Global Barley Malt Market - Key Trends & Drivers Summarized

What Is Barley Malt, And Why Is It Important In Modern Food and Beverage Production?

Barley malt is a key ingredient in brewing and food production, made by partially germinating barley grains through a process known as malting. This process involves soaking barley in water to start germination and then drying it in kilns to halt the process. The result is barley malt, which contains enzymes that convert the grain's starches into fermentable sugars. This makes it essential for producing alcoholic beverages like beer and whiskey, as well as non-alcoholic products such as malt-based drinks and flavorings for baked goods. Barley malt is also widely used in the food industry as a natural sweetener and flavor enhancer in products like breakfast cereals, confectionery, and bread.The importance of barley malt in the brewing industry cannot be overstated. It provides the primary source of fermentable sugars needed for alcohol production and contributes to the flavor, color, and body of the final product. Barley malt is also valued for its role in food manufacturing, where it enhances the flavor and nutritional profile of a wide range of products. As consumer preferences shift toward natural ingredients and authentic flavors, barley malt is becoming increasingly important in clean-label products that cater to the growing demand for transparency in food production. With its versatility and natural origin, barley malt is a staple in both traditional brewing and modern food applications.

What Types Of Barley Malt Are Available, And How Do They Cater To Different Industry Needs?

Barley malt comes in various types, each catering to specific applications in the brewing, distilling, and food industries. The two primary types of barley malt are base malts and specialty malts. Base malts, such as pale malt, are the most commonly used in brewing and provide the majority of the fermentable sugars needed for alcohol production. Pale malt, for instance, is lightly kilned and has a high enzyme content, making it ideal for producing beers like lagers and pale ales. It serves as the foundation for most beer recipes, offering a mild flavor and light color that allow for versatility in brewing.Specialty malts, on the other hand, are used to add flavor, color, and complexity to the final product. These malts are roasted or kilned for longer periods, resulting in darker colors and richer, more intense flavors. Examples include caramel malts, which add sweetness and body to beer, and roasted malts, which impart deep, roasted flavors and darker hues to stouts and porters. Distillers' malts, a specific category of malt used in whiskey production, are selected for their high enzyme activity and ability to convert starches into fermentable sugars, essential in the distillation process. Each type of malt is designed to meet specific needs, whether it's to create a light, refreshing beer or a rich, flavorful whiskey.

In the food industry, barley malt extracts and syrups are widely used as natural sweeteners and flavor enhancers. Malt extracts are often used in baking to improve the flavor and texture of bread, rolls, and pastries. They also serve as a natural preservative, extending the shelf life of products. Additionally, barley malt is used in health-focused products due to its natural origin and nutrient content, making it an attractive ingredient for clean-label and organic foods. With different types of barley malt available, producers in the beverage and food sectors can tailor their recipes and formulations to achieve desired flavors, textures, and product characteristics.

How Are Technological Advancements Impacting The Barley Malt Market?

Technological advancements in malting processes and brewing techniques are having a profound impact on the barley malt market, enhancing product quality, sustainability, and efficiency. One of the most significant advancements is the optimization of malting techniques that ensure consistent quality and flavor profiles in barley malt. Automated malting systems now enable precise control over temperature, humidity, and germination times, allowing for greater consistency in malt production. These systems not only improve the quality of the malt but also increase efficiency in the malting process, reducing energy consumption and minimizing waste. As a result, brewers and food manufacturers can rely on high-quality malt with predictable results, which is crucial in large-scale production.In addition to process optimization, advancements in barley breeding and agricultural practices are improving the availability and quality of barley used for malting. Modern breeding techniques are leading to the development of barley varieties with higher yields, better resistance to disease, and improved malting characteristics. These new varieties are more efficient in converting starches to sugars and have improved enzyme activity, which enhances their suitability for brewing and distilling. This not only supports the growing demand for malt in the beverage industry but also contributes to more sustainable barley production by reducing the need for chemical inputs and increasing resilience to climate variability.

Another technological advancement influencing the barley malt market is the rise of craft brewing and small-batch malting innovations. Small-scale maltsters are using traditional and artisanal malting techniques to create unique malt profiles tailored to the needs of craft brewers and distillers. This has opened up new avenues for experimentation with specialty malts, leading to the creation of innovative beer and whiskey flavors that appeal to consumers seeking novel and artisanal products. Craft malting allows for greater customization and the use of locally sourced barley, promoting regional agriculture and sustainability. As the craft brewing industry continues to expand, the demand for artisanal barley malt is expected to grow, driving further innovation and differentiation in the market.

What Is Driving The Growth In The Barley Malt Market?

The growth in the barley malt market is driven by several key factors, including the expanding global beer and whiskey industries, the increasing demand for natural and clean-label ingredients in food, and the rise of craft brewing. One of the primary drivers is the growing consumption of beer and whiskey worldwide. As global alcohol markets continue to expand, particularly in emerging economies like China, India, and Brazil, the demand for barley malt is rising. Beer, which relies heavily on barley malt for its production, remains one of the most popular alcoholic beverages globally. The growing popularity of craft beer is further fueling demand, as craft brewers often use higher-quality and specialty malts to create distinctive flavors and premium products.In the whiskey industry, barley malt is equally critical. The increasing global demand for whiskey, particularly premium single malts and craft-distilled whiskeys, is boosting the need for high-quality distillers' malt. This growth is being driven by rising disposable incomes, increased interest in artisanal spirits, and the globalization of whiskey consumption. As distilleries scale production to meet international demand, they are investing in consistent, high-quality barley malt to ensure the flavor and integrity of their products. This is contributing to significant growth in the barley malt market, particularly in regions known for whiskey production, such as Scotland, Ireland, and the United States.

The shift toward natural, minimally processed ingredients in food products is another significant factor driving the barley malt market. As consumers become more concerned with health and sustainability, they are seeking out products made from simple, natural ingredients. Barley malt, with its rich flavor and nutritional benefits, is increasingly used as a natural sweetener and flavor enhancer in foods such as baked goods, cereals, and snacks. Its appeal as a clean-label ingredient aligns with consumer preferences for transparent, wholesome food products. Moreover, barley malt is gaining traction in the production of plant-based and functional foods due to its natural origin and health-promoting properties, further expanding its application in the food industry.

Lastly, the rise of the craft brewing industry is playing a major role in driving market growth. As more consumers turn to craft beers and specialty products, the demand for unique, high-quality malts continues to grow. Craft brewers often experiment with different malt types, adding complexity and richness to their brews, which in turn fuels innovation in the malt industry. With these factors combined, the barley malt market is poised for continued growth, supported by expanding beverage markets, increasing demand for natural ingredients, and ongoing innovation in brewing and distilling.

Report Scope

The report analyzes the Barley Malt market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Base Malts, Specialty Malts); Application (Food, Beer, Feed).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Base Malts segment, which is expected to reach US$7.4 Billion by 2030 with a CAGR of a 4.2%. The Specialty Malts segment is also set to grow at 4.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.5 Billion in 2024, and China, forecasted to grow at an impressive 6.6% CAGR to reach $2.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Barley Malt Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Barley Malt Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Barley Malt Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bairds, Cargill, Crisp Malting, Soufflet, Malteurop and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Barley Malt market report include:

- Bairds

- Cargill

- Crisp Malting

- Soufflet

- Malteurop

- Muntons

- Simpsons

- Agraria

- Malting India

- Axereal

- Heineken

- Muntons and Graincorp.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bairds

- Cargill

- Crisp Malting

- Soufflet

- Malteurop

- Muntons

- Simpsons

- Agraria

- Malting India

- Axereal

- Heineken

- Muntons and Graincorp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

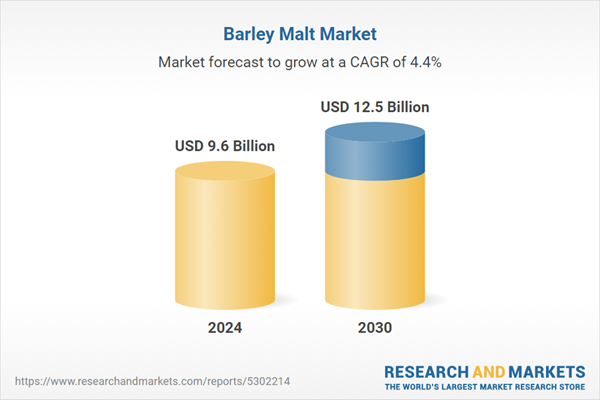

| Estimated Market Value ( USD | $ 9.6 Billion |

| Forecasted Market Value ( USD | $ 12.5 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |