The global market is experiencing significant growth due to increasing demand for efficient vehicle cooling solutions, crucial for maintaining engine performance in various climatic conditions. In accordance with this, rising vehicle production, particularly in emerging markets, alongside the growing adoption of electric vehicles (EVs), further drive the market demand. EVs require specialized cooling systems to regulate battery temperatures, contributing to market expansion. Besides this, stringent environmental regulations pushing for eco-friendly antifreeze solutions are stimulating innovation and impacting the automotive antifreeze market trends.

For example, on February 15, 2024, DuPont launched its DuPont AmberLite EV2X resin, designed to enhance glycol purification for e-mobility applications. This resin extends the life of EV coolants and filters, offering thermal stability under extreme conditions. Moreover, continual technological advancements in antifreeze formulations, alongside the expanding automotive aftermarket sector, are key factors propelling market growth.

The United States stands out as a key regional market and is majorly driven by the increasing demand for advanced engine cooling solutions that optimize vehicle performance across varying temperatures. Similarly, the rapid growth of the electric vehicle (EV) sector, fueled by federal incentives and consumer preference for sustainable options, is a key factor, as EVs require specialized cooling systems for batteries and powertrains. Additionally, the rising vehicle fleet and the demand for high-performance vehicles with improved engine efficiency further stimulate automotive antifreeze market share.

Moreover, increasing environmental awareness and the shift toward biodegradable antifreeze solutions align with regulatory trends, encouraging innovation. Notably, on July 22, 2024, onsemi announced a deal with Volkswagen Group to provide a power system solution for next-gen traction inverters. The EliteSiC M3e MOSFETs improve efficiency and heat management, allowing EVs to drive further on a single charge by integrating a cooling system for better heat control.

Automotive Antifreeze Market Trends:

Rising Vehicle Production and Sales

In its latest automotive antifreeze market outlook, it has been projected that the worldwide automotive industry is growing at a steady pace, this is translating into increased consumption of antifreeze products in the industry. With middle-class populations continuing to grow in every country, car ownership rates also increase. Sales of vehicle units were sold out in 2023, in United States and reached 15,608,386. The growth is directly linked with the increasing demand for automotive fluids, like antifreeze, which helps keep the performance of vehicles.This trend also reflects the increasing demand for automotive antifreeze in commercial vehicle production, fueled by the expansion of logistics, construction, and agriculture industries. As vehicle production is enhanced along with ownership, cooling systems that protect engines from overheating and freezing in extreme climates call for demand to be critical. The automobile maintenance after market, which involves coolant replacement, is increasing. Therefore, the demand for antifreeze products is also rising.

Continual Advancements in Engine Technology

According to the analysis of the automotive antifreeze market, modern engines are powerful, compact, and efficient, and they also work at higher temperatures. As such, they require effective coolants and high-quality antifreeze in this respect. Modern engines, especially turbocharged engines and high-performance engines, require advanced coolants that handle heat management better. Moreover, the latest automotive antifreeze market outlook indicates that under such conditions, conventional water-based coolants may not be enough, thereby creating a huge demand for special antifreeze formulations that can work well at extreme temperatures.Another trend toward downsizing engines to meet emission regulations, which has resulted in the adoption of turbocharged engines, is also augmenting the automotive antifreeze market demand. According to reports, turbochargers can enable downsized engines to achieve an improvement in fuel economy of as much as 20% to 40% in gas and diesel engines, respectively.

Growing Adoption of Electric Vehicles (EVs)

The newest automotive antifreeze market forecast reveals that electric vehicles create new thermal management system requirements, thus improving demand for automotive antifreeze solutions. The IEA reports that more than 3 million electric cars have been sold in the first quarter of 2024. While ICEs use antifreeze mainly to control engine temperatures, EVs require cooling for its battery and motors as well as power electronics.

Thermal management is, therefore, very crucial for EV components, and most importantly, the battery pack, which can degrade rapidly if exposed to extreme temperatures. Governments across the globe are stimulating clean energy use and reducing pollution, which led to the hike in electric car adoption. This has made it necessary for new antifreeze formulations targeted at the special needs of an electric powertrain, which further augments the automotive antifreeze market growth.

Automotive Antifreeze Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global automotive antifreeze market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on fluid type, technology, vehicle type, and distribution channel.Analysis by Fluid Type:

- Ethylene Glycol

- Propylene Glycol

- Glycerine

This dominance is primarily due to its superior properties, such as high boiling and freezing points, which enhance engine protection under extreme temperatures. Ethylene glycol-based antifreeze solutions provide effective heat transfer, preventing engine overheating and freezing in cold weather. Additionally, its low cost, availability, and compatibility with a wide range of vehicle types contribute to its widespread use. As a result, ethylene glycol remains the preferred choice for automotive cooling systems globally.

Analysis by Technology:

- Inorganic Additive Technology (IAT)

- Organic Acid Technology (OAT)

- Hybrid Organic Acid Technology (HOAT)

Analysis by Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

- Construction Vehicle

The higher volume of coolant needed for large engines, along with the necessity for reliable, long-lasting antifreeze to reduce maintenance costs, strengthens demand in this sector. Additionally, the rise of logistics, freight transportation, and the increasing number of commercial vehicles worldwide further contribute to the market's dominance in this segment.

Analysis by Distribution Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Furthermore, the expansion of the aftermarket sector and increased vehicle ownership in emerging economies play pivotal roles. Notably, on December 20, 2024, Airtificial secured its largest-ever contract, valued at over EUR 9 Million, for an advanced electric car compressor assembly line, featuring cutting-edge cooling technologies critical for vehicle battery and cabin cooling.

Key Regional Takeaways:

United States Automotive Antifreeze Market Analysis

The U.S. automotive antifreeze market is expanding due to increasing vehicle ownership, rising production of passenger and commercial vehicles, and strict regulations on emissions and engine efficiency. People are prioritizing advanced cooling solutions to improve engine longevity, reduce emissions, and enhance fuel efficiency, driving demand for high-performance antifreeze formulations. Stringent environmental policies by the Environmental Protection Agency (EPA) and the Department of Transportation (DOT) are prompting automakers to adopt long-life coolants with reduced toxicity and improved heat transfer properties.In addition, increasing preferences for hybrid and electric vehicles (EVs) is reshaping antifreeze demand, as thermal management remains critical for battery performance and longevity. Innovations in EV-specific coolants, including glycol-based and non-conductive formulations, are gaining traction among manufacturers and aftermarket suppliers. Besides this, the increasing number of miles driven per vehicle is fueling the need for regular coolant replacements and maintenance, sustaining demand from service centers and retailers. The presence of major automotive manufacturers and aftermarket service providers in the U.S. is another key factor.

Companies are focusing on developing biodegradable, low-toxicity antifreeze solutions to comply with shifting sustainability goals. The rise of fleet management services and shared mobility solutions, such as ride-hailing and rental services, is also accelerating coolant consumption due to higher vehicle utilization rates. As per reports, Uber and Lyft, ride-hailing services in USA have around 77.6 million users in 2024.

Europe Automotive Antifreeze Market Analysis

Strict environmental regulations, the rising adoption of electric vehicles, and a strong presence of leading automobile manufacturers is impelling the market growth. Stringent emission norms imposed by the European Union (EU) are prompting automakers to improve engine efficiency and develop advanced cooling technologies. The transition toward low-emission and hybrid vehicles is significantly influencing the demand for high-performance antifreeze solutions tailored for modern powertrains. In addition, cold climatic conditions in several European countries, including Germany, France, and Scandinavia, drive the need for high-quality antifreeze to prevent engine freezing during harsh winters.At the same time, heat waves in Southern Europe are increasing demand for effective cooling solutions, particularly in countries like Spain and Italy. The growing emphasis on all-weather antifreeze products that can function in varying climatic conditions is shaping product innovation. Moreover, the expanding electric vehicle (EV) market, particularly in Norway, the Netherlands, and Germany, is reshaping antifreeze demand. According to the IEA, new electric car registrations reached nearly 3.2 million in 2023 in Europe, increasing by almost 20% relative to 2022.

Advanced thermal management solutions are essential for regulating battery temperatures and ensuring optimal EV performance. The increasing adoption of glycol-based coolants for lithium-ion batteries is a key driver, as battery longevity and safety depend on efficient cooling systems. Europe’s strong automotive aftermarket sector, with well-established service networks and maintenance centers, is also catalzying demand for antifreeze replacements.

Asia Pacific Automotive Antifreeze Market Analysis

The Asia Pacific market remains influenced by rapid urbanization, increasing vehicle production, and rising disposable incomes that have led to greater demand for automobiles in China, India, Japan, and Southeast Asian countries. According to the PIB, it has predicted by 2030 there will be more than 40% of India's population are expected to be living in cities. In addition, the growing middle-class populations coupled with better infrastructure for roads will accelerate the acquisition of vehicles leading to increased usage of antifreeze and coolants.Furthermore, the expanding automotive manufacturing, especially in the countries of China and India whose production volumes have been among the highest in the world, continues to support this market growth. Apart from this, increased temperatures across several Asian Pacific regions, particularly tropical and subtropical, mean cooling needs a proper cooling mechanism. Therefore, the high-performance antifreeze is adopted there. In cold climates, in particular, in northern China and Japan, freezing protection requires an antifreeze. Climate condition differences throughout this region have spurred the production of multifunctional coolant formulations with capabilities for severe temperature swings.

In addition, the stringent emission standards and regulations in countries like China and India are forcing car manufacturers to look for better-performing engines. This is expected to increase demand for high-performance antifreeze formulations. Greater investments in research and development (R&D) by local as well as international players are adding momentum to innovation in coolant technology in the region.

Latin America Automotive Antifreeze Market Analysis

The Latin American automotive antifreeze market is expanding due to rising vehicle ownership, growing automotive production, and extreme temperature variations across the region. In countries like Brazil, Mexico, and Argentina, an increasing middle-class population and improving road infrastructure are contributing to higher vehicle sales, fueling demand for antifreeze products. The expanding commercial vehicle segment, driven by logistics growth, is also influencing market dynamics. According to the reports, commercial vehicle production in Brazil reached approximately 543,226 units in 2023.Additionally, climate conditions in Latin America, ranging from hot and humid regions in Brazil to colder areas in Argentina, necessitate diverse antifreeze formulations. The growing preference for extended-life coolants is evident among fleet operators looking to reduce maintenance costs. Automotive industry growth, coupled with increasing aftermarket service centers, is supporting antifreeze demand. Additionally, advancements in engine technology, including turbocharging and downsized engines, are increasing the thermal stress on cooling systems, necessitating superior antifreeze formulations.

Middle East and Africa Automotive Antifreeze Market Analysis

The increasing vehicle sales and growing construction and logistics sectors are driving the market growth. According to reports, total sales of vehicles in Saudi Arabia were 729,466 units (+16.9%) in 2023. The high temperatures in Gulf countries such as Saudi Arabia and the UAE require more advanced cooling systems to avoid engine overheating. With expanding infrastructure projects and widening logistics, commercial vehicle usage is increasing, which also means increased antifreeze usage.Fleet operators prefer long-lasting coolant formulation to decrease maintenance costs, particularly under adverse environmental conditions. African regions, especially countries like South Africa and Nigeria, are gaining popularity due to increasing urbanization and better roads. The growth of the aftermarket segment, with service centers providing niche coolant products, is supporting the market growth.

Competitive Landscape:

The automotive antifreeze market is highly competitive with major players trying to innovate and cater to the needs of the automotive industry. Companies are looking at creating more advanced, environmentally friendly formulations for antifreeze, high-performance, thermal stability, and corrosion resistance. Most offer pre-diluted and ready-to-use solutions for added convenience and minimizing errors.In the face of growing electric vehicles, companies are producing dedicated coolants for EV batteries and powertrains. Key strategies include forming strategic partnerships with OEMs and expanding into markets. For example, on June 18, 2024, Recochem acquired KIK Consumer Products' Auto Care business, including Prestone and Holts, which will augment its global automotive solutions and expand its portfolio of antifreeze and coolant products.

The report provides a comprehensive analysis of the competitive landscape in the automotive antifreeze market with detailed profiles of all major companies, including:

- AMSOIL Inc.

- BP p.l.c.

- Chevron Corporation

- Cummins Inc.

- ExxonMobil Corporation

- Fuchs Petrolub SE

- Halfords Group PLC

- Motul S.A

- Prestone Products Corporation

- Recochem Inc.

- Shell plc

- TotalEnergies SE

- Valvoline Inc.

- VOLTRONIC Gmb.

Key Questions Answered in This Report

- How big is the automotive antifreeze market?

- What is the future outlook of automotive antifreeze market?

- What are the key factors driving the automotive antifreeze market?

- Which region accounts for the largest automotive antifreeze market share?

- Which are the leading companies in the global automotive antifreeze market?

Table of Contents

Companies Mentioned

- AMSOIL Inc.

- BP p.l.c.

- Chevron Corporation

- Cummins Inc.

- ExxonMobil Corporation

- Fuchs Petrolub SE

- Halfords Group PLC

- Motul S.A

- Prestone Products Corporation

- Recochem Inc.

- Shell plc

- TotalEnergies SE

- Valvoline Inc.

- VOLTRONIC GmbH

Table Information

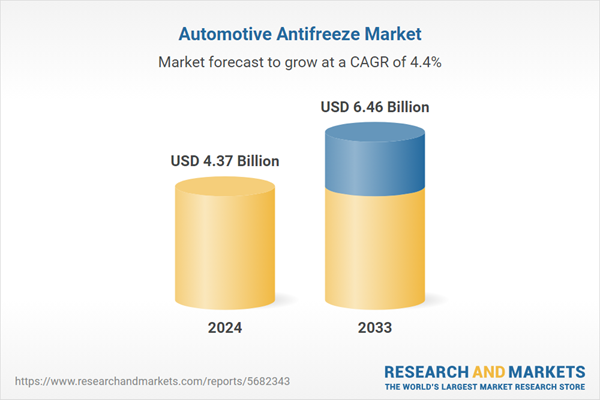

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 4.37 Billion |

| Forecasted Market Value ( USD | $ 6.46 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |