Asia Pacific Generic Drugs Market Analysis

A generic drug is similar to a brand-name drug in terms of dosage form, safety, strength, clinical performance, and intended use, among others. Generic medicines are generally available at a lower price and act as an equal substitute for their branded counterparts. In Asia Pacific, the rising burden of chronic diseases and the growing aging population are fuelling the need for affordable healthcare solutions, leading to the expansion of the global generic drugs market . Additionally, as policymakers in the region continuously introduce supportive measures for the promotion of generic medication uptake, the Asia Pacific generic drugs market demand is expected is witness a surge in the forecast period.India is ranked as the largest manufacturer and exporter (by volume) of generic drugs, producing over 60,000 generic drugs across 60 therapeutic categories. It was reported that Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP), a campaign-public welfare scheme of the Government of India to provide quality medicines at affordable prices through special outlets called Pradhan Mantri Bharatiya Janaushadhi Pariyojana Kendra, achieved an impressive generic medicines sales of INR 1000 crore in 2023. Moreover, people who purchased medicines from these outlets saved around INR 5,000 crore. The government further plans to open 25,000 such Janaushadhi Kendras across the country by March 2026. Such government initiatives that can drive substantial healthcare cost savings are projected to bolster the Asia Pacific generic drugs market growth.

One of the major market trends is the rise in patent expirations of branded drugs which allows the market entry of various generic medications, thereby increasing their access to the growing patient pool. In July 2023, it was reported that at least three Indian pharmaceutical companies, Lupin Limited, Natco Pharma, and Macleods Pharmaceuticals Ltd, are poised to manufacture generic versions of Johnson & Johnson's tuberculosis drug Bedaquiline following its patent expiration. Thus, the increasing expiration of market exclusivity of brand-name products is likely to boost the market share and foster the production of the necessary generic medications.

Asia Pacific Generic Drugs Market Segmentation

The report offers a detailed analysis of the market based on the following segments:Market Breakup by Therapy Area

- Cardiovascular

- Dermatology

- Respiratory

- Oncology

- Rheumatology

- Others

Market Breakup by Route of Administration

- Oral

- Injectables

- Dermal/Topical

- Inhalers

- Others

Market Breakup by Distribution Channels

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Market Breakup by Region

- India

- China

- Japan

- Others

Leading Players in the Asia Pacific Generic Drugs Market

The key features of the market report include patent analysis, grants analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Teva Pharmaceutical Industries Ltd

- Viatris Inc.

- Sun Pharmaceutical Industries Ltd

- Lupin

- AstraZeneca

- Baxter

- Takeda Pharmaceutical Company Limited

- GSK plc

- Bausch + Lomb

- Novartis AG

- Sanofi

- Pfizer Inc.

- Fresenius SE & Co. KGaA

- Aurobindo Pharma

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Teva Pharmaceutical Industries Ltd

- Viatris Inc.

- Sun Pharmaceutical Industries Ltd

- Lupin

- AstraZeneca

- Baxter

- Takeda Pharmaceutical Company Limited

- GSK plc

- Bausch + Lomb

- Novartis AG

- Sanofi

- Pfizer Inc.

- Fresenius SE & Co. KGaA

- Aurobindo Pharma

Table Information

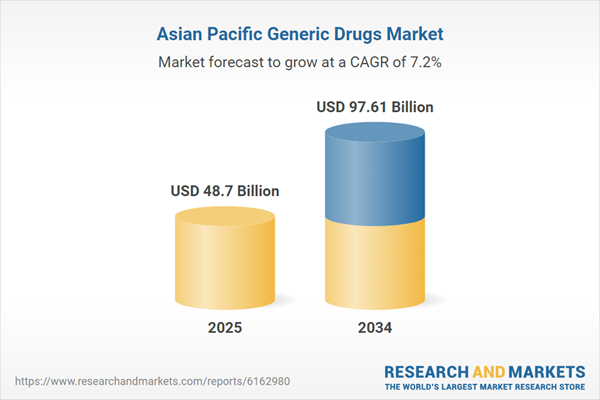

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 48.7 Billion |

| Forecasted Market Value ( USD | $ 97.61 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 14 |