Automotive Immobilizer - Key Trends and Drivers

Automotive immobilizers are advanced security systems integrated into vehicles to prevent unauthorized engine start and deter theft. These systems work by disabling the engine's ignition system, fuel system, or both, unless the correct key or key fob is present. Modern immobilizers use transponder chips embedded in the key, which communicate with the vehicle's electronic control unit (ECU) to verify the legitimacy of the key. If the transponder's code does not match the one stored in the ECU, the engine will not start. This technology has significantly reduced car theft rates globally, as it makes hot-wiring or other conventional methods of stealing a car nearly impossible. Many modern vehicles come with factory-installed immobilizers, and aftermarket solutions are available for older models.The design and functionality of automotive immobilizers have evolved alongside advancements in vehicle electronics and communication technologies. Early systems relied on simple coded keys, but today's immobilizers incorporate complex encryption algorithms and rolling code systems to enhance security. Some advanced immobilizers also integrate with other vehicle security features such as alarm systems and GPS tracking, offering comprehensive protection. Additionally, the rise of smart keys and keyless entry systems has further refined immobilizer technology. These systems use radio frequency identification (RFID) or Bluetooth technology to allow seamless and secure communication between the key fob and the vehicle, enhancing user convenience without compromising security.

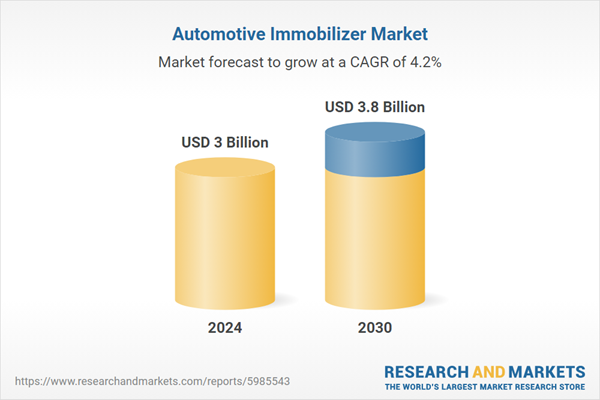

The growth in the automotive immobilizer market is driven by several factors, including increasing vehicle theft rates, advancements in automotive electronics, and stringent government regulations. The rise in vehicle theft has prompted both consumers and manufacturers to invest in more sophisticated security systems. Technological advancements, particularly in encryption and wireless communication, have enabled the development of more secure and reliable immobilizers. Furthermore, government regulations mandating the installation of immobilizers in new vehicles to enhance public safety and reduce insurance fraud have significantly boosted market demand. Consumer behavior, particularly the growing preference for vehicles with integrated advanced security features, also plays a crucial role. Additionally, the proliferation of connected cars and the integration of Internet of Things (IoT) technology in the automotive sector are creating new opportunities for immobilizer systems that offer enhanced connectivity and remote management capabilities. These factors collectively contribute to the robust growth of the automotive immobilizer market, making it a critical component of modern vehicle security solutions.

Report Scope

The report analyzes the Automotive Immobilizer market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Passenger Cars Application, Commercial Vehicles Application).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Passenger Cars Application segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of a 4.1%. The Commercial Vehicles Application segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $800.3 Million in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $811.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Immobilizer Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Immobilizer Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Immobilizer Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Asahi Denso Co., Ltd., Bosch Mobility Solutions, Dynamco, HELLA GmbH and Co. KGaA, iBlue AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Automotive Immobilizer market report include:

- Asahi Denso Co., Ltd.

- Bosch Mobility Solutions

- Dynamco

- HELLA GmbH and Co. KGaA

- iBlue AG

- Mastergard Enterprises Inc.

- NXP Semiconductors NV

- PFK Electronics

- Ravelco

- Robert Bosch GmbH (Bosch Mobility)

- Samsara Inc.

- STRATTEC Security Corporation

- TESORPLUS Corporation

- Tokai Rika Co. Ltd.

- Yuebiz Technology Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Asahi Denso Co., Ltd.

- Bosch Mobility Solutions

- Dynamco

- HELLA GmbH and Co. KGaA

- iBlue AG

- Mastergard Enterprises Inc.

- NXP Semiconductors NV

- PFK Electronics

- Ravelco

- Robert Bosch GmbH (Bosch Mobility)

- Samsara Inc.

- STRATTEC Security Corporation

- TESORPLUS Corporation

- Tokai Rika Co. Ltd.

- Yuebiz Technology Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 3.8 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |