Benzene serves as a critical raw material in the production of Maleic Anhydride, playing a foundational role in the chemical synthesis process. Maleic Anhydride is primarily manufactured through the oxidation of benzene or n-butane, with the former being the more widely utilized route due to its cost-effectiveness and efficiency. In the production process, benzene undergoes catalytic oxidation, typically using a vanadium oxide catalyst, to yield Maleic Anhydride. Thus, the Japan market used 72.45 Kilo Tonnes of benzene as raw material in the market in 2023.

The China market dominated the Asia Pacific Maleic Anhydride Market by Country in 2023 and would continue to be a dominant market till 2031; thereby, achieving a market value of $754.5 million by 2031. The India market is registering a CAGR of 4.7% during (2024 - 2031). Additionally, The Japan market would showcase a CAGR of 3.3% during (2024 - 2031).

The adoption of maleic anhydride spans various end-use industries, each leveraging its unique properties for different applications. For instance, the chemical industry is one of the primary consumers of maleic anhydride, utilizing it as a precursor in producing various downstream chemicals and materials. Maleic anhydride is a building block for synthesizing unsaturated polyester resins (UPRs), alkyd resins, maleic acid, fumaric acid, and 1,4-butanediol (BDO). The growing chemical industry translates into higher demand for maleic anhydride. For instance, according to the National Investment Promotion & Facilitation Agency, the market size of India’s chemicals & petrochemicals sector is around $215 Bn. It is expected to grow to $300 Bn by 2025.

Moreover, in the automotive industry, maleic anhydride produces fiberglass-reinforced plastics (FRP) for components such as body panels, bumpers, and interior trim. UPRs derived from maleic anhydride offer high strength, durability, and corrosion resistance, making them suitable for automotive applications. Furthermore, maleic anhydride-based materials, such as UPRs and alkyd resins, are utilized in the construction industry for applications such as composite panels, laminates, coatings, adhesives, and sealants. These materials provide structural integrity, weather resistance, and aesthetic appeal to architectural and infrastructure projects.

China has emerged as a leading producer of maleic anhydride, with numerous chemical companies investing in the expansion of production capacity to meet domestic demand and cater to export markets. The expansion of the chemical industry in China has led to the establishment of new maleic anhydride manufacturing facilities and the retrofitting of existing plants with advanced technologies to enhance production efficiency and output. As per the State Council of the People’s Republic of China, in 2022, the investment in chemical raw materials and product manufacturing jumped 19 percent year on year, 7.4 percentage points higher than the average level of all industries. Therefore, the growing chemical industry and rising packaging sector in the region drive the market’s growth.

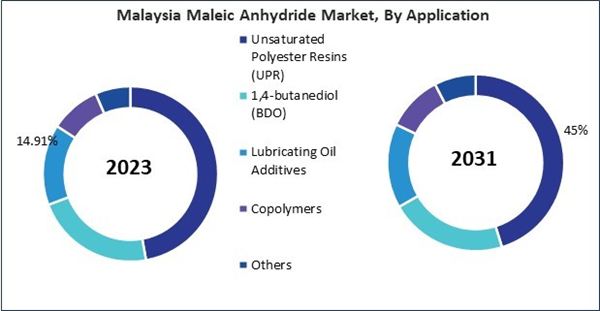

Based on Raw Material, the market is segmented into N-Butane and Benzene. Based on Application, the market is segmented into Unsaturated Polyester Resins (UPR), 1,4-butanediol (BDO), Lubricating Oil Additives, Copolymers and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Huntsman Corporation

- Mitsubishi Chemical Holdings Corporation

- Lanxess AG

- Nan Ya Plastics Corp. (NPC)

- Nippon Shokubai Co., Ltd.

- IG Petrochemicals Limited (IGPL)

- China National BlueStar (Group) Co, Ltd. (China National Chemical Corporation)

- Yongsan Chemical Co., Ltd.

- Aekyung Chemical Co., Ltd. (AK Holdings Co., Ltd.)

- Ningbo Jiangning Chemical Co., Ltd. (Zhejiang Jiangshan Chemical Co., Ltd.)

Market Report Segmentation

By Raw Material (Volume, Kilo Tonnes, USD Billion, 2020-2031)- N-Butane

- Benzene

- Unsaturated Polyester Resins (UPR)

- 1,4-butanediol (BDO)

- Lubricating Oil Additives

- Copolymers

- Others

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- Huntsman Corporation

- Mitsubishi Chemical Holdings Corporation

- Lanxess AG

- Nan Ya Plastics Corp. (NPC)

- Nippon Shokubai Co., Ltd.

- IG Petrochemicals Limited (IGPL)

- China National BlueStar (Group) Co, Ltd. (China National Chemical Corporation)

- Yongsan Chemical Co., Ltd.

- Aekyung Chemical Co., Ltd. (AK Holdings Co., Ltd.)

- Ningbo Jiangning Chemical Co., Ltd. (Zhejiang Jiangshan Chemical Co., Ltd.)