Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Hats in the Asia Pacific region is used in several contexts: as fashion accessories, for functional purposes like protection from weather conditions (sun, rain), in religious and cultural ceremonies, and in sports and recreational activities. The market is heavily influenced by the cultural diversity of the region, where different types of hats hold symbolic meaning in various traditions. Hats designed for practical use, such as sun protection hats, rain hats, and winter beanies. The market is shaped by factors such as seasonal demand (e.g., sun hats in summer, beanies in winter), the influence of social media and celebrity endorsements, and the rise of e-commerce platforms which have broadened the accessibility of diverse hat styles across the region.

Market Drivers

Rising Fashion Consciousness and Influence of Pop Culture

One of the key drivers of the hat market in the Asia Pacific region is the growing fashion awareness among consumers. With globalization and the rise of digital media, fashion trends from around the world are instantly accessible. Social media platforms such as Instagram, TikTok, and Pinterest play a crucial role in promoting various hat styles, from bucket hats and baseball caps to wide-brimmed and beanie hats. Influencers and celebrities often showcase stylish headwear, making hats not just functional accessories but essential fashion statements.In urban centers like Tokyo, Seoul, and Shanghai, fashion is seen as a way of self-expression. As streetwear and K-fashion trends gain popularity, hats are increasingly incorporated into everyday outfits. Local and international brands are responding to this trend by releasing collections that appeal to younger, trend-conscious consumers. Furthermore, collaborations between fashion houses and celebrities or designers have also helped boost the desirability and market demand for hats in this region.

Key Market Challenges

Seasonal Demand and Limited Year-Round Usage

One of the primary challenges in the Asia Pacific hats market is the seasonal nature of demand. Unlike essential apparel, hats are often perceived as optional or seasonal accessories, particularly used during summer months for sun protection or winter for warmth. In tropical climates, while sun hats and caps may be used frequently, colder-weather hats like beanies and woolen caps see limited demand due to milder winters in many parts of Asia.This seasonality restricts year-round sales for many retailers, creating fluctuations in revenue and inventory issues. Brands often struggle to maintain consistent production and sales cycles, leading to either overstocking during off-seasons or understocking during peak periods. Retailers must rely heavily on forecasting and promotional strategies to move inventory in less active months, which can increase marketing and operational costs.

Key Market Trends

Rise of Sustainable and Eco-Friendly Hats

With growing environmental awareness among consumers, there’s a significant shift toward sustainable fashion, and this trend is now impacting the hat industry in Asia Pacific. Consumers, especially Gen Z and millennials, are increasingly looking for products that are ethically sourced, biodegradable, or made from recycled materials. This has led to a surge in demand for hats made from organic cotton, bamboo fiber, hemp, cork, and recycled polyester.Brands are responding by launching eco-conscious collections and promoting transparency in their supply chains. For instance, tags now often indicate whether a product is cruelty-free, vegan, or produced with water-saving methods. Sustainable packaging is also being adopted as part of a broader green initiative. This trend isn’t just about environmental impact; it’s also becoming a fashion statement. Consumers are aligning their personal style with their values, using sustainable hats as a form of self-expression. While sustainable materials can be costlier, many consumers are willing to pay a premium for ethical and eco-friendly products. As this movement continues to grow, sustainability is evolving from a niche feature into a mainstream expectation.

Key Market Players

- James Lock & Co. Ltd.

- Goorin Brothers, Inc.

- Bestseller A/S

- Dalix MP INC.

- Tan Thanh Dat Co., Ltd.

- Nike, Inc.

- Zhangjiagang Huaxia Headgear Co., Ltd.

- Nantong Foremost Garments & Accessories Co., Ltd.

- Richardson Sports, Inc.

- Larix Gear LLP

Report Scope:

In this report, the Asia Pacific Hats Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Asia Pacific Hats Market, By Product Type:

- Sports Hats

- Fashion Hats

- Working Hats

Asia Pacific Hats Market, By Material Use:

- Polyester

- Cotton

- Wool

- Others

Asia Pacific Hats Market, By End User:

- Men

- Women

Asia Pacific Hats Market, By Country:

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia Pacific Hats Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- James Lock & Co. Ltd.

- Goorin Brothers, Inc.

- Bestseller A/S

- Dalix MP INC.

- Tan Thanh Dat Co., Ltd.

- Nike, Inc.

- Zhangjiagang Huaxia Headgear Co., Ltd.

- Nantong Foremost Garments & Accessories Co., Ltd.

- Richardson Sports, Inc.

- Larix Gear LLP

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | July 2025 |

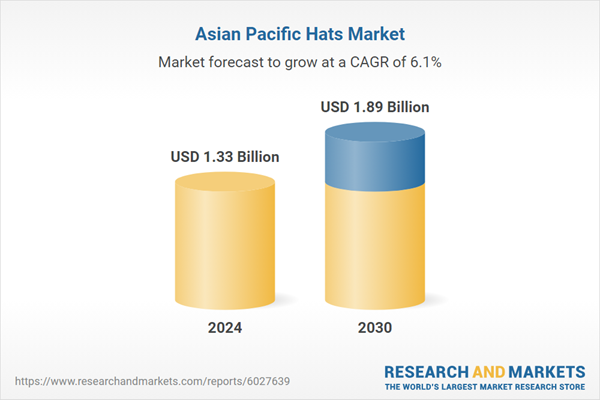

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.33 Billion |

| Forecasted Market Value ( USD | $ 1.89 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |