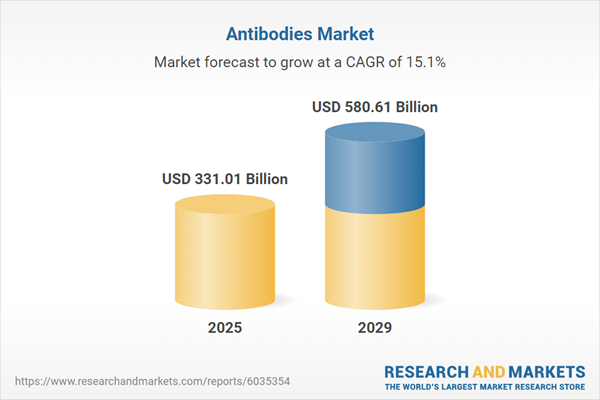

The antibodies market size has grown rapidly in recent years. It will grow from $286.81 billion in 2024 to $331.01 billion in 2025 at a compound annual growth rate (CAGR) of 15.4%. The growth in the historic period can be attributed to rise in prevalence of chronic diseases, growth in number of clinical trials, expansion of therapeutic areas, growth in awareness of personalized medicine, and rise in diagnostic applications.

The antibodies market size is expected to see rapid growth in the next few years. It will grow to $580.61 billion in 2029 at a compound annual growth rate (CAGR) of 15.1%. The growth in the forecast period can be attributed to increasing cancer research, growing immunotherapy applications, increasing use of monoclonal antibodies, rising number of clinical trials, and increasing adoption of precision medicine. Major trends in the forecast period include the implementation of advanced biomanufacturing technologies, advancements in antibody engineering, integration of high throughput screening methods, implementation of next-generation sequencing technologies, and implementation of novel delivery systems.

The increasing prevalence of autoimmune diseases is expected to drive the growth of the antibodies market. Autoimmune diseases are conditions where the immune system mistakenly targets and damages its own tissues, including disorders such as rheumatoid arthritis, lupus, and multiple sclerosis. The rising incidence of autoimmune diseases is linked to environmental factors, genetic predispositions, and lifestyle changes. Antibodies are critical in this context as they target and neutralize specific immune cells or inflammatory molecules that erroneously attack the body's tissues, thus reducing inflammation and alleviating symptoms. For example, in May 2024, the Multiple Sclerosis International Federation, a UK-based non-profit organization, reported an increase in the global number of people with multiple sclerosis from 2.8 million in 2020 to 2.9 million in 2023. Consequently, the growing prevalence of autoimmune diseases is contributing to the expansion of the antibodies market.

Leading companies in the antibodies market are focusing on developing validated antibodies to improve accuracy and ensure consistent results in both diagnostics and therapeutics. Validated antibodies are those that have undergone testing and confirmation for accuracy and specificity in detecting target proteins. This validation enhances the reliability of research findings and the effectiveness of antibody-based products. For instance, in March 2024, Bio-Rad Laboratories, a US-based life science research and clinical diagnostics company, introduced Celselect slides validated antibodies designed for rare cell and circulating tumor cell (CTC) enumeration. This advancement enhances the study of tumor heterogeneity and disease progression. The validated antibodies, compatible with Bio-Rad’s Celselect Slides Enumeration Stain Kits, facilitate precise CTC detection, representing a significant advancement in cancer research and diagnostics.

In June 2024, Johnson & Johnson Services Inc., a US-based pharmaceutical and medical device company, acquired Proteologix Inc. for $850 million. This acquisition aims to strategically advance Johnson & Johnson’s development of innovative treatments for immune-mediated diseases by integrating Proteologix’s advanced bispecific antibodies. The acquisition aligns with Johnson & Johnson’s objective to enhance its immunology portfolio with effective and optimized therapies for conditions such as atopic dermatitis and asthma. Proteologix Inc. is a US-based provider of antibodies.

Major companies operating in the antibodies market are Pfizer Inc., Johnson & Johnson Services Inc., F. Hoffmann-La Roche Ltd., Merck & Co Inc., AbbVie Inc., Sanofi S.A., Bristol Myers Squibb Company, Novartis AG, GSK plc, Takeda Pharmaceutical Company Limited, Eli Lilly and Company, Amgen Inc., Regeneron Pharmaceuticals Inc., Biogen Inc., Alexion Pharmaceuticals Inc., Incyte Corporation, Kyowa Kirin Co Ltd, Ultragenyx Pharmaceutical Inc, Xencor Inc., MacroGenics Inc., ImmunoGen Inc., Sorrento Therapeutics Inc., Beam Therapeutics Inc., SAB Biotherapeutics Inc., bluebird bio Inc., Iovance Biotherapeutics Inc.

North America was the largest region in the antibodies market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the antibodies market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the antibodies market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Antibodies are proteins produced by the immune system in response to foreign substances such as bacteria or viruses. They recognize and attach to antigens, which are specific molecules found on the surface of these invaders. This attachment either neutralizes the pathogen or signals other immune cells to destroy it. Antibodies are a crucial part of the adaptive immune system, with each one targeting a specific antigen.

The main product types in the antibodies market include monoclonal antibodies, polyclonal antibodies, and antibody-drug conjugates. Monoclonal antibodies are lab-created molecules engineered to specifically target certain proteins or antigens within the body. These products are used for various disease indications, such as cardiovascular diseases, central nervous system (CNS) disorders, cancer, autoimmune diseases, and more, and are utilized by hospitals, long-term care facilities, research institutions, and others.

The antibodies market research report is one of a series of new reports that provides antibodies market statistics, including the antibodies industry global market size, regional shares, competitors with antibodies market share, detailed antibodies market segments, market trends, and opportunities, and any further data you may need to thrive in the antibodies industry. These antibodies market research reports deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The antibodies market consists of sales of recombinant antibodies, antibody-based assays, bispecific antibodies, single domain antibodies, humanized antibodies, and diagnostic kits. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Antibodies Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on antibodies market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for antibodies ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The antibodies market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Monoclonal Antibodies; Polyclonal Antibodies; Antibody Drug Complexes2) By Disease Indication: Cardiovascular Diseases; Central Nervous System (CNS) Disorders; Cancer; Autoimmune Disorders; Other Indications

3) By End User: Hospitals; Long Term Care Facilities; Research Institutes; Other End Users

Subsegments:

1) By Monoclonal Antibodies: IgG Monoclonal Antibodies; IgM Monoclonal Antibodies; IgA Monoclonal Antibodies; Other Isotypes2) By Polyclonal Antibodies: Serum-derived Polyclonal Antibodies; Purified Polyclonal Antibodies; Antibody Fractionation Products

3) By Antibody Drug Complexes: Conjugated Antibodies; Bispecific Antibodies; Antibody-Drug Conjugates (ADCs)

Key Companies Mentioned: Pfizer Inc.; Johnson & Johnson Services Inc.; F. Hoffmann-La Roche Ltd.; Merck & Co Inc.; AbbVie Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Antibodies market report include:- Pfizer Inc.

- Johnson & Johnson Services Inc.

- F. Hoffmann-La Roche Ltd.

- Merck & Co Inc.

- AbbVie Inc.

- Sanofi S.A.

- Bristol Myers Squibb Company

- Novartis AG

- GSK plc

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Amgen Inc.

- Regeneron Pharmaceuticals Inc.

- Biogen Inc.

- Alexion Pharmaceuticals Inc.

- Incyte Corporation

- Kyowa Kirin Co Ltd

- Ultragenyx Pharmaceutical Inc

- Xencor Inc.

- MacroGenics Inc.

- ImmunoGen Inc.

- Sorrento Therapeutics Inc.

- Beam Therapeutics Inc.

- SAB Biotherapeutics Inc.

- bluebird bio Inc.

- Iovance Biotherapeutics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 331.01 Billion |

| Forecasted Market Value ( USD | $ 580.61 Billion |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |