Growing Industrial Automation Worldwide Boosts Asia Pacific Distributed Control Systems Market

The 21st century is characterized by extreme competition in all industrial sectors. The manufacturers of various products face intense competition with their competitors on account of quality, service, costs, and time-to-market. Also, manufacturers have faced huge challenges concerning maintaining a perfect balance between the demand and supply of the product. With the increasing functionality of equipment such as industrial robots, it is projected that non-automotive industries will accelerate the adoption of industrial automation. This growth is attributed to the modernization and transformation required in distributed control system market.The rising penetration of advanced technologies, such as machine learning (ML), the Internet of Things (IoT), and artificial intelligence (Al), has helped accelerate the growth of industrial automation. Furthermore, the increase in product development and strategic initiatives from key industrial control systems companies is boosting the demand for industrial automation. For instance, in October 2023, Rockwell Automation, Inc. and Microsoft Corp. announced an extension of their longstanding relationship to accelerate industrial automation design and development through generative artificial intelligence (AI). Similarly, in December 2023, Rockwell Automation, Inc.

announced that it strengthened its collaboration with Michelin, one of the world’s leading tires manufacturing company, focusing on digital innovation across Michelin's manufacturing processes. Further, the growing industrial automation, the Internet of Things (IoT), and the 5G technology are a few factors contributing to market growth. Moreover, the penetration of connected enterprises and the need for mass manufacturing of products due to the growing demand for real-time data analysis across the globe and the rising integration of advanced technologies across end-use industries to improve performance are promoting automation trends in manufacturing. In March 2023, Samsung announced that it would invest in setting up smart manufacturing capabilities at its mobile phone plant in Noida, India, to make production more competitive.

The distributed control system enables remote monitoring of activities and ensures efficiency enhancement, thereby inducing growth and productivity in the manufacturing sector. The increasing adoption of automation in the manufacturing industry propels the demand for DCS integration, driving the distributed control system market.

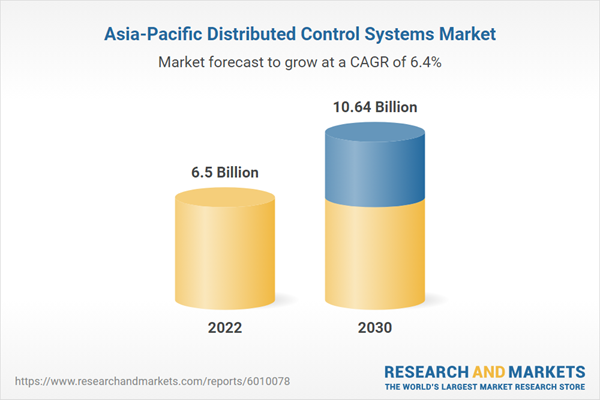

Asia Pacific Distributed Control Systems Market Overview

Asia Pacific (APAC) is a technologically advancing region with tech-savvy countries, including China, India, Japan, South Korea, and Australia. These countries showcase an astonishing demand for advanced technologies. Owing to the constant growth in their economies, their governments and private organizations are investing significantly higher amounts in developing and procuring advanced systems. Energy & power, automotive, and pharmaceutical industries and food & beverages and chemicals & petrochemicals sectors are among the fastest-growing industries in the region. The growing production in these sectors is leading to an increased demand for DCS, which is the key catalyzer for the distributed control systems market.China is the most mature market in the APAC in terms of technologies, and it continues to dominate the region. The continuous growth in the chemicals & petrochemicals industry is the key driving factor for the distributed control systems market in China. Chinese chemical companies are engaged in implementing higher numbers of DCS. For instance, in November 2022, China's Wanhua Chemical Group announced that they are digitizing the operations in their chemical plant. In the plant, smart terminals are connected to the distributed control system (DCS) or safety instrumented system (SIS) via FieldComm Group technology. Smart terminals can then achieve maximum management and control efficiency by using the intelligent equipment management platform.

In addition, ABB's Freelance DCS is helping China's largest soda ash producer increase its marine chemical industrial chain and boost the local economy and chemical industry. This majorly pertains to the fact that the chemical and petrochemical plants have multiple input/output (I/O) points, and monitoring and controlling every I/O point with human interference is difficult.

In addition, the construction of new industrial infrastructure is limited by various factors, including political, environmental, legal, and economic parameters. However, the infrastructures outfitted with DCS demand continuous operation, and due to this, the demand for service providers is surging in the region, which is ultimately boosting the distributed control systems market in Asia-Pacific.

Asia Pacific Distributed Control Systems Market Segmentation

- The Asia Pacific distributed control systems market is segmented based on component, industry, and country.

- Based on component, the Asia Pacific distributed control systems market is segmented into hardware, software, and services. The hardware segment held the largest share in 2022.

- In terms of industry, the Asia Pacific distributed control systems market is segmented into power generation, oil and gas, pharmaceutical, food and beverages, chemicals, and others. The oil and gas segment held the largest share in 2022.

- Based on country, the Asia Pacific distributed control systems market is categorized into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific distributed control systems market in 2022.

- Honeywell International Inc, General Electric Co, ABB Ltd, Yokogawa Electric Corp, Toshiba Corp, Siemens AG, Emerson Electric Co, NovaTech LLC, Schneider Electric SE, and Rockwell Automation Inc are some of the leading companies operating in the Asia Pacific distributed control systems market.

Market Highlights

- Based on component, the Asia Pacific distributed control systems market is segmented into hardware, software, and services. The hardware segment held 44.8% share of the Asia Pacific distributed control systems market in 2022, amassing US$ 2.91 billion. It is projected to garner US$ 4.52 billion by 2030 to expand at 5.7% CAGR during 2022-2030.

- In terms of industry, the Asia Pacific distributed control systems market is segmented into power generation, oil and gas, pharmaceutical, food and beverages, chemicals, and others. The oil and gas segment held 27.0% share of the Asia Pacific distributed control systems market in 2022, amassing US$ 1.75 billion. It is estimated to garner US$ 2.50 billion by 2030 to expand at 4.5% CAGR during 2022-2030.

- China held 26.4% share of Asia Pacific distributed control systems market in 2022, amassing US$ 1.71 billion. It is projected to garner US$ 3.06 billion by 2030 to expand at 7.5% CAGR during 2022-2030.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific distributed control systems market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in Asia Pacific distributed control systems market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Asia Pacific Distributed Control Systems market include:- Honeywell International Inc

- General Electric Co

- ABB Ltd

- Yokogawa Electric Corp

- Toshiba Corp

- Siemens AG

- Emerson Electric Co

- NovaTech LLC

- Schneider Electric SE

- Rockwell Automation Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | August 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 6.5 Billion |

| Forecasted Market Value ( USD | $ 10.64 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 11 |