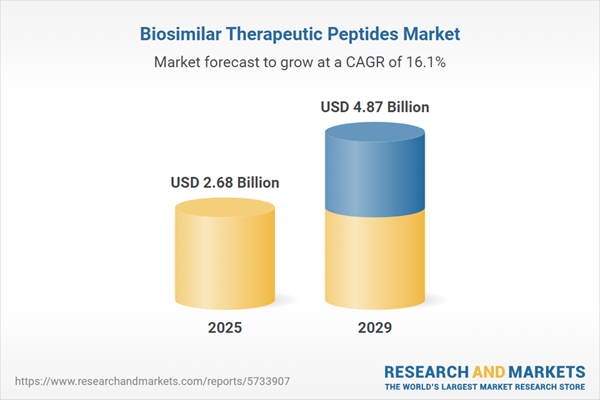

The biosimilar therapeutic peptides market size has grown exponentially in recent years. It will grow from $2.06 billion in 2024 to $2.68 billion in 2025 at a compound annual growth rate (CAGR) of 30.3%. The growth in the historic period can be attributed to increasing demand for cost-effective therapeutics, regulatory support and frameworks, patent expirations of biologic drugs, rising incidence of chronic diseases, and established manufacturing processes.

The biosimilar therapeutic peptides market size is expected to see rapid growth in the next few years. It will grow to $4.87 billion in 2029 at a compound annual growth rate (CAGR) of 16.1%. The growth in the forecast period can be attributed to expanding therapeutic applications, the global aging population, market competitiveness, strategic collaborations and partnerships, and patient preference for non-invasive therapies. Major trends in the forecast period include advancements in biotechnology, increasing demand for biologics, technological innovations in manufacturing, focus on cost-efficiency and access to healthcare, and technological advancements.

The projected increase in the aging population is expected to drive the growth of the biosimilar therapeutic peptides market as the elderly are more susceptible to various chronic diseases. The global rise in chronic conditions among older individuals is set to continue, with the World Health Organization estimating that the population over 60 will reach 2 billion by 2050. Additionally, the number of people aged 80 and above is anticipated to surge from 143 million in 2019 to 426 million in 2050, as per World Population Prospects. Biosimilar therapeutic peptides, utilized in treating various chronic diseases and cancers, are poised to experience increased demand due to the growing aging population facing such health conditions.

The prevalence of chronic diseases is another factor expected to fuel the biosimilar therapeutic peptide market. Chronic diseases, necessitating ongoing management and treatment, are on the rise globally, creating a demand for cost-effective treatments. Biosimilar therapeutic peptides present an affordable option, enhancing patient access and contributing to the sustainability of healthcare systems. Regulatory support and clinical evidence further bolster market growth. Projections by the National Center for Biotechnology Information suggest a significant increase, reaching 142.66 million individuals aged 50 and older with at least one chronic illness by 2050, up from 71.522 million in 2020. Consequently, the prevalence of chronic diseases is a key driver for the biosimilar therapeutic peptides market.

Major companies in the biosimilar therapeutic peptide market are actively developing research platforms to optimize peptide synthesis, improve production efficiency, and ensure consistent quality throughout the drug discovery to commercialization process. Fujitsu Limited launched the Biodrug Design Accelerator platform in May 2023, aiming to expedite peptide drug discovery research and enhance efficiency in the design, make, test, analyze (DMTA) cycles. The platform supports scientists in pharmaceutical companies, facilitating accelerated and informed design of peptide drug candidates.

Major players in the biosimilar therapeutic peptide market are making substantial investments in developing biosimilar facilities to enhance production efficiency and ensure consistent quality throughout the entire process, from discovery to commercialization. An example of such strategic investment is seen in Sandoz Group AG, a Switzerland-based manufacturer of generic pharmaceuticals and biosimilars. By the year 2026, Sandoz plans to invest approximately $90 million in its facility located in Ljubljana, Slovenia. This investment aims to establish a dedicated Sandoz Biopharma Development Center, emphasizing the company's commitment to supporting the future growth of its biosimilar pipeline. Additionally, there are reports indicating the company's intentions to expand biosimilar development capabilities at its Holzkirchteen site in Germany, with a notable €25 million investment. This move is designed to consolidate Sandoz's advanced facilities and analytical expertise into one location.

In November 2022, Pfizer Inc., a prominent biopharmaceutical company based in the United States, made an announcement regarding the acquisition of Biohaven Pharmaceutical Holding Company Ltd. The financial details of the acquisition were undisclosed. Through this strategic move, Pfizer gains access to a portfolio featuring promising calcitonin gene-related peptide (CGRP) receptor antagonists, such as rimegepant and zavegepant. Additionally, Pfizer acquires a portfolio of pre-clinical CGRP assets from Biohaven Pharmaceutical Holding Company Ltd., a pharmaceutical company based in the U.S. known for offering late-stage product candidates targeting neurological illnesses. This acquisition further strengthens Pfizer's position in the biosimilar therapeutic peptide market.

Biosimilar therapeutic peptides are peptide drugs utilized either in lieu of or in addition to peptide hormones when endogenous levels decrease. These biosimilar therapeutic peptides find applications in treating various conditions, including cancer, metabolic disorders, pulmonary diseases, cardiovascular ailments, and other illnesses.

The primary types of biosimilar therapeutic peptides are innovative and generic. It's common for biosimilar medications to be confused with generic drugs, as both are presented as cost-effective alternatives to high-priced name-brand medications. However, a key distinction lies in the fact that generics replicate synthetic pharmaceuticals, while biosimilars are derived from drugs containing biological organisms as active components. These therapeutic peptides are administered through different routes, including the parenteral route, transdermal route, and others, and are employed in the treatment of cancer, cardiovascular disorders, central nervous system conditions, metabolic disorders, infections, hematological disorders, gastrointestinal disorders, dermatological issues, and respiratory disorders.

The biosimilar therapeutic peptides market research report is one of a series of new reports that provides biosimilar therapeutic peptides market statistics, including global market size, regional shares, competitors with a biosimilar therapeutic peptides market share, detailed biosimilar therapeutic peptides market segments, market trends, and opportunities, and any further data you may need to thrive in the biosimilar therapeutic peptides industry. This biosimilar therapeutic peptide market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Major companies operating in the biosimilar therapeutic peptides market include Pfizer Inc., F. Hoffmann-La Roche Ltd., Merck & Co. Inc., Novartis AG, Sanofi SA, AstraZeneca plc, GlaxoSmithKline plc, Takeda Pharmaceuticals Co. Ltd., Eli Lilly and Company, Amgen Inc., Novo Nordisk A/S, BioXpress Therapeutics SA, Apotex Inc., Teva Pharmaceuticals Industries Ltd., Sandoz International GmbH, Lonza Inc., Stada Arzneimittel AG, Ipsen S.A, Biocon Biopharmaceuticals Pvt. Ltd., Dr. Reddy's Laboratories Ltd., Alvogen Pharma US Inc., Corden Pharma GmbH, Bachem Holding AG, PolyPeptide Laboratories Ltd., PeptiDream Inc., Coherus BioSciences Inc., Celltrion Inc., BioPartners Inc., Samsung Bioepis Co. Ltd.

North America was the largest region in the biosimilar therapeutics market in 2024. Middle East is expected to be the fastest growing region in the biosimilar therapeutic peptides market report during the forecast period. The regions covered in the biosimilar therapeutic peptides market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the biosimilar therapeutic peptides market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The biosimilar therapeutic peptides market consists of sales of pegfilgrastim, bevacizumab, and adalimumab. Values in this market are """"factory gate values,"""" that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Biosimilar Therapeutic Peptides Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on biosimilar therapeutic peptides market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for biosimilar therapeutic peptides ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The biosimilar therapeutic peptides market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Innovative; Generic2) By Route of Administration: Parenteral Route; Transdermal Route; Other Route of Administrations

3) By Application: Cancer; Cardiovascular; Central Nervous Systems; Metabolic Disorders; Infection; Hematological Disorders; Gastrointestinal Disorders; Dermatology; Respiratory Disorders

Subsegments:

1) By Innovative: Long-Acting Peptides; Combination Peptides2) By Generic: Monoclonal Antibodies; Hormones; Enzymes

Key Companies Mentioned: Pfizer Inc.; F. Hoffmann-La Roche Ltd.; Merck & Co. Inc.; Novartis AG; Sanofi SA

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Biosimilar Therapeutic Peptides market report include:- Pfizer Inc.

- F. Hoffmann-La Roche Ltd.

- Merck & Co. Inc.

- Novartis AG

- Sanofi SA

- AstraZeneca plc

- GlaxoSmithKline plc

- Takeda Pharmaceuticals Co. Ltd.

- Eli Lilly and Company

- Amgen Inc.

- Novo Nordisk A/S

- BioXpress Therapeutics SA

- Apotex Inc.

- Teva Pharmaceuticals Industries Ltd.

- Sandoz International GmbH

- Lonza Inc.

- Stada Arzneimittel AG

- Ipsen S.A

- Biocon Biopharmaceuticals Pvt. Ltd.

- Dr. Reddy's Laboratories Ltd.

- Alvogen Pharma US Inc.

- Corden Pharma GmbH

- Bachem Holding AG

- PolyPeptide Laboratories Ltd.

- PeptiDream Inc.

- Coherus BioSciences Inc.

- Celltrion Inc.

- BioPartners Inc.

- Samsung Bioepis Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.68 Billion |

| Forecasted Market Value ( USD | $ 4.87 Billion |

| Compound Annual Growth Rate | 16.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |