Rising Development of Dual-Band SAR Boosts Asia Pacific Synthetic Aperture Radar Market

Dual-band synthetic aperture radar (SAR) technology operates in two frequency bands simultaneously, allowing for enhanced imaging capabilities and improved image quality compared to single-band SAR systems. The use of dual-band SAR offers several advantages. Firstly, it enables better target discrimination and identification, as the combination of two different frequency bands provides more detailed and accurate imaging. This is particularly valuable in applications such as military surveillance, border control, and maritime monitoring, where the ability to distinguish between objects and detect subtle changes is crucial.Secondly, dual-band SAR technology enhances the system's ability to penetrate and detect objects under challenging environmental conditions. Utilizing two different frequency bands, SAR systems can overcome limitations posed by factors such as vegetation cover, weather conditions, and surface roughness. This increased robustness allows for reliable imaging even in adverse conditions, expanding the range of applications for SAR technology. Moreover, the improved image quality offered by dual-band SAR systems facilitates better interpretation and analysis of the acquired data.

This is particularly beneficial in applications such as disaster management, environmental monitoring, and infrastructure planning, where accurate and detailed information is vital for decision-making. Thus, dual-band synthetic aperture radar (SAR) technology has emerged as a significant advancement in the synthetic aperture radar market, presenting new opportunities for market growth and expansion.

Asia Pacific Synthetic Aperture Radar Market Overview

The Asia Pacific synthetic aperture radar market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The growing application of synthetic aperture radar in remote sensing applications such as environment monitoring, disaster management, maritime surveillance, and target detection enables regions to focus on the development of synthetic aperture radar.For example, in October 2023, an international conference, the Asia Pacific Conference on Synthetic Aperture Radar (APSAR), was held on Bali Island, Indonesia. The conference was devoted to synthetic aperture radar technology development and applications. This conference was jointly hosted with the 2023 IEEE International Conference on Aerospace Electronics and Remote Sensing Technology (ICARES 2023).

Several players across Asia Pacific are entering into partnerships for the development of synthetic aperture radar. For example, in October 2023, Data Patterns entered into a licensing and transfer of technology (ToT) agreement with space nodal agency IN-SPACe for Synthetic Aperture Radar (SAR) development. The partnership will help Data Patterns in radar development efforts.

China is severely affected by monsoon weather and frequent meteorological disasters. China also has experienced severe landslides, floodwaters, and other geological hazards. Thus, China has emphasized the deployment of interferometric synthetic aperture radar (InSAR) satellites. For example, in March 2023, China launched four interferometric synthetic aperture radar (InSAR) satellites developed by Chinese private satellite developer GalaxySpace using the CZ-2D rocket at the Taiyuan Satellite launch center in North China's Shanxi province. This type of satellite provides comparatively stable formation configuration and high mapping efficiency.

The satellites are a powerful tool for the early identification of major geological hazards in complex areas due to their millimeter-level deformation monitoring capability. They can provide data support for exploration and the prevention of land subsidence, collapse, landslides, and other disasters. Thus, such instances drive the growth of the synthetic aperture radar market in Asia Pacific.

Asia Pacific Synthetic Aperture Radar Market Segmentation

- The Asia Pacific synthetic aperture radar market is categorized into component, frequency band, application, platform, mode, and country.

- Based on component, the Asia Pacific synthetic aperture radar market is categorized into receiver, transmitter, and antenna. The antenna segment held the largest market share in 2022.

- In terms of frequency band, the Asia Pacific synthetic aperture radar market is categorized into x band, l band, c band, s band, and others. The x band segment held the largest market share in 2022.

- By application, the Asia Pacific synthetic aperture radar market is segmented into commercial and defense. The defense segment held a larger market share in 2022.

- Based on platform, the Asia Pacific synthetic aperture radar market is bifurcated into ground and airborne. The airborne segment held a larger market share in 2022.

- In terms of mode, the Asia Pacific synthetic aperture radar market is bifurcated into single and multi. The multi segment held a larger market share in 2022.

- By country, the Asia Pacific synthetic aperture radar market is segmented into Australia, Japan, India, China, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific synthetic aperture radar market share in 2022.

- Northrop Grumman Corp, ASELSAN AS, BAE Systems Plc, Israel Aerospace Industries Ltd, Leonardo SpA, Lockheed Martin Corp, Raytheon Technologies Corp, Thales SA, and Saab AB are some of the leading companies operating in the Asia Pacific synthetic aperture radar market.

Market Highlights

- Based on component, the Asia Pacific synthetic aperture radar market is categorized into receiver, transmitter, and antenna. The antenna segment held 60.2% market share in 2022, amassing US$ 687.07 million. It is projected to garner US$ 1.76 billion by 2030 to register 12.5% CAGR during 2022-2030.

- In terms of frequency band, the Asia Pacific synthetic aperture radar market is segmented into x band, l band, c band, s band, and others. The x band segment held 47.1% share of Asia Pacific synthetic aperture radar market in 2022, amassing US$ 537.69 million. It is anticipated to garner US$ 1.34 billion by 2030 to expand at 12.2% CAGR during 2022-2030.

- The defense segment held 55.0% share of Asia Pacific synthetic aperture radar market in 2022, amassing US$ 626.75 million. It is projected to garner US$ 1.50 billion by 2030 to expand at 11.6% CAGR from 2022 to 2030.

- The airborne segment held 83.7% share of Asia Pacific synthetic aperture radar market in 2022, amassing US$ 954.20 million. It is predicted to garner US$ 2.38 billion by 2030 to expand at 12.1% CAGR between 2022 and 2030.

- In terms of mode type, the Asia Pacific synthetic aperture radar market is bifurcated into single and multi. The multi segment held 75.8% share of Asia Pacific synthetic aperture radar market in 2022, amassing US$ 864.75 million. It is estimated to garner US$ 2.17 billion by 2030 to expand at 12.2% CAGR during 2022-2030.

- This analysis states that China captured 46.7% share of Asia Pacific synthetic aperture radar market in 2022. It was assessed at US$ 532.70 million in 2022 and is likely to hit US$ 1.44 billion by 2030, registering a CAGR of 13.3% during 2022-2030.

- In December 2021, Leonardo conducted the inaugural flight trials of its Osprey 50 Active Electronically Scanned Array (AESA) radar, which is an enhanced version of the successful Osprey surveillance radar. These flight trials were carried out in support of production for a Strategic Intelligence, Surveillance, and Reconnaissance (ISR) platform, as well as Collins Aerospace's Tactical Synthetic Aperture Radar (TacSAR) reconnaissance system.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific synthetic aperture radar market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific synthetic aperture radar market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the Asia Pacific synthetic aperture radar market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Asia Pacific Synthetic Aperture Radar market include:- Northrop Grumman Corp

- ASELSAN AS

- BAE Systems Plc

- Israel Aerospace Industries Ltd

- Leonardo SpA

- Lockheed Martin Corp

- Raytheon Technologies Corp

- Thales SA

- Saab AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | August 2024 |

| Forecast Period | 2022 - 2030 |

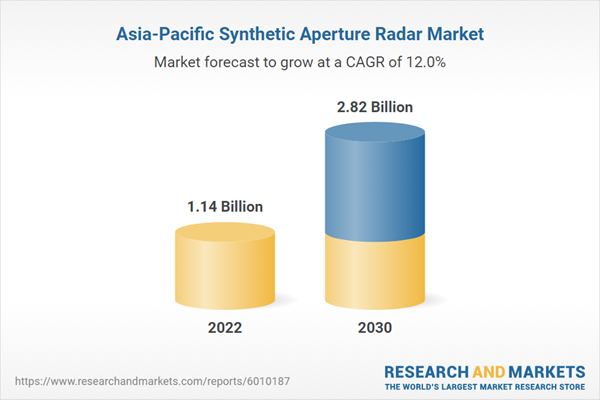

| Estimated Market Value ( USD | $ 1.14 Billion |

| Forecasted Market Value ( USD | $ 2.82 Billion |

| Compound Annual Growth Rate | 12.0% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |