Animal feed refers to various substances and products that are specifically designed for ingestion by livestock and poultry. These feeds are intended to offer the vital nutrients, energy, and minerals required for animal health, growth, and productivity. The Asia-Pacific region is experiencing rapid urbanization as well as income growth, leading to increased demand for animal protein products like meat, eggs, and dairy. This has increased livestock production volumes, fuelling the demand for animal feed. Technological advancements are improving feed efficiency, nutritional value, and regulatory standards. The market is dynamic and evolving, supporting livestock industries for food security and economic development.

Notably, as per OEC data of Importers of Animal meal and pellets shows China imports 31.5%, Indonesia 3.87%, and Thailand 2.72%. Japan 2.64% and South Korea imported 1.28% in the year 2022. Moreover, according to Invest India, India is the largest producer of milk and buffalo meat, with a vast livestock and poultry resource that improves rural socio-economic conditions. With 303.76 million bovines, 74.26 million sheep, 148.88 million goats, 9.06 million pigs, and 851.81 million poultry, India ranks 2nd in goat meat production, 3rd in egg production, and 8th in overall meat production globally. The livestock sector experienced a 13.36% compound annual growth rate from 2014-15 to 2021-22.

Asia-Pacific animal feed market drivers

Rising demand for meat proteins is projected to propel the Asia-Pacific animal feed market expansion.A growing number of consumers are demanding meat and animal products in the Asia-Pacific region. With lifestyle changes, income rise, and urbanization, there has been a noticeable shift towards higher consumption of animal protein. This is expanding the levels of animal feedproduction to support livestock farming, which results in the rise of the Asia-Pacific animal feed market. According to a recent report published by the USFDA, it is projected that chicken meat production in China is forecasted to increase from 14.9 million metric tons (MMT) in 2020 to 15.3 MMT in 2021.

Moreover, China's chicken meat production is primarily composed of white-feather broilers, which account for 50%, followed by yellow-feather broilers at 32%, hybrid chickens at 10%, and ex-layers at 8%. White broiler production is primarily concentrated in the North, led by Shandong Province, and yellow broiler production in the South, led by Guangdong Province. This growth is expected to continue in 2021 due to significant investments in poultry production, such as the construction of 17 new white broiler facilities in Fujian Province and plans for 1.7 billion RMB in new facilities in Liaoning Province.

Furthermore, the National Agro-Food Policy in Malaysia is an instance of a government initiative intended to promote the expansion of the livestock industry. It is anticipated that the production of animal feed in the area would increase in order to fulfill the expanding demand from the livestock industry. Additionally, it is anticipated that the government's incentives would motivate farmers as well as the commercial sector to provide fodder for both ruminants and non-ruminants. This will scale up the production which will be able to meet the growing demand of meat protein in the region.

Asia-Pacific animal feed market geographical outlook

The Asia-Pacific animal feed market has been segmented into China, Japan, India, South Korea, Australia, Indonesia, Vietnam, Thailand, Taiwan and others. China is expected to hold a substantial market share. The animal feed market in India has witnessed substantial growth in recent years, propelled by various factors contributing to the nation's evolving agricultural landscape and increasing demand for livestock products. One of the primary drivers behind this growth is the expanding livestock population in India, fueled by the rising consumption of meat, milk, and eggs. As the population continues to grow and urbanize, dietary habits are shifting towards higher protein consumption, consequently driving the demand for livestock products and, consequently, animal feed. According to the Ministry of Fisheries, Animal Husbandry & Dairying, research was conducted on the Livestock Census, which was published on April 5th, 2022. This census covered all domesticated animals and its headcounts for total 16 species of animals like Cattle, Buffalo, Mithun, Yak, Sheep, Goat, Pig, Horse, Pony, Mule, Donkey Camel, Dog, Rabbit and Elephant and poultry birds (Fowl, Duck, Turkeys and other poultry birds) possessed by the households, household enterprises/non- household enterprises and institutions at their site. Moreover, the 20th livestock census was indeed regarded as a unique attempt for the first-time data collected using tablet computers to digitize household-level data through online transmission from the field. Some of the significant findings of the 20th Livestock Census consisted of the total Livestock population which is 536.76 million in the country showing an increase of 4.8% over the Livestock Census 2012. The total Livestock population in rural and urban areas is 514.11 million and 22.65 million respectively, with a percentage share of 95.78% for rural and 4.22% for urban areas. The total Bovine population (Cattle, Buffalo, Mithun and Yak) was 303.76 million in 2019 which shows an increase of 1.3% over the previous census. The total number of Cattle in the country was 193.46 million in 2019 showing an increase of 1.3 % over previous Census.In addition, technological advancements and innovations in feed manufacturing processes have contributed to the growth of the animal feed market in India. The adoption of modern feed formulations and manufacturing techniques has enabled feed producers to develop customized feeds tailored to the specific nutritional requirements of different livestock species and production stages, thereby improving feed efficiency and animal performance.

Key developments in the market have also played a crucial role. For instance, in October 2023, De Heus India announced to set up a new state-of-the-art production plant at Vividha Industrial Park, Punjab where the company would produce high-quality feed products that would bolster farm practices, The plant will be operational by 2025 and will produce 180 kMT (Kilo metric Tons) of animal feed.

In addition, technological advancements and innovations in feed manufacturing processes have contributed to the growth of the animal feed market in India. The adoption of modern feed formulations and manufacturing techniques has enabled feed producers to develop customized feeds tailored to the specific nutritional requirements of different livestock species and production stages, thereby improving feed efficiency and animal performance.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2029

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The Asia-Pacific animal feed market is analyzed into the following segments:

By Type

- Fodder

- Forage

- Compound Feed

By Livestock

- Swine

- Aquatic Animals

- Cattle

- Poultry

- Others

- Soya

- Canola

- Rendered Meal

- Others

By Production Systems

- Integrated

- Commercial Mills

By Distribution Channel

- Direct Selling

- Distributor

By Country

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Vietnam

- Thailand

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Cargill, Incorporated

- Kemin Industries, Inc.

- New Hope Liuhe Co., Ltd.

- Archer-Daniels-Midland Company

- Weston Milling Animal Nutrition

- De Heus Beheer B.V.

- Tyson Foods Inc.

- Alltech Inc.

- East Hope Group

- Godrej Agrovet Limited

- Novus International

- BASF SE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | December 2024 |

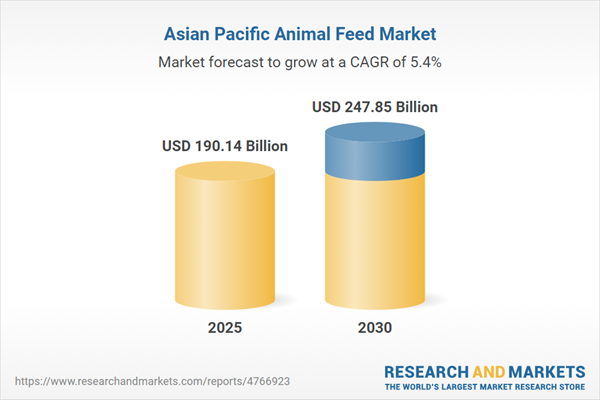

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 190.14 Billion |

| Forecasted Market Value ( USD | $ 247.85 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 12 |