Based on application, the Australia commercial kitchen appliances market share is driven by full-service restaurants to meet the diverse cooking needs of various types of consumers

The Australia commercial kitchen appliances market growth is gaining traction owing to these restaurants preparing a wide range of items which require a variety of specialized kitchen equipment to ensure high-quality food production. These appliances are equipped with features such as temperature control, easy-to-clean surfaces, and sanitary design to maintain food quality as restaurants must comply with food safety and hygiene standards to ensure consumer satisfaction. Restaurants use such appliances which reduces the time of using separate appliances and helps in managing waste reduction. According to the United States Department of Agriculture (USDA), there is a presence of 63,594 independent and chain restaurants in Australia.The increasing need to convert commercial kitchens into energy efficient has led restaurants, cafés, and other foodservice restaurants to install energy-efficient appliances to reduce their energy consumption and their environmental impact.

The Australia commercial kitchen appliances market dynamics and trends are driven by innovations that reduces energy consumption and boosts efficiency. Companies like Electrolux develop energy-efficient kitchen appliances such as cooktops, ovens, dishwashers and many more. Their cooktops automatically stop energy flow when no pans are detected on them which reduces energy consumption by 60%. Dishwasher uses less water, detergent, and electricity while reducing energy consumption by 19%.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

- Ovens

- Dishwashers

- Refrigerators

- Cooktop and Cooking Ranges

- Others

Market Breakup by Application

- Full-Service Restaurant

- Railway Dining

- Resort and Hotel

- Hospital

- Quick Service Restaurant

- Others

Market Breakup by Distribution Channel

- Offline

- Online

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Commercial Kitchen Appliances Market Share

In the commercial kitchen appliances market, products such as ovens, refrigerators, and cooktops/cooking ranges are prominent. These appliances are essential for food preparation, storage, and cooking in restaurants, hotels, cafeterias, and other food service establishments. Ovens are used for baking and heating food, refrigerators for storing perishable items, and cooktops/cooking ranges for cooking meals. Dishwashers are also crucial for maintaining hygiene by efficiently cleaning utensils and kitchen equipment.Leading Companies in the Australia Commercial Kitchen Appliances Market

The growth of the commercial kitchen appliances market is fuelled by the increasing presence of cafes and restaurants across Australia and the increasing installation of energy-efficient appliances.- Electrolux AB

- B+S Commercial Kitchens

- MEIKO Maschinenbau GmbH & Co. KG

- Hoshizaki Corporation

- Langford Metal Industries Group

- Ali Group S.r.l.

- SKOPE Refrigeration

- Arcus Australia Pty. Ltd.

- Others

Table of Contents

Companies Mentioned

- Electrolux AB

- B+S Commercial Kitchens

- MEIKO Maschinenbau GmbH & Co. KG

- Hoshizaki Corporation

- Langford Metal Industries Group

- Ali Group S.r.l.

- SKOPE Refrigeration

- Arcus Australia Pty. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 116 |

| Published | October 2025 |

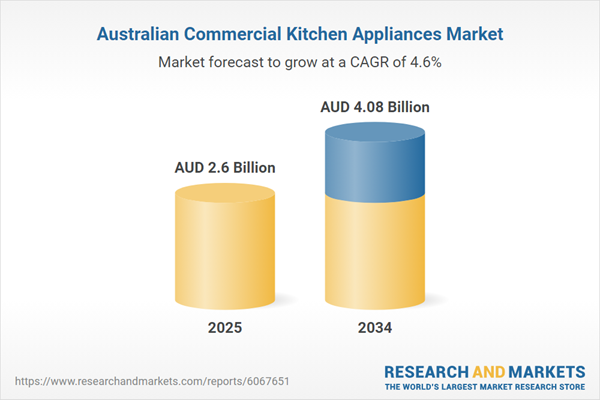

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 2.6 Billion |

| Forecasted Market Value ( AUD | $ 4.08 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 8 |