Global API Testing Market - Key Trends and Drivers Summarized

Why Is API Testing Crucial in Today's Digital Landscape?

API testing has become an essential practice in modern software development, ensuring the reliability, security, and performance of application programming interfaces (APIs). As APIs act as the backbone for connecting various software components, microservices, and third-party integrations, the need for rigorous testing is paramount. The importance of API testing is underscored by the shift towards microservices architecture, which involves breaking down applications into smaller, interconnected services. This architectural trend, while offering greater scalability and flexibility, also introduces complexities in communication between services, making API testing crucial to prevent failures and ensure seamless integration. Moreover, the increasing adoption of cloud-native applications and the growing ecosystem of Internet of Things (IoT) devices have expanded the scope of API testing, demanding more sophisticated tools and techniques to manage the complexities of these interconnected systems.What Are The Latest Innovations in API Testing?

The API testing landscape is evolving rapidly, with technological advancements leading the way in automated testing and intelligent analytics. One of the key innovations is the integration of artificial intelligence (AI) and machine learning (ML) into API testing tools, enabling predictive analysis and automated generation of test cases. These intelligent testing solutions can identify potential issues before they occur, significantly reducing the time and effort required for manual testing. Additionally, the rise of low-code and no-code platforms has introduced user-friendly API testing tools, allowing non-technical users to perform comprehensive tests without deep programming knowledge. This democratization of API testing is particularly beneficial in agile development environments, where speed and flexibility are critical. Furthermore, the shift towards continuous integration/continuous deployment (CI/CD) pipelines has necessitated the development of API testing tools that seamlessly integrate with DevOps workflows, ensuring that APIs are tested thoroughly and continuously throughout the development lifecycle.How Are Regulatory and Security Concerns Shaping API Testing?

Regulatory and security concerns are increasingly influencing the API testing market, with organizations prioritizing compliance and data protection more than ever. As data privacy regulations like GDPR and CCPA impose stringent requirements on how data is handled and shared, API testing has become a critical component in ensuring that APIs adhere to these legal standards. Security testing, in particular, has gained prominence as APIs become common targets for cyberattacks. The proliferation of open APIs, especially in sectors like finance and healthcare, has heightened the need for robust security testing to prevent unauthorized access and data breaches. Consequently, organizations are investing in advanced API penetration testing tools and practices that can simulate potential attacks and identify vulnerabilities before they can be exploited. The focus on API security is further intensified by the increasing use of APIs in mobile applications, where ensuring secure and efficient API communication is essential for protecting sensitive user data.The Growth in the API Testing Market Is Driven by Several Factors

The growth in the API testing market is driven by several factors, reflecting the broader trends in technology and consumer behavior. The rapid adoption of microservices and cloud-native architectures has expanded the demand for API testing tools that can handle complex, distributed systems. As businesses increasingly rely on APIs to deliver digital services, the need for continuous and automated API testing has surged, driven by the requirements of agile and DevOps practices. Additionally, the rise of API-as-a-Product, where APIs are monetized and offered as standalone products, has necessitated more rigorous testing to ensure these APIs meet quality and performance standards. The growing focus on customer experience has also spurred demand for API testing, as seamless API interactions are crucial for delivering smooth and reliable digital experiences. Furthermore, the expansion of the Internet of Things (IoT) and the proliferation of mobile applications have created new opportunities and challenges in API testing, driving innovation in testing tools and methodologies. Finally, increasing regulatory pressures and the rising threat of cyberattacks have made comprehensive API testing a critical priority for organizations across industries, fueling the market's growth.Report Scope

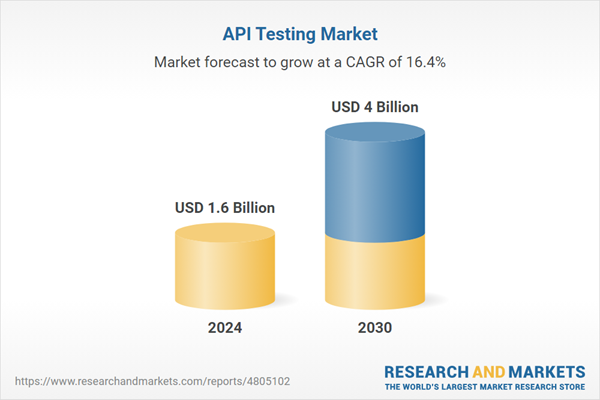

The report analyzes the API Testing market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (API Testing Tools / Software, API Testing Services); Deployment (On-Premise, Cloud).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the API Testing Tools / Software segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of 15.2%. The API Testing Services segment is also set to grow at 19.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $422.8 Million in 2024, and China, forecasted to grow at an impressive 21.8% CAGR to reach $953.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global API Testing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global API Testing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global API Testing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as CA Technologies, Inc., Cigniti Technologies Ltd., IBM Corporation, Infosys Ltd., Micro Focus International PLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this API Testing market report include:

- CA Technologies, Inc.

- Cigniti Technologies Ltd.

- IBM Corporation

- Infosys Ltd.

- Micro Focus International PLC

- Oracle Corporation

- Parasoft

- QualityLogic Inc.

- Runscope, a part of CA Technologies

- SmartBear Software, Inc.

- Tricentis GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- CA Technologies, Inc.

- Cigniti Technologies Ltd.

- IBM Corporation

- Infosys Ltd.

- Micro Focus International PLC

- Oracle Corporation

- Parasoft

- QualityLogic Inc.

- Runscope, a part of CA Technologies

- SmartBear Software, Inc.

- Tricentis GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 4 Billion |

| Compound Annual Growth Rate | 16.4% |

| Regions Covered | Global |