COVID-19 positively impacted the packaging tape market in Asia-Pacific. Packaging tapes are widely utilized in the e-commerce and food and beverage industries, which significantly grew due to the lockdowns imposed by the governments across the major countries and created a substantial demand for packaging tapes in Asia-Pacific throughout the pandemic.

Key Highlights

- In the short term, the growing adoption of packaging tapes from the e-commerce industry is boosting the market's growth.

- Rising demand for superior strength, toughness, and break strength of packaging materials is expected to drive the growth of the packaging tapes market in Asia-Pacific.

- Strict regulations regarding single-use plastics remain a constraint for the growth of the market studied.

- China is expected to dominate the packaging tapes market in Asia-Pacific and is also likely to witness the highest CAGR during the forecast period.

APAC Packaging Tapes Market Trends

Rising Demand for Packaging Tapes from E-Commerce Industry.

- Packaging tapes are widely utilized in the e-commerce industry for secure packing. It is preferred due to its transparency, good adherence, and strong aging resistance property.

- The most often used tape colors in the e-commerce industry are abee brown and transparent. Transparent tapes are used to secure the billing over the packing box, while abee-brown tapes are used to secure the packed materials from damage.

- The growth of the e-commerce industry in the region is one of the major factors that will drive the market's expansion over the forecast period. For instance, according to Invest India, 140 million users are shopping online in India, and the e-commerce market is estimated to have an annual gross merchandise value of USD 350 billion by 2030.

- Japan is the third-largest e-commerce market in the world. According to the Ministry of Economy, Trade, and Industry, Japan, the scale of business-to-consumer sales in e-commerce increased to 20.7 trillion yen (USD 195.22 billion) in 2021, with an increment of 7.35% as compared to the previous year, and this trend is likely to continue in the future. This fact sheet is information regarding the consumption of packaging tapes in the e-commerce industry within the region.

- Therefore, considering the above-mentioned factors, the demand for the packaging tapes market in Asia-Pacific is expected to rise in the e-commerce segment significantly in the near future.

China to Dominate the Market

- Packaging tapes are used in the food and beverage, e-commerce, and retail industries for secure and safe packaging. China holds a considerable market share in this sector, which provides a significant growth opportunity for the market studied.

- China has the world's largest food sector, with a profit of around CNY 618.7 billion (~USD 91.39 billion) in 2021, and is predicted to expand in the future.

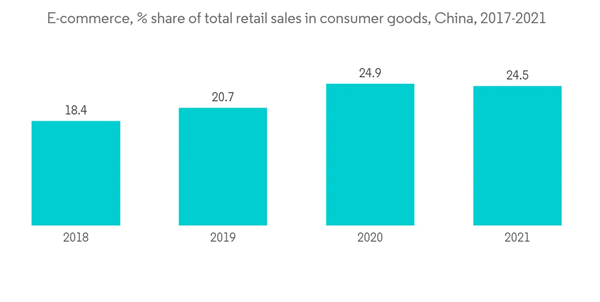

- According to the National Bureau of Statistics of China, the country has the largest retail e-commerce market worldwide. About 24.5% of the total retail sales in China were made online in 2021, slightly lower than the 24.9% in the previous year. Furthermore, packaging tapes are utilized as a packaging good, which provides a growth opportunity for the market studied within the region.

- According to China Internet Network Information Center (CNNIC), China has the world's largest online food delivery business, with 544 million users, and is likely to grow in the future. Packaging tapes are frequently utilized in food packaging for secure and online delivery, thus promoting the growth of the packaging tapes market in the food industry.

- All the aforementioned factors are likely to fuel the growth of the packaging tape market in China over the forecast period.

APAC Packaging Tapes Market Competitor Analysis

The Asia-Pacific packaging tapes market is fragmented in nature. Some of the major players in the market are 3M Company, AVERY DENNISON CORPORATION, Nitto Denko, Intertape Polymer Group Inc., and CCT Tapes, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Growing Adoption of Packaging Tapes from the E-commerce Industry

4.1.2 Rising Demand for Superior Strength, Toughness and Break Strength of Packaging Materials

4.2 Restraints

4.2.1 Strict Regulations Regarding Single-use Plastics

4.3 Industry Value-Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Consumers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION

5.1 By Material Type

5.1.1 Plastic

5.1.2 Paper

5.2 By Adhesive Type

5.2.1 Acrylic

5.2.2 Hot Melt

5.2.3 Rubber-based

5.2.4 Other Adhesive Types

5.3 By End-user Industry

5.3.1 E-Commerce

5.3.2 Food and Beverage

5.3.3 Retail

5.3.4 Other End-user Industries

5.4 By Geography

5.4.1 China

5.4.2 India

5.4.3 Japan

5.4.4 South Korea

5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share(%)**/Rank Analysis**

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 3M Company

6.4.2 Advance tapes international

6.4.3 AVERY DENNISON CORPORATION

6.4.4 Berry Global Inc.

6.4.5 CCT Tapes

6.4.6 Henkel AG and Corporation

6.4.7 Intertape Polymer Group Inc.

6.4.8 Intertape Polymer Group Inc.

6.4.9 Nitto Denko

6.4.10 Mactac LLC

6.4.11 **List not Exhaustive

6.5 MARKET OPPORTUNITIES AND FUTURE TRENDS

6.6 **Subject to Availability in the Public Domain, Paid Databases, and Primary Interviews

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Advance tapes international

- AVERY DENNISON CORPORATION

- Berry Global Inc.

- CCT Tapes

- Henkel AG and Corporation

- Intertape Polymer Group Inc.

- Intertape Polymer Group Inc.

- Nitto Denko

- Mactac LLC

- **List not Exhaustive