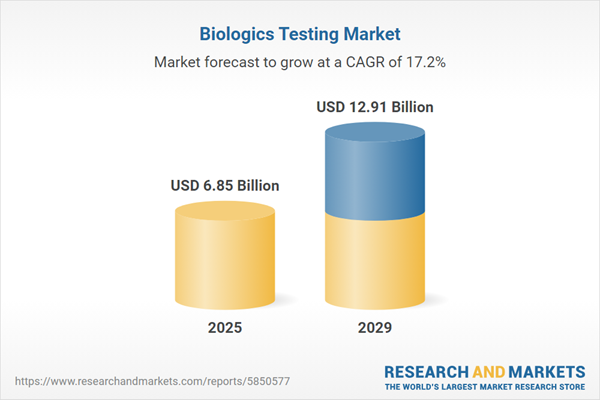

The biologics testing market size is expected to see rapid growth in the next few years. It will grow to $12.91 billion in 2029 at a compound annual growth rate (CAGR) of 17.2%. The growth in the forecast period can be attributed to emergence of advanced therapies, increasing demand for contract testing services, expansion of biologics pipelines, globalization of biopharmaceutical manufacturing, increasing demand for rapid testing solutions. Major trends in the forecast period include advanced analytical technologies, cell-based assays, next-generation sequencing (NGS), quality by design (QBD) principles, integration of artificial intelligence (AI), rapid methods for product release.

The swiftly expanding pharmaceutical and biotechnology sectors are expected to significantly boost the growth of the biologics testing market in the future. The pharmaceutical industry mainly focuses on the development and production of medications for a variety of diseases and medical conditions, while the biotechnology sector emphasizes the application of technology in biology and healthcare. Biologics testing encompasses tests designed to identify and quantify impurities, assess drug stability, and evaluate immune responses to medications. The growth of these industries has also spurred advancements in biologics testing technologies, including the creation of new analytical tools and techniques. These innovations have facilitated more accurate and efficient testing processes, thereby reducing the time and cost associated with bringing new biologics to market. For example, a report from Eurostat, a Belgium-based governing body, revealed that pharmaceutical production in the EU rose from €36 billion ($39.4 billion) in 2021 to €44 billion ($46.7 billion) in 2023, indicating substantial growth in the sector. Consequently, the rapid expansion of the pharmaceutical and biotechnology industries is driving the growth of the biologics testing market.

The projected growth of the biologics testing market is further fueled by rising government initiatives in research and development, a pivotal catalyst for advancing safety, effectiveness, and innovation in biologics. Government initiatives encompass various facets of biologics testing, ensuring safety and efficacy through robust support programs. The White House's substantial funding allocation of $204.9 billion for research and development in the President's 2023 budget reflects this commitment, representing a 28% increase from the 2021 level. These initiatives significantly contribute to the growth of the biologics testing market by nurturing innovation and advancing research.

A prominent trend in the biologics testing market is the focus on product innovations, with companies striving to introduce cutting-edge solutions to maintain their market positions. Noteworthy is Charles River Laboratories International, Inc.'s December 2022 launch of the Endosafe Nexus 200TM, a state-of-the-art instrument in their endotoxin testing line. This instrument, utilizing Endosafe Limulus Amebocyte Lysate (LAL) cartridge technology, streamlines processes for water, in-process, and final product testing, offering enhanced traceability, security, and data management.

Major companies in the biologics testing market are innovating with new technologies, such as protein engineering techniques, to enhance profitability. Queensland University of Technology's launch of a novel protein-engineering technique in July 2023 underscores this trend. This groundbreaking technology aims to expedite and refine the creation of diagnostic tests, promising significant positive impacts on both healthcare and the economy. Such innovations are instrumental in driving advancements within the biologics testing market, fostering growth and profitability.

In July 2022, Solvias Inc., a pharmaceutical testing and manufacturing firm based in the U.S., acquired Cergentis B.V. for an undisclosed sum. This acquisition is intended to strengthen Solvias's capabilities in biologics and cell and gene therapy (CGT) testing solutions, addressing the increasing demand in these areas. Cergentis B.V., located in the Netherlands, is a biotechnology company that specializes in offering innovative solutions in genomics and molecular biology.

Major companies operating in the biologics testing market include Charles River Laboratories Inc., Thermo Fisher Scientific Inc., Merck KGaA, SGS Société Générale de Surveillance SA, WuXi AppTec Co. Ltd., Sartorius AG, Cytovance Biologics Inc., Pace Analytical Services Inc., Avance Biosciences Inc., Celgene Corporation, Biomerieux SA, Lonza Group Ltd., Genscript Biotech Corp., Bio-Rad Laboratories Inc., Accugen Laboratories Inc., Gibraltar Laboratories Inc., Jordi Labs, Gilead Sciences Inc., Bioquell Limited, Southern Research, Promega Corporation, Lancaster Laboratories Inc., Toxikon Corporation, Eurofins BioPharma Product Testing, Johnson & Johnson Inc., QIAGEN N.V., GlaxoSmithKline plc, Danaher Corporation, Agilent Technologies Inc., PerkinElmer Inc., Abbott Laboratories, Beckman Coulter Inc., Becton Dickinson and Company, Roche Holding AG, Novartis AG, Eli Lilly and Company, Pfizer Inc.

North America was the largest region in the biologics testing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global biologics testing market duirng the forecast period. The regions covered in the biologics testing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the biologics testing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Biologics testing encompasses a spectrum of services designed to assess the safety, effectiveness, and quality of biological products.

Within the realm of biologics testing, the primary products include reagents, kits, instruments, and other related items. Instruments, in this context, refer to tools, devices, or machines utilized for conducting experiments, analyzing data, or observing biological samples. The suite of tests involved in biologics testing spans various assessments such as endotoxin testing, sterility testing, mycoplasma testing, bioburden testing, residual detection of host-cell proteins and DNA, virus safety testing, and other specialized tests. These tests find applications across vaccine development and manufacturing, the development and manufacturing of monoclonal antibodies, cellular and gene therapy products, blood and blood products, and various other applications within the biologics industry.

The biologics testing market research report is one of a series of new reports that provides biologics testing optical components market statistics, including biologics testing optical components industry global market size, regional shares, competitors with a biologics testing optical components market share, detailed biologics testing optical components market segments, market trends and opportunities, and any further data you may need to thrive in the biologics testing optical components industry. This biologics testing optical components market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The biologics testing market includes revenues earned by entities by providing services such as potency testing, purity testing, sterility testing, immunogenicity testing and others. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Biologics Testing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on biologics testing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for biologics testing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The biologics testing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Reagents and Kits; Instruments; Other Products2) By Test Type: Endotoxin Test; Sterility Test; Mycoplasma Tests; Bioburden Tests; Residual Host-Cell Proteins and DNA Detection Tests; Virus Safety Test; Other Test Types

3) By Application: Vaccine Development and Manufacturing; Monoclonal Antibodies Development and Manufacturing; Cellular and Gene Therapy Products Development and Manufacturing; Blood and Blood Products Development and Manufacturing; Other Applications

Subsegments:

1) By Reagents and Kits: ELISA Kits; PCR Kits; Cell Culture Reagents; Other Assay Kits2) By Instruments: Spectrophotometers; Chromatography Systems; Microplate Readers; Other Analytical Instruments

3) By Other Products: Software; Consumables; Reference Standards

Key Companies Mentioned: Charles River Laboratories Inc.; Thermo Fisher Scientific Inc.; Merck KGaA; SGS Société Générale de Surveillance SA; WuXi AppTec Co. Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Charles River Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- SGS Société Générale de Surveillance SA

- WuXi AppTec Co. Ltd.

- Sartorius AG

- Cytovance Biologics Inc.

- Pace Analytical Services Inc.

- Avance Biosciences Inc.

- Celgene Corporation

- Biomerieux SA

- Lonza Group Ltd.

- Genscript Biotech Corp.

- Bio-Rad Laboratories Inc.

- Accugen Laboratories Inc.

- Gibraltar Laboratories Inc.

- Jordi Labs

- Gilead Sciences Inc.

- Bioquell Limited

- Southern Research

- Promega Corporation

- Lancaster Laboratories Inc.

- Toxikon Corporation

- Eurofins BioPharma Product Testing

- Johnson & Johnson Inc.

- QIAGEN N.V.

- GlaxoSmithKline plc

- Danaher Corporation

- Agilent Technologies Inc.

- PerkinElmer Inc.

- Abbott Laboratories

- Beckman Coulter Inc.

- Becton Dickinson and Company

- Roche Holding AG

- Novartis AG

- Eli Lilly and Company

- Pfizer Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.85 Billion |

| Forecasted Market Value ( USD | $ 12.91 Billion |

| Compound Annual Growth Rate | 17.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 37 |