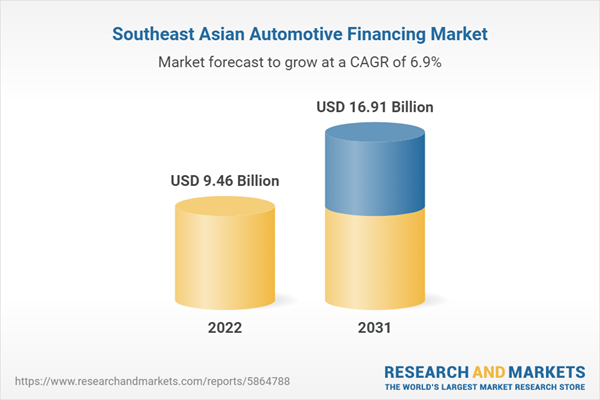

The Southeast Asia automotive financing market held a market value of USD 9.46 billion in 2022 and is estimated to reach USD 16.91 billion by the year 2031. The market is projected to list a CAGR of 6.88% during the forecast period.The Southeast Asia automotive financing market held a market value of USD 9.46 billion in 2022 and is estimated to reach USD 16.91 billion by the year 2031

With the aim of giving back control to the users and decentralising the internet, automotive financing is still in its infancy. Decentralization is made possible by the blockchain system, and when it succeeds, people will be able to live in a society that combines the online and physical worlds.

Automotive financing presents intelligent individuals and businesspeople with a blue ocean chance. Since it will be able to exchange assets peer to peer for the first time without the need for centralised trusted intermediaries, it will have a bigger impact than the internet itself. Starting with the banking and gaming industries, this will have an effect on every industry.

One of the key drivers of growth in the Southeast Asia automotive financing market is the emergence of digital channels and online financing solutions. As more consumers turn to digital platforms for their financial needs, automotive finance companies have had to adapt by offering online applications and other digital solutions to remain competitive. Overall, the Southeast Asia automotive financing market is expected to continue to grow in the coming years, driven by factors such as rising demand for vehicles, increasing purchasing power, and the continued development of digital channels and online financing solutions.

The region has seen economic and political instability in certain countries, which can lead to uncertainty and affect consumer confidence. This can result in decreased demand for automotive financing products and services. In addition to that, changes in regulations and government policies can impact the automotive financing industry, particularly in areas such as interest rates, loan terms, and licensing requirements. These changes can create uncertainty for companies operating in the market and affect their ability to offer competitive products.

Growth Influencers:

Emergence of Online Automotive Finance Applications propelling GrowthThe emergence of online automotive finance applications has indeed been a key driver for the growth of the Southeast Asia automotive financing market in recent years. With more and more consumers turning to digital channels for their financial needs, automotive finance companies have had to adapt by offering online applications that are fast, easy, and convenient. These online applications allow consumers to apply for financing from the comfort of their own homes, without the need for lengthy paperwork or in-person meetings. They can also provide instant approvals and personalized loan offers, making the process more efficient and tailored to the individual's needs.

In addition to the convenience factor, online automotive finance applications have also helped to increase competition in the market. With more players entering the market and offering digital solutions, consumers have more options to choose from, which can help to drive down interest rates and fees.

Segments Overview:

The Southeast Asia Automotive financing market is segmented into vehicle, ownership, vehicle usage, provider, financing, end user.By Vehicle

- 2-Wheeler

- 3-Wheeler

4-Wheeler

- LCVs

- HCVs

By Ownership

- New Vehicle

- Old Vehicle

By Vehicle Usage

- Private Vehicles

- Commercial Vehicles

- Heavy Vehicles

By Provider

- Banks

- OEMs

- Others

By Financing

- Leases

Loans

- Direct

- Indirect

By End User

- Individuals

- Enterprises

The Southeast Asian market for Automotive financing, on the basis of geography, is divided into Singapore, Thailand, Indonesia, Vietnam, Malaysia, Philippines, Cambodia, Myanmar, and rest of ASEAN. The Thailand market for automotive financing is estimated to grow at a fastest rate of 8.5% over the forecast period.

Competitive Landscape

The top players operating in the Southeast Asia automotive financing market include Hitachi Capital, General Motors, Ford Motor Credit Company, Honda Financial Services, Daimler Financial Services, Chase Auto Finance, BNP Paribas, Volkswagen Financial Services, Toyota Financial Services. The cumulative market share of the ten major players is close to 35% to 45%. With partners BNP Paribas SA, Credit Agricole SA, and Banco Santander SA, Stellantis NV overhauled its European leasing and finance services in December 2021, streamlining the automaker's disjointed operations there. According to a statement, the manufacturer of Jeep, Peugeot, and Fiat vehicles will establish a leasing joint venture business with Credit Agricole. Additionally, it will form partnerships with BNP and Santander to oversee financial operations.

The Southeast Asia Automotive financing market report provides insights on the below pointers:

- Market Penetration: Provides comprehensive information on the market offered by the prominent players

- Market Development: The report offers detailed information about lucrative emerging markets and analyzes penetration across mature segments of the markets

- Market Diversification: Provides in-depth information about untapped geographies, recent developments, and investments

- Competitive Landscape Assessment: Mergers & acquisitions, certifications, product launches in the Southeast Asia Automotive financing market have been provided in this research report. In addition, the report also emphasizes the SWOT analysis of the leading players.

- Product Development & Innovation: The report provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

- Pricing Analysis: Pricing analysis of various components

- Manufacturing Cost Analysis: Cost-share of various components

- SEA Automobile Production

- Automobile Costs Breakdown

The Southeast Asia Automotive financing market report answers questions such as:

- What is the market size and forecast of the Southeast Asia automotive financing market?

- What are the inhibiting factors and impact of COVID-19 on the Southeast Asia automotive financing market during the assessment period?

- Which are the products/segments/applications/areas to invest in over the assessment period in the Southeast Asia automotive financing market?

- What is the competitive strategic window for opportunities in the Southeast Asia automotive financing market?

- What are the technology trends and regulatory frameworks in the Southeast Asia automotive financing market?

- What is the market share of the leading players in the Southeast Asia automotive financing market?

- What modes and strategic moves are considered favorable for entering the Southeast Asia automotive financing market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Honda Financial Services

- Hitachi Capital

- General Motors Financial Inc.

- Ford Motor Credit Company

- Daimler Financial Services

- Volkswagen Financial Services

- Toyota Financial Services

- Standard Chartered Auto Financing

- DBS Car Loan

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 224 |

| Published | July 2023 |

| Forecast Period | 2022 - 2031 |

| Estimated Market Value ( USD | $ 9.46 Billion |

| Forecasted Market Value ( USD | $ 16.91 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Asia Pacific |