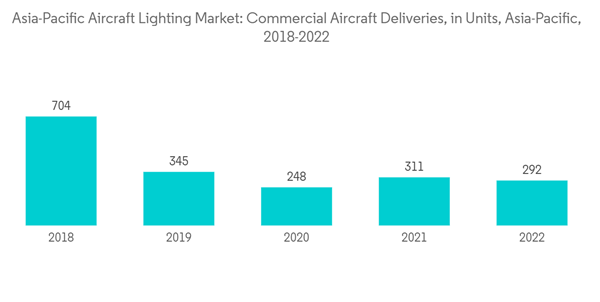

In the past few years, major countries in the region, like China, India, and Japan, witnessed a rapid increase in passenger traffic, resulting in large orders for new aircraft from airlines operating in the region. The rising per capita income of the population due to increased economic and infrastructure development aided the growth of the number of air passengers and supported the fleet expansion plans of domestic and regional airlines. The rising number of aircraft deliveries of new commercial passenger aircraft positively drove the growth of the aircraft lighting market. Additionally, the retrofit orders for new cabin lighting as a part of cabin modernization initiatives undertaken by the airlines are also expected to accelerate the growth of the market in the coming years. However, supply chain disruptions can restrain market growth.

Asia-Pacific Aircraft Lighting Market Trends

Commercial Aircraft Segment to have the Largest Market Share During the Forecast Period

Asia-Pacific is expected to become the major aviation industry globally in the coming decade. In 2022, the air passenger traffic in the region surged rapidly as compared to other regions. On this note, as per the annual data released by the IATA, in 2022, air passenger traffic in Asia-Pacific was recorded at 1.9 billion. Airline companies in the region are implementing fleet expansion plans to cater to the growing air passenger traffic in the major countries. China, India, Japan, and Indonesia accounted for 70% of the total air passenger traffic in the region, generating demand for new aircraft compared to other Asia-Pacific countries.Due to the growth in passenger traffic, major airlines in the countries are expanding their fleet of aircraft. Several low-cost carriers operating in the region are focused on enhancing the customer experience onboard long-haul flights. In 2022, some airlines, such as All Nippon Airways, started introducing mood-based lighting in their aircraft. Lighting is increasingly becoming an important part of the overall passenger experience, and the suppliers have taken steps to ensure that it can be consistent throughout the cabin and for everyone. New lighting products are launched regularly, each designed to improve performance and aesthetics. Due to such initiatives, it is expected to surge the demand for line-fit and retrofit market of aircraft lighting, is anticipated to bolster the growth of the segment in the forecast period.

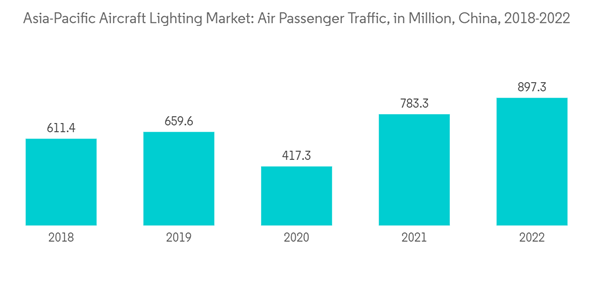

China to Witness Highest Growth During the Forecast Period

China is becoming a major hub for aviation and the country is expected to become the top aviation industry by 2030. A total of 897 million air passengers traveled through China in 2022, compared to 783.25 million in 2021. The rising number of deliveries of new commercial passenger aircraft has positively driven the growth of the lighting market. Of the commercial aircraft deliveries, about 85% were narrowbody, followed by 15% widebody aircraft. To cater to the growing passenger traffic in the region, the airlines in China are expanding their destination network and increasing their fleet, which is propelling aircraft demand. Similarly, with the growth in high-net-worth individuals has led to an increase in charter business travel in the country, generating demand for helicopters and business jets. To further enhance the passenger experience onboard aircraft (commercial aircraft and business jets), the airlines and charter providers are investing in modern cabin interiors with better lighting systems. Similar cabin modernization plans of airlines and charter providers are anticipated to propel the growth of the aircraft lighting market in the country.Asia-Pacific Aircraft Lighting Industry Overview

The Asia-Pacific aircraft lighting market is semi-consolidated and players such as Collins Aerospace (RTX Corporation), STG Aerospace Limited, Oxley Group, Honeywell International Inc., Safran SA, etc. account for a significant market share. Collins Aerospace and Honeywell International Inc. are the major players in the market that support major aircraft programs of Airbus, Boeing, Embraer, COMAC, and Bombardier among others with interior and exterior lighting. Key players are investing heavily in innovations and power-saving technologies such as LEDs and OLEDs to suit the operational demand for the thriving low-cost carrier segment market in the region.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.