This report offers a comprehensive overview with a focus on ten countries (Australia, China, India, Japan, Malaysia, Singapore, South Korea, Taiwan-China, Thailand, and Vietnam), including key trends, production and consumption figures, international trade data, and forecasts for the office furniture demand in 2025 and 2026. It also highlights the leading manufacturers and players and analyses the office furniture sector by sub-segment.

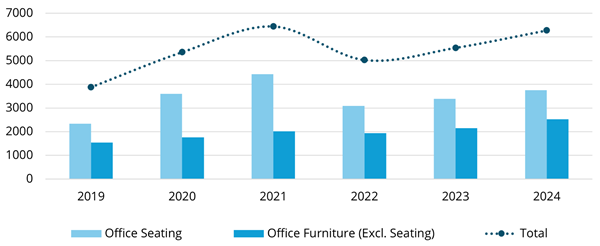

Asia-Pacific Office Furniture Trade Balance: Seating/Office Furniture Excluding Seating (2019-2024, USD Million)

The office furniture trade balance in Asia-Pacific has continued to show a growing surplus despite international tensions and protectionist measures implemented in recent years. This growth is mainly supported by China and Vietnam, with varying trends corresponding to different product segments.

On the consumption side, the largest office furniture markets are China, India, and Japan. Among them, India is steadily emerging as one of the most dynamic ones in the area, projected to exceed the average forecasted growth for the whole region.

ASIA PACIFIC: OFFICE FURNITURE MARKET OVERVIEW

The first section offers basic data on production, consumption, and international trade of office furniture, in Asia and the Pacific and by country, highlighting trade dynamics, market openness and prices.

OFFICE FURNITURE MARKET TRENDS AND FORECASTS FOR 2025-2026

Looking ahead, the report outlines expected market developments, with forecasts for office furniture consumption in 2025 and 2026. Factors influencing the market include macroeconomic trends and workplace transformations.

LEADING GROUPS IN ASIA AND THE PACIFIC AND THEIR MARKET SHARES

The competitive environment and the leading office furniture manufacturers operating in the Asia-Pacific market are outlined through information on their performance, the market concentration and the latest M&A operations.

BUSINESS PERFORMANCE: OFFICE FURNITURE MARKET IN THE ASIA PACIFIC COUNTRIES

Production, consumption, international trade of office furniture for the years 2019-2024, macroeconomic indicators and office furniture market forecasts 2025-2026 for:

- Australia

- China

- India

- Japan

- Malaysia

- Singapore new in this year’s edition

- South Korea

- Taiwan, China

- Thailand

- Vietnam

OFFICE FURNITURE TRADE DYNAMICS: EXPORTS AND IMPORTS

This section provides a deep look at key export and import flows, identifying the main importers and exporters of office furniture in the area, with trade partners.

OFFICE FURNITURE SUPPLY SYSTEM AND PRODUCT SEGMENTS

Production and consumption of office furniture in the Asia Pacific and for selected countries (Australia, China, India, Japan, and South Korea) are provided for the main sub-segments:

- Office seating

- Office desking

- Executive furniture

- Storage/filing systems

- Walls, partitions, and acoustic products

- Phone booths and acoustic pods

- Furniture for communal areas

A special focus is provided for:

- Office seating: Breakdown of office seating production by type and by covering, and seating breakdown by type in a sample of companies. Production and consumption of office seating / office furniture excluding seating, are also provided by country.

- Office desking & Height-Adjustable Desks (HAT): Incidence of HAT on total desk production in the Asia Pacific, with incidence and production value also for Australia, China, India, Japan, and South Korea; Height Adjustable Tables by kind of mechanism; Breakdown of desking supply between fixed and HAT in a sample of companies

- Partitions, Acoustic Pods & Phone Booths: Production of partitions, acoustic pods, and phone booths in Asia Pacific, by segment, by kind; production of phone booths and acoustic pods for Australia, China, India, Japan, and South Korea and estimates of breakdown by type (single, double, multiple)

DISTRIBUTION OF OFFICE FURNITURE IN THE ASIA PACIFIC

The report analyses the structure of the distribution landscape in the Asia Pacific region through the evolution of distribution channels:

- Direct sales

- Indirect sales (specialist dealers, non-specialist dealers, e-commerce)

The incidence of the distribution channels is also provided for Australia, China, India, Japan, and South Korea.

COMPETITION IN THE ASIA PACIFIC OFFICE FURNITURE MARKET: LEADING MANUFACTURERS AND MARKET SHARES BY PRODUCT AND BY COUNTRY

In this section, the report analyses the key players in the office furniture market with an overview of market shares and data for office seating, desking, executive, storage, walls/partitions, acoustic pods/phone booths, and communal furniture.

Finally, the report outlines the office furniture market competitive landscape across the Asia Pacific region, exploring the largest players in Australia, China, India, Japan, Malaysia, Singapore, South Korea, Taiwan (China), Thailand, and Vietnam, with selected company profiles.

A list of around 165 of the most important players operating in the office furniture sector in the Asia Pacific completes the research.

THIS REPORT OFFERS AN IN-DEPTH ANALYSIS WHICH HELPS TO RESPOND TO THE FOLLOWING QUESTIONS:

- What is the current size and structure of the office furniture market in Asia and the Pacific?

- Which are the top and fastest-growing office furniture markets in the Asia-Pacific region?

- What are the key trends driving the office furniture market in Asia and the Pacific?

- What are the office furniture demand forecasts for 2025 and 2026 in Asia-Pacific countries?

- Which are the leading office furniture manufacturers in Asia and the Pacific?

- What are the main import and export flows of office furniture in the Asia-Pacific region?

- What product segments make up the office furniture market in Asia-Pacific?

- How is the distribution of office furniture structured in the Asia Pacific region?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bestuhl

- Burgeree

- Dious

- Featherlite

- Fursys Group

- Godrej Interio

- Haworth

- Henglin Home

- Itoki

- Jongtay

- Kano

- Kokuyo

- Koplus

- Loctek

- Merryfair

- MillerKnoll

- Novah

- Okamura

- Quama

- Schiavello

- Sitzone

- Soundbox

- Steelcase

- Sunon

- Teknion Malaysia

- UE Furniture

- Victory