Evolution of IoT and Connected Devices Boosts Asia Pacific Automated Test Equipment Market

The evolution of IoT enables devices to be connected over the Internet. For instance, according to Cisco Systems, Inc., nearly two-thirds or 66% of the global population will have Internet access, reaching 5.3 billion of total Internet users by the end of 2023. The rapid growth of data traffic over the Internet is attributed to the rising penetration of smartphones, smartwatches, and other consumer electronic devices that can be connected over the Internet, increasing the popularity of IoT.Strong internet infrastructural deployments in advanced countries coupled with the development of advanced infrastructures such as 5G, fiber optic cables, and wireless connectivity are establishing new use cases, including Fixed Wireless Access, Critical IoT, and Massive IoT. Growing advancements in internet technology are driving businesses to harness the best out of the presented opportunity and maximize revenue generation streams. It is estimated that each individual will have close to a dozen devices that will be connected to the Internet by 2020.

As per Ericsson's latest mobility report, the number of mobile subscriptions has reached 59 billion in the first quarter of 2023. The number of mobile broadband subscriptions is growing at 89% percent year-on-year, reaching a total of 65 million in the first quarter of 2023. The growing number of mobile subscriptions associated with inactive subscriptions, optimization of subscriptions for different types of calls, and multiple device ownership. A huge population from countries such as India and China are highly adopting smartphones and other consumer electronic devices, which is projected to create opportunities in the market. Additionally, significant initiatives taken by the government toward the digitalization of economies in developing countries such as India, and Japan are creating a larger number of data traffic over the Internet. Moreover, countries such as Singapore are also experiencing rapid growth in digitalization, resulting in a huge influx of data over the Internet.

Growing awareness related to the benefits provided by advanced technologies such as IoT, communications, and sensors is paving the way for the integration of sensors into the devices, creating opportunities for the automated test equipment market growth. Several industries, such as consumer electronics, automotive, healthcare, and aerospace & defense, are adopting automated testing equipment to automate and transform numerous business functions such as supply chain planning and logistics and manufacturing across industries for increasing profitability. The growth of automated test equipment in the various end user industries is anticipated to rise at a rapid rate in the coming years, with IoT gaining more prominence in the coming years.

Asia Pacific Automated Test Equipment Market Overview

Asia Pacific consists of many developing countries such as China, Japan, India, and South Korea, which have witnessed high growth in their manufacturing industries in recent years. Asia Pacific is on the verge of becoming a global manufacturing hub with the presence of diverse manufacturing industries, including electronics, automotive, and petrochemical production businesses. China is evolving into a high-skilled manufacturing hub, followed by other developing countries such as India, South Korea, Vietnam, and Taiwan. Governments of several Asia Pacific countries are offering tax rebates, funds, subsidies, etc., to attract manufacturing companies to set up plants in their respective countries. Initiatives such as Made in China 2025 and Make in India propel the growth of the manufacturing industry in the respective countries.China is the largest producer of passenger cars in the world, followed by Japan, India, and South Korea. This would further propel the automated test equipment market growth in the country. Also, the consumer electronics manufacturing industry in Asia Pacific is leading globally. The presence of these industries is anticipated to influence the ATE market positively. On the other hand, China, which is the largest manufacturing hub, is experiencing a rise in the country's labor cost owing to the aging population of the country. As a result, manufacturing enterprises from developed countries are seeking to make investments in other Southeast Asian countries to take advantage of improving infrastructure, rising domestic consumption, and lower costs in these countries.

Additionally, many of the economies of Asia Pacific are embracing digitalization by adopting modern trends such as autonomous vehicles, smart cities, and IoT to become global powers. Asia Pacific presents strong business opportunities for investment in 5G technology amid the rapid-paced digital transformation in countries in this region, especially for investors seeking to avoid high operating costs in the US. 5G deployment trials have already commenced in Asian countries. According to the GSM Association, the adoption of 5G technology would cost over US$ 133 billion to the Asia Pacific economy by 2030.

Countries such as South Korea, China, Japan, and India have already adopted 5G technology to transform their manufacturing facilities. Device compliance is another major factor that drives the deployment of 5G in Asia. Device manufacturers such as ZTE have unveiled 5G-ready smartphones, further defining Asia's leadership in 5G development. The percentage of 5G trials conducted in Asia Pacific accounts for nearly 50% of the global number. Over 30 operators in Asia Pacific are testing 5G, with 9 involved in field trials-including SK Telecom, KT, and LG Uplus in South Korea; China Mobile and China Unicom; and NTT Docomo in Japan. Such developments in 5G infrastructure are likely to create a demand for ATE in Asia Pacific in the coming years.

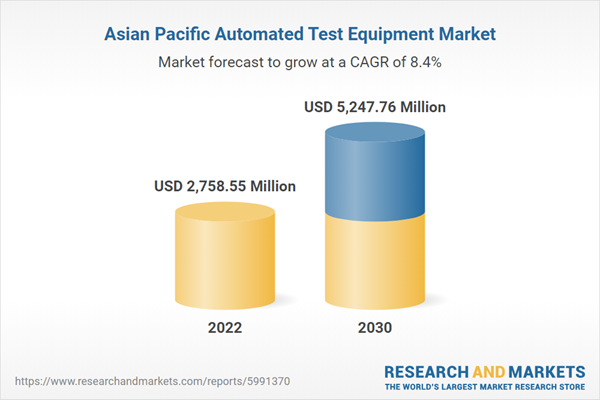

Asia Pacific Automated Test Equipment Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Automated Test Equipment Market Segmentation

The Asia Pacific automated test equipment market is categorized into type, component, end user, and country.Based on type, the Asia Pacific automated test equipment market is segmented into integrated circuits (ICs) testing, printed circuit boards (PCBs) testing, hard disk drives (HDDs) testing, and others. The integrated circuits (ICs) testing segment held the largest market share in 2022.

In terms of component, the Asia Pacific automated test equipment market is segmented into industrial PCs, mass interconnect, and handler/prober. The industrial PCs segment held the largest market share in 2022.

By end user, the Asia Pacific automated test equipment market is segmented into consumer electronics, automotive, medical, aerospace & defense, IT & telecommunication, and other industries. The consumer electronics segment held the largest market share in 2022.

By country, the Asia Pacific automated test equipment market is segmented into China, India, South Korea, Taiwan, India, and the Rest of Asia Pacific. China dominated the Asia Pacific automated test equipment market share in 2022.

Advantest Corp; Anritsu Corp; Averna Technologies Inc; Chroma ATE Inc.; Exicon Co., Ltd; National Instruments Corp; SPEA S.p.A; Teradyne Inc; and Test Research, Inc. are among the leading companies operating in the Asia Pacific automated test equipment market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific automated test equipment market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific automated test equipment market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the Asia Pacific automated test equipment market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

- Advantest Corp

- Anritsu Corp

- Averna Technologies Inc

- Chroma ATE Inc.

- Exicon Co., Ltd

- National Instruments Corp

- SPEA S.p.A.

- Teradyne Inc

- Test Research, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 107 |

| Published | June 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 2758.55 Million |

| Forecasted Market Value ( USD | $ 5247.76 Million |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 9 |