Automated material handling is a part of the manufacturing process that acquires raw materials and ships them to the intended customer. It has ousted human workers from within the plant. With its capacity to enhance productivity, scalability, and operational efficiency, automated material handling reduces the probability of mistakes or defects. The term “material handling equipment” refers to the machines involved in the automated material handling process.

Their core tasks throughout all stages of production, disposal, and consumption are safeguarding, storing, or managing materials and transporting goods or merchandise. A positive change in the market for automated material handling is projected owing to rising labor costs, concerns about safety, and the emergence of rival companies offering robotic warehouse automation services.

Demand for material handling robots heighten herewith an aim of improving productivity. Manufacturing firms are able to streamline their production processes through using fast and accurate handlers which swiftly perform all sorts of work involved with pallets such as stacking, picking, sorting or packing among others. One more thing that drives growth is increased expenditure by companies on research and development aimed at improving the capabilities and efficiency of material-handling robots. In addition, these robots now execute complex operations as a result of advanced AI and ML. In addition, it is anticipated that skilled labour availability and government policies enticing automation into manufacturing will significantly enhance this growth.

Asia Pacific Automated Material Handling Market Drivers:

Growing presence of start-up companies providing robotic solutions for warehouse automation

The increasing acceptance of robotic systems significantly contributes to the demand for automatic handling systems, especially in warehousing and storage processes. This is because these systems enable consumers to move goods quickly and securely in warehouses and factories while at the same time ensuring safety and security along a process chain that extends from when goods leave production through to their actual endpoints. The Internet establishes a connection between the robotic appliances that comprise the warehouse concept and the connected network devices that control them. Because of the growing idea of the Internet of Things (IoT), one of the emerging markets for robotics manufacturing companies is the material handling sector.Asia Pacific Automated Material Handling Market Geographical Outlook

China is witnessing exponential growth during the forecast period

China has played a significant role in expanding the automated material handling market in the Asia Pacific area. The market is expanding favourably as a result of the rising demand for automated material handling products in various industries, including manufacturing, automotive, and e-commerce. China, with its massive population, has a substantial industrial policy. This country has been at the forefront of the world in terms of exports, imports, and trade by purchasing power parity for nearly ten years. In summary, it is transitioning from an economy based on manufacturing and construction to one emphasizing consumption.Reasons for buying this report::

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub- segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2029

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The Asia Pacific Automated Material Handling market is segmented and analyzed as follows:

By-Products

- Automated Guided Vehicles

- Towing Vehicles

- Unit Load Vehicles

- Pallet Trucks

- Fork Trucks

- Assembly Line Vehicles

- Others

- Automated Storage and Retrieval Systems

- Unit Load

- Mini Load

- Horizontal Carousels

- Vertical Carousels

- Robotic AS/RS

- Others

- Software

- Services

By Industry

- Manufacturing

- Medical & Healthcare

- Electronics & Semiconductor

- Chemicals

- Food & Beverages

- Warehousing

- Automotive

- Others

By Geography

- China

- Japan

- India

- Australia

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

Companies Mentioned

- BEUMER Group GmbH & Co. KG

- Murata Machinery Ltd.

- Daifuku Co., Ltd.

- Mecalux SA

- Kardex Group

- KION Group

- JBT Corporation

- Jungheinrich AG

- SSI Schaefer AG

- VisionNav Robotics

- System Logistics

- Interroll Group

- Witron Logistik

- Kuka AG

- Honeywell Intelligrated Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 92 |

| Published | October 2024 |

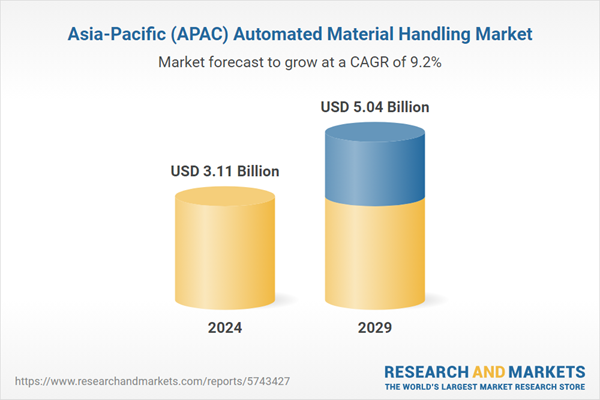

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 3.11 Billion |

| Forecasted Market Value ( USD | $ 5.04 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 15 |