Global Automotive End-point Authentication Market - Key Trends and Drivers Summarized

How Is Automotive End-Point Authentication Revolutionizing Vehicle Security and Connectivity?

Automotive end-point authentication is revolutionizing vehicle security and connectivity by providing advanced, secure methods for verifying the identity of devices and users interacting with the vehicle's network. As vehicles become increasingly connected and reliant on digital systems, the need to protect against cyber threats and unauthorized access has become paramount. End-point authentication ensures that only authorized devices, such as key fobs, smartphones, or onboard diagnostics systems, can communicate with the vehicle's systems. This technology is critical in safeguarding against hacking, data breaches, and other security risks that could compromise vehicle safety, privacy, or functionality. By authenticating every interaction, whether it's starting the engine, accessing onboard services, or connecting to external networks, automotive end-point authentication plays a vital role in maintaining the integrity of the vehicle's systems. As the automotive industry moves towards more sophisticated, connected, and autonomous vehicles, robust end-point authentication systems are essential to protect both the vehicle and its occupants from evolving cyber threats.What Innovations Are Enhancing the Functionality of Automotive End-Point Authentication?

Innovations in automotive end-point authentication are enhancing its functionality through advancements in biometrics, blockchain technology, and multi-factor authentication systems. One of the most significant developments is the integration of biometric authentication methods, such as fingerprint recognition, facial recognition, and voice identification, into vehicles. These technologies offer a highly secure and personalized way to verify the identity of drivers and passengers, reducing the risk of theft and unauthorized access. Another key innovation is the use of blockchain technology to create decentralized, tamper-proof authentication systems that ensure the integrity of communication between the vehicle and external devices or networks. Blockchain can securely manage and record authentication transactions, providing a transparent and immutable record that is resistant to hacking and fraud. Additionally, multi-factor authentication (MFA) systems, which require two or more verification methods, are becoming increasingly common in the automotive industry. MFA combines something the user knows (like a password), something the user has (like a smartphone), and something the user is (biometrics), creating a robust defense against unauthorized access. The development of over-the-air (OTA) updates that can continuously improve and adapt authentication protocols is also enhancing the resilience of automotive end-point authentication systems. These innovations are making automotive end-point authentication more secure, versatile, and adaptable to the rapidly changing landscape of vehicle connectivity and cybersecurity.How Does Automotive End-Point Authentication Impact Vehicle Security and User Experience?

Automotive end-point authentication has a significant impact on vehicle security and user experience by providing a secure environment for both the vehicle's digital systems and the personal data of its occupants. From a security standpoint, end-point authentication is crucial in preventing unauthorized access to the vehicle's systems, which could lead to theft, tampering, or cyberattacks that compromise the safety and functionality of the vehicle. For instance, robust authentication measures can prevent car thefts by ensuring that only the rightful owner can start and operate the vehicle, even if the physical key or key fob is stolen. This technology also protects the integrity of onboard systems by ensuring that only verified software updates or diagnostic tools can interact with the vehicle, reducing the risk of malware or unauthorized modifications. In terms of user experience, automotive end-point authentication enhances convenience and personalization. Biometric authentication methods, such as fingerprint or facial recognition, can be used to automatically adjust vehicle settings to the preferences of the authenticated user, such as seat position, climate control, and infotainment options, providing a highly personalized driving experience. Additionally, the integration of secure smartphone-based authentication allows for seamless access to vehicle functions, such as remote start or unlocking, without the need for traditional keys. This not only adds convenience but also improves security by linking vehicle access to the owner's verified mobile device. As vehicles become more connected and integrated with digital ecosystems, the role of end-point authentication in safeguarding data and ensuring a smooth, user-friendly experience is increasingly important. By combining security with convenience, automotive end-point authentication is shaping the future of how drivers interact with their vehicles in a connected world.What Trends Are Driving Growth in the Automotive End-Point Authentication Market?

Several trends are driving growth in the automotive end-point authentication market, including the increasing connectivity of vehicles, the rise of autonomous driving technologies, and growing concerns over cybersecurity. As vehicles become more connected, with features like internet access, vehicle-to-everything (V2X) communication, and integration with smart home devices, the need for secure authentication mechanisms becomes critical to protect against cyber threats. The rise of autonomous driving technologies, which rely on complex networks of sensors, data, and communication systems, further amplifies the need for robust end-point authentication to ensure that all interactions with the vehicle are secure and authorized. The growing awareness of cybersecurity threats in the automotive industry is also a significant driver of market growth. High-profile incidents of vehicle hacking and data breaches have highlighted the vulnerabilities in current vehicle systems, leading to increased demand for advanced security solutions like end-point authentication. Additionally, regulatory bodies and industry standards are beginning to require more stringent cybersecurity measures for connected and autonomous vehicles, further boosting the adoption of end-point authentication technologies. The push towards more personalized and user-friendly vehicle experiences is another trend supporting market growth. Consumers increasingly expect their vehicles to offer the same level of convenience and security as their other digital devices, such as smartphones and smart home systems. This expectation is driving automakers to integrate advanced authentication technologies that not only enhance security but also improve the overall user experience.Report Scope

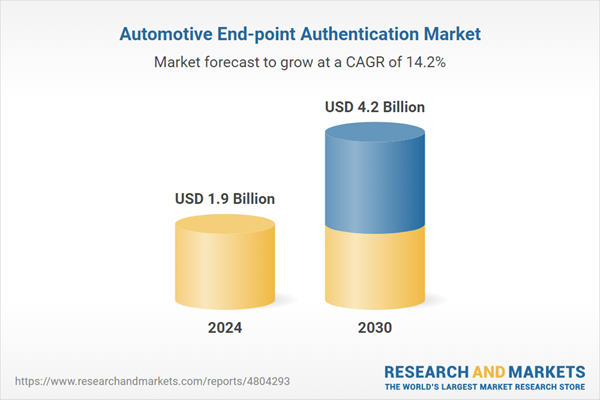

The report analyzes the Automotive End-point Authentication market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Authentication Type (Biometric Vehicle Access, Smartphone Applications, Automotive Wearables); End-Use (Passenger Cars, Electric Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Passenger Cars End-Use segment, which is expected to reach US$3.6 Billion by 2030 with a CAGR of 14.2%. The Electric Vehicles End-Use segment is also set to grow at 14.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $521.7 Million in 2024, and China, forecasted to grow at an impressive 13.5% CAGR to reach $640.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive End-point Authentication Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive End-point Authentication Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive End-point Authentication Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bosch Mobility Solutions, Continental AG, Denso Corporation, Fujitsu Ltd., Nuance Communications, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Automotive End-point Authentication market report include:

- Bosch Mobility Solutions

- Continental AG

- Denso Corporation

- Fujitsu Ltd.

- Nuance Communications, Inc.

- Safran SA

- Samsung Electronics Co., Ltd.

- Synaptics, Inc.

- TokenOne

- Valeo SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bosch Mobility Solutions

- Continental AG

- Denso Corporation

- Fujitsu Ltd.

- Nuance Communications, Inc.

- Safran SA

- Samsung Electronics Co., Ltd.

- Synaptics, Inc.

- TokenOne

- Valeo SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 4.2 Billion |

| Compound Annual Growth Rate | 14.2% |

| Regions Covered | Global |