The outlook for gas in the helium market is entering a phase of significant evolution and opportunity. Helium, a crucial element in various industries including healthcare, electronics, and aerospace, faces fluctuations in supply and demand that often influence market dynamics. Currently, the market is experiencing a transitional period characterized by both challenges and prospects. Therefore, the China market utilized 9,886.0 tonnes of Helium gas in 2022.

The China market dominated the Asia Pacific Helium Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $405.5 million by 2030. The Japan market is experiencing a CAGR of 6.3% during (2023 - 2030). Additionally, The India market would exhibit a CAGR of 7.6% during (2023 - 2030).

Helium, denoted by the symbol He and atomic number 2, is a chemical element. This gas is inert, tasteless, odorless, and colorless. Moreover, it is non-toxic. After hydrogen, helium ranks as the second least massive and most prevalent element in the observable universe. Primary contributors include the nuclear fusion of hydrogen within stars. It has several unique properties that make it valuable for various applications. It has the lowest boiling point of any element, making it ideal for use in cryogenics and superconductivity research. It is also a lifting gas in balloons and airships due to its low density.

Primarily, it is generated via the radioactive decay of thorium and uranium that occurs naturally in the Earth's crust. As these elements decay, they release alpha particles, which are helium nuclei. Over millions of years, the helium gas produced by this process migrates upward and accumulates in natural gas deposits underground. During this process, natural gas is cooled to very low temperatures, causing helium to liquefy and separate from the other gases. The natural availability of helium is limited, and it is considered a non-renewable resource. Once helium is extracted and used, it cannot be easily replaced.

According to the State Council of China, from January 2022 to February 2022, the added value of major electronics manufacturers rose 12.7 percent year-on-year, compared with the 7.5 percent growth seen in the overall industrial sector. During the two months, the growth rate of fixed-asset investment in the electronics manufacturing industry was 35.1 percent, 15.3 percentage points higher than the national industrial investment growth. The export value of Chinese electronics products increased by 11.4 percent year-on-year. Therefore, the significant growth of this industry in this region will augment the expansion of the regional market in the coming years.

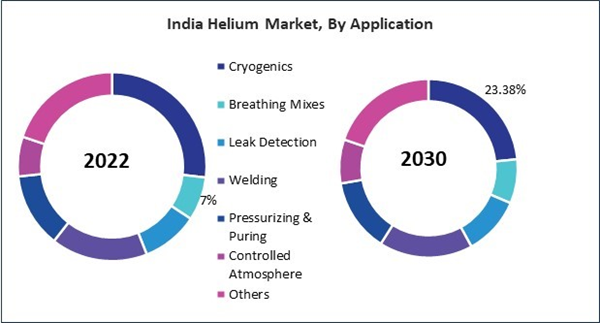

Based on Phase, the market is segmented into Gas and Liquid. Based on End-use, the market is segmented into Medical & Healthcare, Aerospace & Defense, Electronics & Electrical, Nuclear Power, Metal Fabrication and Others. Based on Application, the market is segmented into Cryogenics, Breathing Mixes, Leak Detection, Welding, Pressurizing & Puring, Controlled Atmosphere and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Air Products and Chemicals, Inc.

- Linde plc

- Air Liquide S.A.

- Messer SE & Co. KGaA (Messer Industrie GmbH)

- Gulf Cryo

- Axcel Gases

- Iwatani Corporation

- MESA International Technologies, Inc.

- Matheson Tri-Gas, Inc. (The Nippon Sanso Holdings Group)

- IACX Energy LLC (Alder Midstream, LLC)

Market Report Segmentation

By Phase (Volume, Tonnes, USD Billion, 2019-2030)- Gas

- Liquid

- Medical & Healthcare

- Aerospace & Defense

- Electronics & Electrical

- Nuclear Power

- Metal Fabrication

- Others

- Cryogenics

- Breathing Mixes

- Leak Detection

- Welding

- Pressurizing & Puring

- Controlled Atmosphere

- Others

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- Air Products and Chemicals, Inc.

- Linde plc

- Air Liquide S.A.

- Messer SE & Co. KGaA (Messer Industrie GmbH)

- Gulf Cryo

- Axcel Gases

- Iwatani Corporation

- MESA International Technologies, Inc.

- Matheson Tri-Gas, Inc. (The Nippon Sanso Holdings Group)

- IACX Energy LLC (Alder Midstream, LLC)