Asia Pacific Bone Cement Market Overview

Bone cement is a type of biomaterial that is used within human bodies to repair fractures, support joint arthroplasty, and fill in gaps between implant prosthesis and the bone. Bone cement is rigid and provides additional stability. It is a fine powder which is mixed with a liquid to create a paste. Bone cement can also provide additional strength to artificial implants.The Asia Pacific bone cement market value is benefitting from the rising advancements in bone cement formulations and delivery methods that improve the performance and safety of these products. The market growth is also supported by the heightened awareness of bone health among the public and the increasing innovations in diagnostic technologies. Such developments are leading to early diagnosis and treatment of bone disorders, which also affects the demand in the global bone cement market . Other factors that influence the market dynamics include rising healthcare expenditure, supportive government policies, and the growing research initiatives focused on enhancing orthopedic treatments.

Asia Pacific Bone Cement Market Growth Drivers

Growing Aging Population to Affect the Market Landscape Significantly

According to the United Nations Economic and Social Commission for Asia and the Pacific, around 697 million older adults (aged 60 or above) were living in the Asia and Pacific in 2023, accounting for 60% of all older adults worldwide. Further, it is estimated that 1 in 7 individuals in the region are currently aged 60 years or over, and by 2050, 1 out of 4 people will fall in this age cohort. This rapid demographic shift is a significant growth driver of the market as older people are at a higher risk of developing bone-related conditions such as osteoporosis and osteoarthritis. These conditions often lead to weakened joints and bone which prompts the need for surgical interventions requiring bone cement. Moreover, a higher rate of bone injuries and fractures among the elderly population is poised to propel the market growth in the forecast period.Increased Demand for Antibiotic-Loaded Bone Cement to Elevate Asia Pacific Bone Cement Market Value

There is a growing market demand for bone cement incorporated with antibiotics in the Asia Pacific region, owing to its advantages in preventing post-surgical infections, particularly in the case of orthopedic surgeries. Antibiotic-loaded bone cement mitigates the risk of complications in joint replacement surgeries by offering a high local dose of antibiotics. For example, the leading provider of bone cement Heraeus Medical GmbH has introduced COPAL® G+C, a high-viscosity and radiopaque bone cement, carrying an antibiotic combination of 1 g clindamycin and 1 g gentamicin. The rising availability of such advanced bone cement products is expected to improve clinical outcomes and support market growth.Asia Pacific Bone Cement Market Trends

The market is witnessing several trends and developments to improve the current global scenario. Some of the notable trends are as follows:Innovations in Bone Cement Delivery Systems

The rising advancements in bone cement delivery systems are resulting in the accurate application of bone cement during surgeries, leading to precise bone cement delivery and better patient outcomes. Moreover, the increasing focus on improving the safety features of bone cement delivery systems is anticipated to augment the market demand.Rising Preference for Minimally Invasive Procedures

There is a rising patient inclination towards minimally invasive surgical procedures, such as vertebroplasty, kyphoplasty, and minimally invasive joint replacements, due to the associated advantages like shorter recovery time and lower risk of complications. These surgical interventions often require bone cement for fixing implants in place and thus their growing demand is poised to boost the Asia Pacific bone cement market share.Improved Healthcare Access and Infrastructure

In the Asia Pacific region, increased investment in healthcare infrastructure is a major market trend that is influencing the adoption of advanced orthopedic procedures and bone cement products. Moreover, the expansion of specialized orthopedic centers further fuels the market growth.Growing Demand for Biodegradable Bone Cements

The market is witnessing a growing demand for biodegradable bone cement due to its ability to resorb and integrate with natural bone tissue. Biodegradable bone cements are known to promote bone regeneration and healing, leading to better clinical outcomes and reduced risk of long-term complications.Asia Pacific Bone Cement Market Segmentation

Asia Pacific Bone Cement Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product

- Calcium Phosphate Cement (CPC)

- Glass Polyalkenoate Cement

- Polymethyl Methacrylate (PMMA) Cement

Market Breakup by Application

- Kyphoplasty

- Arthroplasty

- Vertebroplasty

Market Breakup by End User

- Hospital

- Ambulatory Surgical Centres

- Clinics

Market Breakup by Region

- China

- Japan

- India

- South Korea

- Australia

Asia Pacific Bone Cement Market Share

Polymethyl Methacrylate (PMMA) Cement Segment is Anticipated to Witness Substantial Market Growth

Based on product, the market report offers an insight into calcium phosphate cement (CPC), glass polyalkenoate cement and polymethyl methacrylate (PMMA) cement. The polymethyl methacrylate segment holds a significant share in the Asia Pacific region. Polymethyl methacrylate bone cement is gaining traction in present-day orthopedic surgeries due to the high endurance of this product and its compatibility with modern surgical techniques. Over the forecast period, the anticipated increase in the application of the product in percutaneous vertebroplasty and kyphoplasty is poised to propel the Asia Pacific bone cement market demand in healthcare units. Moreover, polymethyl methacrylate exhibits an elastic effect which is a critical relative advantage of the product, accelerating the growth of the Asia Pacific market for bone cement.Asia Pacific Bone Cement Market Analysis by Region

Based on the region, the market is segmented into China, Japan, India, South Korea, and Australia. China covers a significant share of the market due to a rapidly aging population, growing demand for minimally invasive procedures in orthopedic surgeries, and increasing healthcare expenditure. The market growth is also supported by the expansion of hospitals and clinics and increased focus on improving access to orthopedic care, particularly in rural areas. India also holds a substantial market value, owing to the rising incidences of orthopedic disorders caused by sedentary lifestyles, sports injuries, and the increasing aging population.Leading Players in the Asia Pacific Bone Cement Market

The key features of the market report comprise the patent analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:Johnson & Johnson MedTech (Depuy Synthes)

Depuy Synthes is the orthopedics division of Johnson & Johnson. It is a medical device manufacturing company that was founded in the year 1895 and was later acquired by Johnson and Johnson. The company provides data-enabled orthopedic and MedTech solutions. Major bone cement products developed by this company facilitate hip and knee replacement.

Stryker Corporation

Stryker Corporation is a multinational MedTech company that was founded in the year 1941 with headquarters in Michigan, United States. The company aims to develop innovative orthopedic, medical, surgical, and neurotechnological products to cater to the demand of patients suffering from chronic musculoskeletal disorders. Stryker operates across more than 75 countries and has a workforce of more than 46,000. One of its key products is SpinePlex bone cement which is clinically proven to possess high compressive and flexural strengths. Stryker is known to heavily invest in advancing bone cement formulations and contributes significantly to the Asia Pacific bone cement market growth.Zimmer Biomet Holdings, Inc

Zimmer Biomet Holdings, Inc. is a leading medical technology company that was founded in the year 1927 and has been helping consumers improve mobility by innovating various MedTech products. This company designs, manufactures, and innovates orthopedic solutions including bone cement products. It operates across 25 countries and is expanding its product offerings to around 100 countries.Smith & Nephew plc

Smith & Nephew plc, also known as Smith+Nephew, is a global medical equipment manufacturing company with a prominent presence in the market. The company offers a range of bone cement products such as its RALLY™ Bone Cement portfolio and leverages strategic partnerships to expand market reach.Other key players in the market include Medtronic plc, DJO, LLC, Globus Medical, Inc., Arthrex, Inc., Cardinal Health, Inc., and Heraeus Medical LLC.

Key Questions Answered in the Asia Pacific Bone Cement Market Report

- What was the Asia Pacific bone cement market value in 2024?

- What is the Asia Pacific bone cement market forecast outlook for 2025-2034?

- What are the regional markets covered in the report?

- What is market segmentation based on product?

- What is the market breakup based on application?

- Who are the major end users in the market?

- What are the major factors aiding the Asia Pacific bone cement market demand?

- How has the market performed so far and how is it anticipated to perform in the coming years?

- What are the market's major drivers, opportunities, and restraints?

- Which country is expected to experience expedited growth during the forecast period?

- How does the increasing number of joint replacement surgeries affect the market landscape?

- What are the major Asia Pacific bone cement market trends?

- How does the rise in the geriatric population impact the market size?

- Which product will dominate the market share?

- Which application area is expected to have a high market value in the coming years?

- Which end user is projected to contribute to the highest market growth?

- Who are the key players involved in the Asia Pacific bone cement market?

- What is the patent landscape of the market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Johnson & Johnson Services, Inc.

- Stryker Corporation

- Zimmer Biomet Holdings, Inc

- Smith & Nephew plc

- Medtronic plc

- DJO, LLC

- Globus Medical, Inc

- Arthrex, Inc.

- Cardinal Health, Inc.

- Heraeus Medical LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | July 2025 |

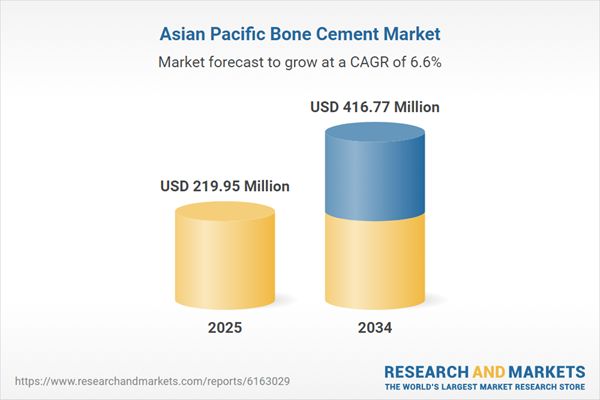

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 219.95 Million |

| Forecasted Market Value ( USD | $ 416.77 Million |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |