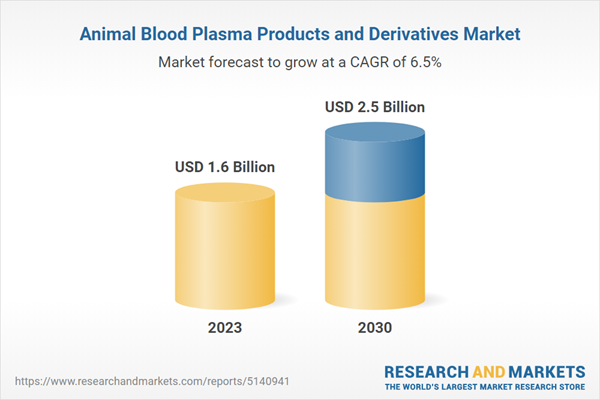

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 2.5 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |