Healthcare Big Data Analytics Market Analysis:

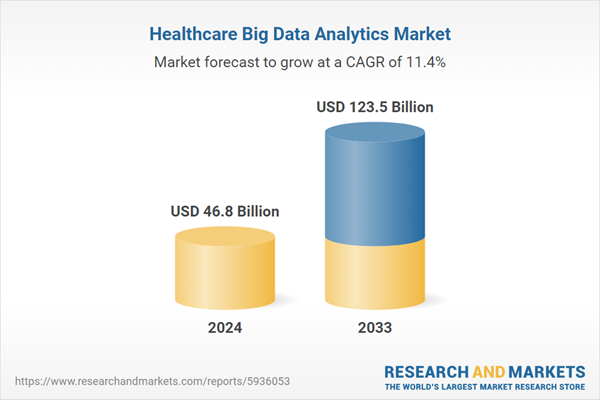

- Market Growth and Size: The market is witnessing strong growth, driven by the increasing volume of healthcare data, along with the growing demand for data-driven insights.

- Technological Advancements: Innovations, such as artificial intelligence (AI)-powered diagnostics and predictive analytics, for personalized recommendations. Moreover, cloud computing and big data platforms are enabling more efficient data storage and processing.

- Industry Applications: Healthcare big data analytics finds applications in clinical decision support, pharmaceutical research, population health management, and telemedicine. It also aids in disease tracking, treatment personalization, and improving patient outcomes.

- Geographical Trends: North America leads the market, driven by stringent data security and privacy measures. However, Asia Pacific is emerging as a fast-growing market due to the rising focus on data-driven decision-making in healthcare facilities.

- Competitive Landscape: Key players are working on integrating data from diverse sources, including electronic health records (EHRs), medical devices, wearables, and research databases, to enable a comprehensive view of patient health and healthcare operations.

- Challenges and Opportunities: While the market faces challenges, such as data security and privacy concerns, it also encounters opportunities in utilizing data for personalized medicine.

- Future Outlook: The future of the healthcare big data analytics market looks promising, with the increasing adoption of advanced technologies. Additionally, the rising focus on population health management is projected to bolster the market growth.

Healthcare Big Data Analytics Market Trends:

Increasing data volume

The healthcare industry is experiencing a huge volume of data generation. This includes electronic health records (EHRs), medical imaging, and genomic data. There is an increase in the adoption of wearable devices that also generate large amounts of data. Besides this, traditional methods of analyzing data are insufficient. In addition, healthcare organizations are recognizing the need to utilize big data analytics to improve patient care, enhance operational efficiency, and make informed decisions. Moreover, advanced analytics tools and techniques can process and analyze large datasets quickly and extract valuable insights relating to clinical decisions, identify trends, and optimize resource allocation. Apart from this, predictive analytics can help hospitals forecast patient admissions, allowing for improved staff scheduling and resource management. Furthermore, large hospitals and healthcare organizations are handling massive amounts of data daily, including administrative, financial, and operational data. In line with this, the rising focus on evidence-based decision-making in healthcare is contributing to the growth of the market.Integration of advanced technologies

Integration of advanced technologies, such as machine learning (ML), artificial intelligence (AI), blockchain, natural language processing (NLP), robotics and telemedicine, and cloud computing, to streamline healthcare operations is impelling the market growth. In addition, ML algorithms can identify patterns in medical data that might not be noticeable to human analysts. Moreover, AI-powered chatbots and virtual assistants are improving patient engagement and delivering personalized health recommendations. AI-driven image analysis can detect anomalies in medical images with high accuracy, aiding radiologists in diagnosing conditions like cancer or fractures. Besides this, NLP algorithms are used to extract valuable information from unstructured healthcare data, such as clinical notes, medical literature, and patient narratives. This technology allows for the automated processing of textual data, making it easier to incorporate narrative data into analytics. Furthermore, blockchain technology assists in enhancing the security and integrity of healthcare data. It provides a secure ledger for health records, ensuring that patient data remains tamper-proof and accessible only to authorized parties.Increasing focus on enhanced patient outcomes

The rising focus on enhanced patient care and outcomes is bolstering the growth of the market. In line with this, there is an increase in the demand for value-based care, as it focuses on achieving improved patient outcomes while controlling costs. Moreover, healthcare organizations are increasingly being reimbursed based on the quality of care delivered, rather than the volume of services provided. Besides this, big data analytics allows healthcare organizations to track patient outcomes, monitor adherence to treatment plans, and identify interventions that improve quality and reduce costs. It also helps in population health management by segmenting patient populations and tailoring interventions to specific groups. Furthermore, healthcare big data analytics enables healthcare providers to make informed decisions based on a wealth of patient data. These data analytics solutions assist in analyzing historical patient data, treatment efficacy, and clinical pathways and allow providers to identify the most effective treatments and interventions.Healthcare Big Data Analytics Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on component, analytics type, delivery model, application, and end-userBreakup by Component:

- Services

- Software

- Electronic Health Record Software

- Practice Management

- Workforce Management

- Hardware

- Data Storage

- Routers

- Firewalls

- Virtual Private Networks

- E-Mail Servers

- Others

Service accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the component. This includes service, software (electronic health record software, practice management software, and workforce management software), and hardware (data storage, routers, firewalls, virtual private networks, e-mail servers, and others). According to the report, service represented the largest segment.Service includes consulting, implementation, maintenance, and support. In addition, consulting services involve assisting healthcare organizations in defining their data analytics strategies, selecting appropriate tools, and optimizing data workflows. Besides this, implementation services focus on the actual deployment of data analytics solutions, including software integration and customization. Furthermore, maintenance and support services ensure the continued operation and performance of data analytics systems.

Software encompasses a wide range of applications, including data analytics platforms, business intelligence tools, and data visualization software. Data analytics platforms benefit in facilitating data processing, analysis, and reporting. Moreover, business intelligence tools enable users to create dashboards and reports for data-driven decision-making. Besides this, data visualization software helps in presenting complex healthcare data in a visually understandable format, aiding in insights discovery.

Hardware includes the physical infrastructure required for data storage and processing. It involves servers, storage systems, and network equipment that support the storage and retrieval of vast healthcare datasets. High-performance computing (HPC) clusters and cloud infrastructure are often used to handle the computational demands of big data analytics.

Breakup by Analytics Type:

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

- Cognitive Analytics

Descriptive analytics holds the largest market share

A detailed breakup and analysis of the market based on the analytics type have also been provided in the report. This includes descriptive analytics, predictive analytics, prescriptive analytics, and cognitive analytics. According to the report, descriptive analytics accounted for the largest market share.Descriptive analytics involves the examination of historical healthcare data to understand past trends and events. It provides a foundational understanding about patient demographics, treatment outcomes, and resource utilization. Descriptive analytics is widely used for reporting and creating visualizations to communicate insights effectively.

Predictive analytics focuses on forecasting future healthcare events or outcomes based on historical data and statistical modeling. It enables healthcare providers to anticipate patient needs, disease outbreaks, and demands of healthcare resources. Predictive analytics is essential for early disease detection and risk assessment, aiding in preventive care and optimized resource allocation.

Prescriptive analytics goes beyond predicting future events to provide actionable recommendations and solutions. In line with this, it helps healthcare organizations make informed decisions by suggesting suitable courses of action to achieve desired outcomes.

Cognitive analytics combines advanced technologies like artificial intelligence (AI) and natural language processing (NLP) to mimic human thought processes. It can interpret unstructured healthcare data, such as physician notes and patient narratives, to derive insights. Cognitive analytics is used for complex tasks like medical image analysis, clinical decision support, and sentiment analysis of patient feedback.

Breakup by Delivery Model:

- On-Premise Delivery Model

- On-Demand Delivery Model

On-demand delivery model represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the delivery model. This includes on-premise delivery model and on-demand delivery model. According to the report, on-demand delivery model represented the largest segment.On-demand delivery model involves the use of cloud computing infrastructure and services to store, process, and analyze healthcare data. It allows healthcare organizations to access data analytics tools and platforms remotely over the internet, eliminating the need for extensive on-site hardware and software. Cloud-based solutions offer scalability, flexibility, and cost-effectiveness, as healthcare providers can pay for services on a subscription or usage basis.

On-premise delivery model, also known as traditional delivery model, involves the installation and maintenance of data analytics software and infrastructure within the physical premises of a healthcare facility. It allows healthcare organizations to have complete control over their data and analytics systems, ensuring data security and compliance with regulatory requirements. On-premise solutions are suitable for organizations with strict data governance policies or specific security concerns.

Breakup by Application:

- Financial Analytics

- Clinical Analytics

- Operational Analytics

- Others

Clinical analytics exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes financial analytics, clinical analytics, operational analytics, and others. According to the report, clinical analytics represented the largest segment.Clinical analytics involves the analysis of healthcare data related to patient care and treatment. It includes the examination of electronic health records (EHRs), medical images, lab results, and patient demographics to improve clinical decision-making. Clinical analytics plays a crucial role in early disease detection, treatment optimization, and personalized medicine.

Financial analytics in healthcare focuses on the management and optimization of financial resources within healthcare organizations. It includes budgeting, revenue cycle management, claims processing, and cost containment. Financial analytics helps healthcare providers maximize revenue, reduce costs, and improve overall financial performance.

Operational analytics focuses on improving the efficiency and effectiveness of healthcare operations. It includes the analysis of data related to hospital logistics, supply chain management, patient flow, and resource allocation. Furthermore, operational analytics helps healthcare organizations streamline processes and enhance operational excellence.

Breakup by End-User:

- Hospitals and Clinics

- Finance and Insurance Agencies

- Research Organizations

Hospitals and clinics represent the biggest market share

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes hospitals and clinics, finance and insurance agencies, and research organizations. According to the report, hospitals and clinics represented the largest segment.Hospitals and clinics are primary end users of healthcare big data analytics solutions. Healthcare providers in these settings use analytics to improve patient care, optimize resource allocation, and enhance operational efficiency. Analytics applications in this segment include clinical decision support, patient outcomes analysis, and population health management.

Finance and insurance agencies play a vital role in healthcare, managing billing, reimbursement, and insurance claims. These organizations use analytics to assess risk, detect fraud, and ensure accurate financial transactions within the healthcare ecosystem. Financial analytics tools play a crucial role in managing revenue cycles effectively.

Research organizations, including pharmaceutical companies, academic institutions, and research centers, use analytics to increase drug discovery, conduct clinical trials, and analyze healthcare trends. Research organizations rely on advanced analytics, including predictive and cognitive analytics, to extract valuable insights from healthcare data.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

North America leads the market, accounting for the largest healthcare big data analytics market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. According to the report, North America accounted for the largest market share due to the presence of improved healthcare infrastructure facilities. In line with this, the rising adoption of big data analytics solutions to manage vast healthcare data, improve patient care, and optimize costs is propelling the market growth. Furthermore, stringent data security and privacy measures in the region are impelling the market growth.Europe stands as another key region in the market, driven by the increasing focus on data analytics to measure and improve patient outcomes. In addition, the growing demand for advanced data analytics for enhanced healthcare decision-making is offering a positive market outlook in the region.

Asia Pacific maintains a strong presence in the market, with the rising number of research institutions and pharmaceutical companies. Besides this, the increasing need for data security and privacy in healthcare data analytics is supporting the growth of the market. Moreover, the growing focus on data-driven decision-making in healthcare facilities is positively influencing the market.

The Middle East and Africa exhibit growing potential in the healthcare big data analytics market on account of the rising adoption of electronic health records (EHRs), which provide valuable data for analysis. In addition, the growing need for data analytics for risk assessment and intervention planning is offering a positive market outlook.

Latin America region shows a developing market for healthcare big data analytics due to the increasing focus on population health management and preventive care. Apart from this, the rising adoption of electronic health records (EHRs) and telemedicine is strengthening the market growth in the region.

Leading Key Players in the Healthcare Big Data Analytics Industry:

Key players are working on integrating data from diverse sources, including electronic health records (EHRs), medical devices, wearables, and research databases, to enable a comprehensive view of patient health and healthcare operations. Apart from this, companies are investing in the development of advanced analytics tools, including machine learning (ML) algorithms, predictive modeling, natural language processing (NLP), and data visualization software. These tools help in analyzing large healthcare datasets efficiently and extracting actionable insights. Moreover, major players are focusing on providing clinical decision support systems that assist healthcare professionals in making informed decisions about patient care. These systems offer real-time insights, treatment recommendations, and risk assessments.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- CitiusTech Inc.

- Cognizant

- Cotiviti, Inc.

- ExlService Holdings, Inc.

- Gainwell Technologies LLC

- Health Catalyst

- Hewlett Packard Enterprise Development LP

- Inovalon

- Koninklijke Philips N.V.

- McKesson Corporation

- MedeAnalytics, Inc.

- Optum, Inc.

- Oracle Corporation

- SAS Institute Inc.

- Veradigm LLC

- Wipro Limited

Key Questions Answered in This Report

1. What was the size of the global healthcare big data analytics market in 2024?2. What is the expected growth rate of the global healthcare big data analytics market during 2025-2033?

3. What has been the impact of COVID-19 on the global healthcare big data analytics market?

4. What are the key factors driving the global healthcare big data analytics market?

5. What is the breakup of the global healthcare big data analytics market based on the component?

6. What is the breakup of the global healthcare big data analytics market based on the analytics type?

7. What is the breakup of the global healthcare big data analytics market based on the delivery model?

8. What is the breakup of the global healthcare big data analytics market based on the application?

9. What is the breakup of the global healthcare big data analytics market based on the end-user?

10. What are the key regions in the global healthcare big data analytics market?

11. Who are the key players/companies in the global healthcare big data analytics market?

Table of Contents

Companies Mentioned

- CitiusTech Inc.

- Cognizant

- Cotiviti Inc.

- ExlService Holdings Inc.

- Gainwell Technologies LLC

- Health Catalyst

- Hewlett Packard Enterprise Development LP

- Inovalon

- Koninklijke Philips N.V.

- McKesson Corporation

- MedeAnalytics Inc.

- Optum Inc.

- Oracle Corporation

- SAS Institute Inc.

- Veradigm LLC

- Wipro Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 123 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 46.8 Billion |

| Forecasted Market Value ( USD | $ 123.5 Billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |