The China market dominated the Asia Pacific Embedded Computing Market by Country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of $6.72 billion by 2031. The Japan market is registering a CAGR of 8.7% during 2024-2031. Additionally, the India market is expected to showcase a CAGR of 10.1% during 2024-2031.

The telecommunications industry is another significant adopter of these technologies. From base stations to routers, communication devices rely on embedded systems to manage network traffic, encryption, and connectivity. With the advent of 5G networks, embedded systems in telecommunications infrastructure have become even more important in supporting the demands for higher bandwidth, lower latency, and faster data transfer rates.

The adoption of this has been on the rise, driven by technological advancements, the need for smarter systems, and the continued growth of IoT. One of the key drivers of their adoption has been the continuous miniaturization of components. Modern embedded systems are smaller, more powerful, and more cost-effective than ever, making them suitable for a wider range of applications.

The telecommunications sector in China has long been a significant driver of technological innovation, but recent developments highlight the increasingly central role of emerging technologies. Sectors such as big data, cloud computing, and IoT have been the key contributors to this growth, with the sector's overall revenue from these emerging domains climbing by an impressive 19.1% in 2023.

India’s automotive industry is profoundly transforming toward smart manufacturing, electric vehicles (EVs), autonomous driving technology, and connected vehicles. As these trends gain momentum, embedded computing solutions are becoming crucial to enabling the advanced functionalities required in modern vehicles. Therefore, the rising telecommunication sector and increasing automotive industry in the region drive the market's growth.

List of Key Companies Profiled

- Fujitsu Limited

- Intel Corporation

- IBM Corporation

- HCL Technologies Ltd.

- Microsoft Corporation

- Qualcomm Incorporated (Qualcomm Technologies, Inc.)

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments, Inc.

- NXP Semiconductors N.V.

Market Report Segmentation

By Component

- Software

- Hardware

- Microcontroller (MCU)

- Microprocessor (MPU)

- Digital Signal Processor (DSP)

- Other Hardware Type

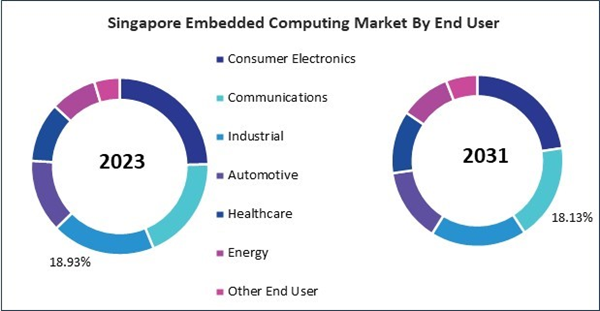

By End User

- Consumer Electronics

- Communications

- Industrial

- Automotive

- Healthcare

- Energy

- Other End User

By Country

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- Fujitsu Limited

- Intel Corporation

- IBM Corporation

- HCL Technologies Ltd.

- Microsoft Corporation

- Qualcomm Incorporated (Qualcomm Technologies, Inc.)

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments, Inc.

- NXP Semiconductors N.V.