Speak directly to the analyst to clarify any post sales queries you may have.

A concise strategic overview of the forces reshaping battery recycling, highlighting technology evolution, policy momentum, and shifting value chains that demand immediate leadership action

The global battery recycling ecosystem is undergoing a rapid realignment driven by electrification, resource nationalism, and technology maturation. Decision-makers across automotive, consumer electronics, and industrial sectors are contending with shifting supplier networks, evolving regulatory demands, and rising attention to circularity metrics that link environmental performance to brand value. This introduction synthesizes the structural forces reshaping the industry and frames the critical questions operators and investors must answer to remain competitive.At its core, the battery recycling value chain is moving from fragmented, end-of-life disposal practices toward integrated systems that recover strategic metals and enable closed-loop material flows. Technological advances in hydrometallurgical and mechanical preprocessing have improved recovery rates for lithium, nickel, cobalt, and other critical elements, while new direct recycling approaches aim to preserve cathode chemistries for reintroduction into manufacturing. These capabilities are becoming as important as traditional refining activities, prompting stakeholders to reassess which service models deliver the best combination of environmental benefit and economic return.

Parallel to technological progress, regulatory and policy environments are converging on higher standards for collection, traceability, and recycling performance. Extended producer responsibility frameworks, waste import-export controls, and evolving trade policy heighten the premium on supply chain transparency. In this environment, companies that integrate collection logistics, black mass handling, and refining partnerships gain operational resilience. The introduction frames the subsequent analysis by highlighting how these dynamics intersect with tariff changes, source diversification, and end-user demand to create new opportunities and operational risks for market participants.

How converging advances in recycling technology, vertical integration, and sustainability requirements are redefining competitive advantage across the battery value chain

The landscape of battery recycling is shifting in ways that recombine technological pathways, supply relationships, and service delivery models. Where past approaches treated recovery as a back-end disposal activity, new frameworks position recycling as an upstream input to manufacturing strategy and material security. Innovations in hydrometallurgy and mechanical preprocessing now sit alongside emergent direct recycling techniques, enabling a spectrum of processing options that were previously mutually exclusive. This convergence permits more tailored recycling strategies that match feedstock types to the most efficient recovery processes.Concurrently, vertical integration is accelerating: automotive OEMs and major battery manufacturers are investing in collection networks and downstream refining capacity to secure feedstock and control quality. This trend is catalyzing partnerships that blur traditional roles between recyclers, suppliers, and original equipment makers. As a result, service providers that can offer end-to-end capabilities-from collection and disassembly through to black mass production and refining-are better positioned to capture higher-value streams and to negotiate long-term offtake agreements.

Market dynamics also reflect shifting demand-side priorities. Corporate sustainability targets and investor scrutiny amplify the importance of traceable circularity and proof of recycled content. Therefore, firms that can demonstrate high recovery rates, lower lifecycle emissions, and certified chain-of-custody are increasingly advantaged when negotiating contracts with OEMs, utilities, and consumer electronics brands. Taken together, these transformative shifts are realigning competitive advantage around technological flexibility, strategic partnerships, and documented sustainability outcomes.

How U.S. tariff adjustments in 2025 will compel supply chain reconfigurations, nearshoring decisions, and technology prioritization across battery recycling operations

Changes in U.S. tariff policy in 2025 create a ripple effect through global battery recycling supply chains by altering the economics of cross-border material flows and incentivizing relocation or nearshoring of critical processing steps. Tariff adjustments that target battery components or recovered materials increase the relative attractiveness of domestic collection, preprocessing, and value-add activities, prompting some firms to re-evaluate sourcing strategies and capital deployment. Consequently, companies are assessing whether to accelerate investment in localized refining capacity or to reconfigure logistics to minimize exposure to tariff-related cost volatility.The tariff environment also influences technology choices. When cross-border costs rise, there is a greater premium on processing approaches that maximize local value retention, such as direct recycling techniques that preserve cathode material properties and reduce the need for extensive chemical refinement. Firms operating in jurisdictions affected by tariffs may prioritize mechanical preprocessing and black mass production to capture intermediate-value steps domestically, while exporting lower-volume, higher-purity streams to specialist refiners in tolerant tariff regimes.

Operationally, tariffs drive closer coordination between collection networks and downstream processors. Companies are investing in traceability systems and contractual mechanisms that optimize the routing of feedstock in response to tariff differentials. Additionally, tariffs accelerate strategic dialogues between industry and policymakers as stakeholders advocate for exemptions, tariff harmonization, or investment incentives aimed at bolstering domestic recycling capacity. Overall, the 2025 tariff landscape tightens the link between trade policy and industrial strategy, making tariff-aware supply chain design a central element of corporate planning.

Actionable segmentation analysis that links battery chemistry, service models, source heterogeneity, processing pathways, and end-user demands to strategic positioning

Segmentation insights reveal how distinct feedstocks, service modalities, sources, processing technologies, and end-user relationships shape competitive dynamics and operational priorities. When viewing the market through the battery type lens, the contrast between non-rechargeable categories such as alkaline, lithium primary, mercury, and zinc-carbon and rechargeable chemistries like lead-acid, lithium polymer, lithium-ion, and nickel-based systems becomes fundamental; the latter group introduces complexities around cell chemistry, state-of-health, and safety that affect disassembly protocols and recycling pathway selection. Within nickel-based chemistries, the presence of both nickel-cadmium and nickel-metal hydride variants modifies regulatory obligations and dictates specific metallurgical techniques for recovery.Service-type segmentation underscores the value of integrated offerings. Entities that combine collection and logistics with disassembly and dismantling, preprocessing and shredding, black mass production, and refining and metal recovery can internalize value and manage impurity profiles more effectively. At the same time, the rise of specialized direct recycling services highlights opportunities for boutique operators to capture high-margin niches by returning cathode materials that meet manufacturing-grade criteria.

Source-based distinctions explain feedstock quality and volume expectations. Automotive-origin batteries, including both EV batteries and non-EV units, introduce large-format packs that require specialized handling and yield concentrated streams of high-value metals. Consumer electronics sources, spanning cameras and accessories, laptops, smartphones and tablets, and wearables, present a broad range of chemistries and sizes that necessitate efficient sorting and preprocessing. Household appliances, industrial batteries, and power tool batteries each add unique operational constraints that influence collection strategies and processing throughput.

Processing technology segmentation reflects divergent investment and operational profiles. Hydrometallurgical processing favors selectivity and relatively lower greenhouse gas intensity for certain recovery pathways, whereas pyrometallurgical processing can handle complex feedstocks but with distinct emissions and energy considerations. Mechanical preprocessing is the essential upstream activity that conditions material for either refining route, and its effectiveness determines downstream recovery yields and impurity loads.

Finally, end-user segmentation illuminates demand-side pull and contractual dynamics. Automotive OEMs and battery manufacturers represent strategic partners that can secure offtake and support closed-loop initiatives, while consumer electronics companies prioritize traceability for brand protection. Government and regulatory bodies influence programmatic requirements and funding. Telecom companies and utilities require reliable secondary sourcing for backup power and grid services, which shapes contract structures and certification requirements. The interplay among these segments creates multiple pathways for differentiation, whether through technological stewardship, service integration, or targeted contractual relationships.

Regional strategic outlook showing where regulatory frameworks, manufacturing concentrations, and logistics considerations will prioritize investments and partnerships

Regional dynamics frame where investments, policy interventions, and operational capabilities will concentrate, shaping competitive opportunities and logistical realities. The Americas demonstrate a trajectory toward scaling domestic collection and refining capabilities driven by demand from automotive OEMs and utility-scale energy storage projects, with stakeholders emphasizing supply chain security and regulatory compliance. In this geography, partnerships between manufacturers and recyclers are increasingly transactional as firms seek to reduce exposure to import tariffs and develop resilient domestic feedstock pipelines.Europe, Middle East & Africa presents a complex regulatory mosaic where Europe leads with stringent extended producer responsibility frameworks and robust traceability requirements, thereby encouraging high recovery standards and certified recycling processes. The Middle East and Africa are focal points for raw material supply and for nascent investments in regional refining capacity, creating opportunities for localized processing hubs that connect to European manufacturing. Across this combined region, policy alignment and incentives for circularity drive technology adoption and the development of accredited recycling infrastructures.

Asia-Pacific remains a pivotal region given its concentration of battery manufacturing and sizable volumes of end-of-life consumer electronics. Policy measures, industrial policy incentives, and the presence of established metallurgical expertise support a diverse set of processing capabilities, from large-scale pyrometallurgical refineries to innovative direct recycling pilots. In this region, competitive advantages arise from scale, proximity to battery production, and the ability to integrate recycling outputs back into domestic manufacturing supply chains. Taken together, these regional distinctions inform investment priorities, partnership strategies, and operational design choices for market participants.

Company-level strategic behaviors and partnership models that determine who captures value through technology leadership, integrated services, and secure feedstock relationships

Company-level dynamics reveal that leadership will belong to organizations that combine technology depth, operational scale, and strong customer relationships. Leading recyclers and materials firms are positioning themselves through strategic investments in preprocessing and refining capacity while also pursuing partnerships with OEMs to secure feedstock and offtake commitments. Firms that develop proprietary hydrometallurgical or direct recycling processes can command premium offtake agreements by delivering recycled materials that meet cathode manufacturing specifications.Service-oriented companies specializing in collection, logistics, and battery-safe disassembly are essential intermediaries that reduce safety risks and improve feedstock quality for downstream processors. These operators are expanding capabilities to offer black mass production as a bundled service, thereby enabling smaller refiners and materials buyers to access standardized intermediate products. Meanwhile, vertically integrated incumbents that internalize both recycling and cell manufacturing functions are experimenting with closed-loop supply agreements that prioritize traceability and recycled content targets.

New entrants and technology startups are differentiating through process innovation, digital traceability systems, and localized servicing models that support rapid scaling of collection networks. Their agility allows them to pilot direct recycling and novel separation techniques at scale, which can attract strategic investment from battery manufacturers seeking to diversify raw material sourcing. Strategic alliances, joint ventures, and center-of-excellence models are common approaches for scaling technologies while sharing capital risk and securing market access. In aggregate, company movements underscore a competitive environment that rewards technological specialization, operational reliability, and deep customer integration.

Action-oriented recommendations for leaders to build integrated collection systems, align technology investments to feedstock realities, and secure traceable offtake partnerships

Industry leaders should pursue a set of coordinated actions to convert transitional forces into competitive advantage. First, prioritize the development of integrated collection and preprocessing infrastructure to control feedstock quality and reduce contamination risk. By investing in battery-safe disassembly and sorting capabilities, organizations improve downstream recovery yields and reduce overall processing costs, enabling higher-value outputs for refiners or direct recycling partners.Second, align technology investments with feedstock composition and regulatory context. Where tariffs or trade frictions elevate the importance of local processing, direct recycling and hydrometallurgical approaches that preserve material integrity offer strategic benefits. Conversely, in contexts where scale and robustness are paramount, pyrometallurgical capacity may remain essential. Leaders should therefore adopt a flexible technology portfolio that allows routing of material to the most appropriate process based on chemistry, contamination levels, and end-use requirements.

Third, strengthen contractual arrangements with end users through certified chain-of-custody frameworks and traceability systems that demonstrate recycled content and environmental performance. These mechanisms create pricing premiums and reduce counterparty risk when entering long-term offtake or supply agreements. Additionally, engage proactively with policymakers to shape producer responsibility rules and trade policies so that industry standards reflect operational realities and encourage infrastructure investment.

Finally, cultivate strategic partnerships across the ecosystem, including OEMs, utilities, and specialized refiners. Joint investments and shared-commercial models lower entry barriers for capital-intensive refining and accelerate the deployment of pilot programs. Executing these recommendations will enable organizations to capture more value from recovered materials, meet stakeholder expectations on sustainability, and hedge against policy and tariff volatility.

A transparent mixed-methods research framework combining stakeholder interviews, technical literature review, trade flow analysis, and scenario-based evaluation to validate strategic findings

The research approach combined qualitative and quantitative methods to ensure robust, actionable insights into the battery recycling landscape. Primary research included structured interviews with stakeholders across the value chain-recyclers, OEM procurement leads, battery manufacturers, logistics providers, and regulatory officials-to capture operational challenges, technology adoption barriers, and strategic priorities. These interviews informed an evidence-based understanding of how companies are sequencing investments and navigating policy-driven constraints.Secondary research encompassed a comprehensive review of technical literature, policy documents, patent filings, and company disclosures to map technology trajectories and identify leading adopters of specific processing techniques. Trade data, customs records, and logistics reports were analyzed to understand material flows and identify friction points caused by tariff changes and regulatory controls. This triangulation of sources enabled cross-validation of qualitative claims against observable trade and corporate activity.

Analytical techniques included value-chain mapping, scenario analysis to evaluate policy and tariff-driven outcomes, and capability benchmarking to assess technology maturity and service integration. The methodology emphasized reproducibility and transparency: assumptions about processing routes, recovery challenges, and contractual structures were documented and stress-tested against alternative policy and market conditions. Together, these methods produced a nuanced picture of operational realities and strategic options available to market participants.

A decisive strategic summary that reinforces how technology, policy, and partnerships converge to convert battery recycling into a resilient, circular industrial capability

In closing, battery recycling is transitioning from a marginal recovery activity into a strategic industry node with implications for material security, manufacturing resilience, and corporate sustainability. Technological advancements, policy evolution, and trade considerations are converging to reward firms that can integrate collection, preprocessing, and refining capabilities while demonstrating traceable recycled content. Firms that adopt flexible technology portfolios and forge deep partnerships across the value chain will be better positioned to capture value and meet increasingly stringent regulatory and customer expectations.The tightening linkage between policy and industrial strategy underscores the need for proactive planning. Tariff shifts and producer responsibility rules will continue to influence where and how processing capacity is deployed, making scenario planning and rapid adaptation essential. Companies that invest in operational excellence, traceability, and contract structures that secure feedstock and offtake will not only mitigate regulatory and trade risks but also create new revenue pathways tied to circularity credentials.

Overall, the industry is moving toward greater professionalization, higher environmental standards, and more sophisticated commercial models. Stakeholders who act decisively-aligning technology to feedstock, optimizing collection networks, and cementing long-term partnerships-will lead the transition from linear disposal to resilient circular systems that underpin the future of battery-enabled mobility and energy systems.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Battery Recycling Market

Companies Mentioned

The key companies profiled in this Battery Recycling market report include:- ACCUREC Recycling GmbH

- Aqua Metals, Inc.

- Ascend Elements, Inc

- Attero Recycling Private Limited

- BASF SE

- Battery Recycling Made Easy

- Battery Solutions LLC

- Call2Recycle, Inc.

- Clarios, LLC

- COM2 Recycling Solutions

- Contemporary Amperex Technology Co., Limited

- DOE Run Company

- East Penn Manufacturing Company

- Eco Recycling Ltd

- Ecobat, LLC

- EnerSys

- Exide Industries Limited

- Fortum Oyj

- Ganfeng Lithium Co., Ltd.

- Gem Co., Ltd.

- Glencore plc

- Gopher Resource, LLC

- Gravita India Limited

- Green Technologies Group Ltd.

- Guangdong Brunp recycling Technology Co., Ltd

- Johnson Controls International PLC

- LG Energy Solution Ltd.

- Lithion Recycling Inc.

- NeoMetals Ltd.

- Onto Technology, LLC

- Raw Materials Company

- RecycLiCo Battery Materials Inc

- Redwood Materials Inc.

- Shenzhen Melasta Battery Co., Ltd

- SK Tes

- Tata Chemicals Limited

- Terrapure Environmental

- Tianneng Power International Limited

- Umicore N.V.

- Veolia SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | January 2026 |

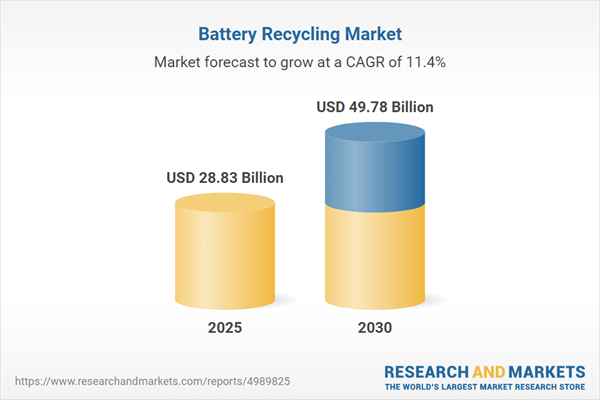

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 28.83 Billion |

| Forecasted Market Value ( USD | $ 49.78 Billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 41 |