Based on product type, the Australia cake market is driven by unpackaged/artisanal forms, as they can be customised according to the consumers dietary needs and specific occasions

The Australian cake market is experiencing growth as artisanal cake makers frequently provide customization options, enabling customers to request specific flavors, designs, and decorations that suit their preferences. This personalized approach boosts customer satisfaction and loyalty, contributing to the Australia cake industry growth. The packaged form of cake has a longer shelf life due to the addition of preservatives and acts as a convenient option due to the reduction in baking time.In March 2024, The Hallway, an independent advertising agency, collaborated with Sydney's Wholegreen Bakery to challenge gluten-free sceptics with the introduction of a Coeliac Australia-certified cardboard cake.

The Australia cake market development is driven by several factors. The increasing use of eco-friendly packaging. Moreover, cake makers are catering to consumer preferences by offering customisation options such as custom flavours, designs, and decorations. Furthermore, skills development is occurring through the rise in cake decorating classes and DIY cake kits, enhancing interactive experiences for individuals. Additionally, the production of cakes is adapting to the growing health consciousness and diverse dietary preferences, with ingredients including plant-based alternatives and natural sweeteners gaining popularity.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Form

- Packaged

- Unpackaged/Artisanal

Market Breakup by Product Type

- Cupcakes

- Cheesecakes

- Dessert Cakes

- Sponge Cakes

- Others

Market Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Speciality Stores

- Online

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Cake Market Share

Supermarkets and hypermarkets hold a major share of the Australia cake market due to their extensive distribution networks, variety of offerings, brand visibility, competitive pricing strategies, convenience, seasonal management, adherence to quality standards, and adoption of online retail innovations.Leading Companies in the Australia Cake Market

The growth of the Australia cake market is driven by health-conscious choices, customisation options, artisanal offerings, e-commerce convenience, celebratory demand, sustainability initiatives, innovative flavours, cultural diversity, social media impact, and adherence to health standards.- Black Velvet & Co Pty Ltd.

- Sugar High Australia Pty Ltd. (Cake Mail)

- Cakes2U

- Ferguson Plarre Bakehouses Pty Ltd.

- Town Inn Pty Ltd. (Miss Maud)

- Khatib Pty Ltd. (Looma’s)

- Marks Quality Cakes

- Mrs Jones The Baker

- Sydney SmashCakes

- Sydney Cake House Sdn. Bhd.

- Others

Table of Contents

Companies Mentioned

- Black Velvet & Co Pty Ltd.

- Sugar High Australia Pty Ltd. (Cake Mail)

- Cakes2U

- Ferguson Plarre Bakehouses Pty Ltd.

- Town Inn Pty Ltd. (Miss Maud)

- Khatib Pty Ltd. (Looma’s)

- Marks Quality Cakes

- Mrs Jones The Baker

- Sydney SmashCakes

- Sydney Cake House Sdn. Bhd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 103 |

| Published | October 2025 |

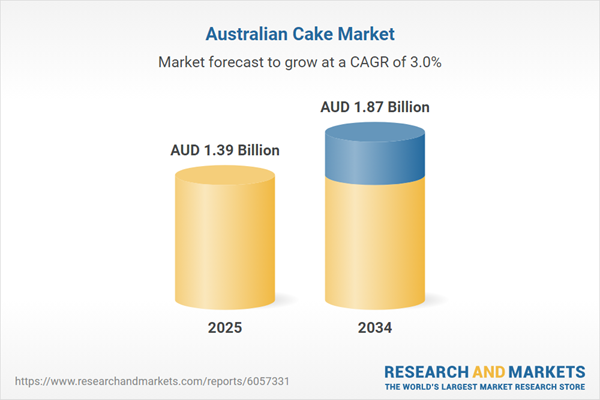

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 1.39 Billion |

| Forecasted Market Value ( AUD | $ 1.87 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 10 |