Growing Awareness of Anti-Counterfeit Packaging in Developing Countries Drive Asia Pacific Anti-Counterfeit Packaging Market

Developing countries such as India and Indonesia are experiencing significant economic growth, industrial development, and increased trade, which is increasing the risk associated with counterfeiting. According to the Federation of Indian Chambers of Commerce & Industry (FICCI) report published on September 22, 2022 - illicit trade in five key industries, including FMCG, mobile phone, cigarette, and alcohol industries, caused the Indian exchequer a tax loss of US$ 7.93 billion and also resulted in the loss of 1.6 million jobs. Furthermore, in developing countries, stakeholders such as industry associations, trade organizations, and consumer advocacy groups are increasingly collaborating to address counterfeiting issues collectively. These collaborations raise awareness, share best practices, and promote the adoption of anti-counterfeit packaging solutions. Joint efforts by industry players create a conducive environment for the adoption of anti-counterfeit measures. Moreover, consumers in developing countries are becoming more aware of the risks associated with counterfeit products and are demanding genuine, safe, and trusted goods. This awareness drives the demand for products with proper anti-counterfeit packaging as consumers actively seek reliable and authenticated products. Businesses prioritizing anti-counterfeit measures can gain a competitive advantage by meeting consumer expectations for product authenticity. Thus, the growing awareness of anti-counterfeit packaging in developing countries is expected to offer lucrative opportunities for the market growth in the coming years.Asia Pacific Anti-Counterfeit Packaging Market Overview

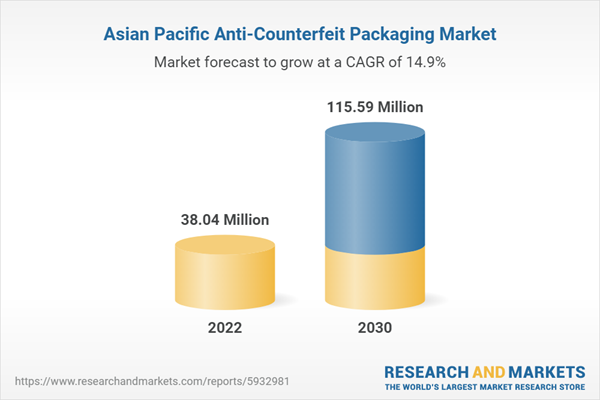

Asia Pacific has experienced a significant rise in counterfeit products across various industries, including pharmaceuticals, consumer goods, food & beverages, and electronics. This has raised concerns about product safety, authenticity, and integrity, leading to increased demand for anti-counterfeit measures. According to the 2021 Annual Review of the Hong Kong Customs & Excise Department (Hong Kong Customs), although being cut off from the world due to COVID-19 restrictions, Hong Kong still recorded a rising number of seized counterfeit goods which were to be sold locally or transshipped to other locations. The number of seized counterfeit products drastically increased by 170% to 3.15 million items in 2021, while the seizure value reached ~US$ 21 million (HK$ 166 million), indicating an increase of 51% from 2020. Moreover, per the International Finance Corporation (IFC) - a member of the World Bank Group - in Southeast Asia, e-commerce tripled in size between 2015 and 2020, and it registered a value of US$ 105 billion. The value is expected to reach US$ 309 billion by 2025. Counterfeit products sold through e-commerce platforms have become a significant issue in Asia Pacific. According to the International Trademark Association, digital trade in Southeast Asia is expected to reach US$ 1 trillion by 2030. The rapid development of online marketplaces and the increasing popularity of e-commerce have provided counterfeiters with a convenient and widespread platform to distribute fake goods. According to the South Korean Intellectual Property Office, online counterfeit sales approximately doubled in 2021 compared to 2019, while the Singapore Consumer Association cited a near-tripling of reported fake online sales in 2020. All these factors led to stricter government regulations and enforcement efforts to protect intellectual property rights. Therefore, the growth of the e-commerce industry and rising counterfeiting cases is expected to boost the Asia Pacific anti-counterfeit packaging market expansion in the coming years.Asia Pacific Anti-Counterfeit Packaging Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Anti-Counterfeit Packaging Market Segmentation

The Asia Pacific anti-counterfeit packaging market is segmented into technology, application, and country.Based on technology, the Asia Pacific anti-counterfeit packaging market is segmented into security inks and coatings, radio frequency identification (RFID), forensic markers, tamper evident, holograms, barcode, and others. In 2022, the barcode segment registered the largest share in the Asia Pacific anti-counterfeit packaging market.

Based on application, the Asia Pacific anti-counterfeit packaging market is segmented into food and beverage; pharmaceutical; personal care and cosmetics; electrical and electronics; textile and apparel; automotive; and others. In 2022, the pharmaceutical segment registered the largest share in the Asia Pacific anti-counterfeit packaging market.

Based on country, the Asia Pacific anti-counterfeit packaging market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. In 2022, Japan registered the largest share in the Asia Pacific anti-counterfeit packaging market.

Antares Vision SpA, Arjo AB, Avery Dennison Corp, Brady Corp, CCL Industries Inc, Constantia Flexibles International GmbH, Gestion Groupe Optel Inc, and KURZ Transfer Products LP are some of the leading companies operating in the Asia Pacific anti-counterfeit packaging market.

Table of Contents

Executive Summary

At 14.9% CAGR, the Asia Pacific Anti-Counterfeit Packaging Market is Speculated to be worth US$ 115.59 million by 2030.According to this research, the Asia Pacific anti-counterfeit packaging market was valued at US$ 38.04 million in 2022 and is expected to reach US$ 115.59 million by 2030, registering a CAGR of 14.9% from 2022 to 2030. Increasing adoption of smart packaging and growing awareness of anti-counterfeit packaging in developing countries are the critical factors attributed to the Asia Pacific anti-counterfeit packaging market expansion.

Smart packaging refers to the integration of advanced technologies and features into product packaging to provide additional functionalities beyond traditional packaging. These technologies include RFID, NFC, QR codes, tamper-evident seals, and other interactive elements. Smart packaging enables enhanced product authentication through the use of unique identifiers and track-and-trace systems. The integration of these technologies allows consumers, retailers, and supply chain stakeholders to verify product authenticity easily. This helps to combat counterfeiting by enabling real-time authentication and detection of counterfeit goods. Smart packaging facilitates improved visibility and traceability throughout the supply chain. By incorporating technologies such as RFID and NFC, manufacturers and stakeholders can track the movement of products from production to distribution. This level of traceability helps identify any diversion, tampering, or counterfeit infiltration within the supply chain, enabling prompt action to mitigate risks. For instance, in June 2022, ExxonMobil Lubricants launched "Mobil Super" - a lubricant for passenger vehicles with improved packaging, offering a new QR-code-based anti-counterfeit feature on the bottles for consumers to verify its authenticity. Furthermore, smart packaging technologies offer interactive features that engage consumers and provide valuable information about the product, its authenticity, and usage instructions. By scanning QR codes or using mobile apps, consumers can access product details, brand information, and anti-counterfeit measures. This increased consumer engagement helps raise awareness about counterfeit risks and encourages informed purchasing decisions. Moreover, smart packaging solutions provide valuable data and insights on consumer behavior, supply chain efficiency, and counterfeit incidents. By analyzing this data, manufacturers and brand owners can identify patterns, vulnerabilities, and potential areas of improvement in their anti-counterfeit strategies. These insights enable continuous enhancement of anti-counterfeit measures and better adaptation to evolving threats. Thus, developing smart and intelligent packaging materials is expected to fuel the Asia Pacific anti-counterfeit packaging market growth during the forecast period.

On the contrary, usage complexity of anti-counterfeit packaging hurdles the growth of Asia Pacific anti-counterfeit packaging market.

Based on technology, the Asia Pacific anti-counterfeit packaging market is segmented into security inks and coatings, radio frequency identification (RFID), forensic markers, tamper evident, holograms, barcode, and others. The barcode segment held 30.0% share of Asia Pacific anti-counterfeit packaging market in 2022, amassing US$ 11.41 million. It is projected to garner US$ 32.20 million by 2030 to expand at 13.8% CAGR during 2022-2030.

Based on application, the Asia Pacific anti-counterfeit packaging market is segmented into food and beverage; pharmaceutical; personal care and cosmetics; electrical and electronics; textile and apparel; automotive; and others. The pharmaceutical segment held 21.2% share of Asia Pacific anti-counterfeit packaging market in 2022, amassing US$ 8.07 million. It is projected to garner US$ 29.84 million by 2030 to expand at 17.8% CAGR during 2022-2030.

Based on country, the Asia Pacific anti-counterfeit packaging market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. Our regional analysis states that Japan captured 26.8% share of Asia Pacific anti-counterfeit packaging market in 2022. It was assessed at US$ 10.19 million in 2022 and is likely to hit US$ 33.79 million by 2030, exhibiting a CAGR of 16.2% during 2022-2030.

Key players profiled in the Asia Pacific anti-counterfeit packaging market report are Antares Vision SpA, Arjo AB, Avery Dennison Corp, Brady Corp, CCL Industries Inc, Constantia Flexibles International GmbH, Gestion Groupe Optel Inc, and KURZ Transfer Products LP, among others.

Companies Mentioned

- Antares Vision SpA

- Arjo AB

- Avery Dennison Corp

- Brady Corp

- CCL Industries Inc

- Constantia Flexibles International GmbH

- Gestion Groupe Optel Inc

- KURZ Transfer Products LP

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | December 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 38.04 Million |

| Forecasted Market Value by 2030 | 115.59 Million |

| Compound Annual Growth Rate | 14.9% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 8 |