Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the complexity of thermal management poses a significant obstacle to the broader expansion of the Global Blade Server Market. The high component density characteristic of blade architectures generates substantial heat that often surpasses the capacity of traditional air-cooling infrastructure. This situation necessitates significant capital investment in specialized precision or liquid cooling systems, which can be cost-prohibitive for organizations with legacy data center facilities, thereby limiting adoption rates in cost-sensitive sectors.

Market Drivers

The surge in High-Performance Computing (HPC) and AI Workloads serves as a primary catalyst for the blade server market, as these demanding applications require the high processing density and low-latency interconnects inherent in blade architectures. Enterprises are actively upgrading their infrastructure to support generative AI models, shifting procurement strategies toward modular systems that maximize compute cores within limited rack space. This structural move toward high-density hardware is quantitatively supported by recent financial reports from major providers. For instance, Dell Technologies reported in its 'Third Quarter Fiscal 2025 Financial Results' from November 2024 that servers and networking revenue grew by 58 percent year-over-year to $7.4 billion, driven by substantial demand for AI-optimized infrastructure, illustrating the market's rapid pivot toward dense server configurations over traditional rack-mount units.Simultaneously, the rising requirement for Energy-Efficient and Sustainable Data Center Solutions influences adoption, as blade servers share power supplies and cooling resources to lower the total energy draw per unit of performance. As thermal envelopes expand, organizations are prioritizing advanced cooling technologies, such as liquid cooling integrated into blade chassis, to mitigate the environmental impact of data-intensive operations. This trend is evident in sales data; Lenovo Group Limited's 'Second Quarter Fiscal Year 2024/25 Financial Results' from November 2024 noted a 48 percent increase in revenue from its Neptune liquid-cooled servers, highlighting the sector's specific shift toward thermal efficiency. Furthermore, Microsoft Corporation's 'First Quarter Fiscal Year 2025 Results' in October 2024 revealed capital expenditures of $34.9 billion to support cloud and AI infrastructure, underscoring the massive financial commitment driving the modern, efficient server market.

Market Challenges

The intricate nature of thermal management presents a major structural impediment to the growth of the Global Blade Server Market. Blade servers inherently condense massive computational power into a reduced physical footprint, resulting in thermal densities that frequently exceed the design limits of standard air-cooled environments. Consequently, deploying these systems often necessitates capital-intensive infrastructure upgrades, such as liquid cooling or rear-door heat exchangers. This requirement acts as a deterrent for organizations with legacy facilities or restricted capital budgets, as the cost of retrofitting existing floors to manage extreme heat loads can outweigh the operational efficiency gains of the hardware.This infrastructure disparity creates a tangible ceiling on market scalability. While blade systems necessitate high-power environments, the physical readiness of the broader global data center landscape often lags behind these technical demands. According to the Uptime Institute, the average server rack density across the industry remained below 8 kW in 2024. This statistic highlights the critical gap between the high-density prerequisites of modern blade architectures and the prevailing low-density capacity of most existing facilities, directly restricting broader market penetration.

Market Trends

The Shift Toward Hybrid Cloud Management Integration is transforming the blade server market as organizations demand on-premise infrastructure that mirrors the agility of the public cloud. Blade chassis, featuring centralized management planes, are uniquely positioned to serve as the physical foundation for these hybrid environments, allowing enterprises to scale resources dynamically while maintaining data sovereignty. This pivot toward "infrastructure-as-a-service" consumption models is driving substantial recurring revenue growth for major vendors. According to Hewlett Packard Enterprise, in its 'Fiscal 2025 Third Quarter Results' from September 2025, the company's annualized revenue run-rate (ARR) surged 77 percent year-over-year to $3.1 billion, reflecting the rapid adoption of its hybrid cloud platform which frequently leverages modular server systems.The Convergence with Hyperconverged Infrastructure (HCI) represents a parallel evolution, where blade servers are increasingly adopted as the preferred dense compute nodes for software-defined data centers. Unlike traditional rack-mount setups, blade systems provide the high-density processing power and shared networking fabric essential for maximizing the efficiency of HCI stacks in virtualized environments. This architectural shift allows businesses to consolidate complex compute and storage workloads into unified, modular hardware, fueling significant demand for integrated infrastructure solutions. According to Lenovo Group Limited, in its 'First Quarter Fiscal Year 2025/26 Financial Results' from August 2025, revenue for the Infrastructure Solutions Group (ISG) increased by 36 percent year-over-year to $4.3 billion, driven by robust demand from cloud service providers and enterprise customers modernizing their compute capabilities.

Key Players Profiled in the Blade Server Market

- Hewlett Packard Enterprise

- Dell Technologies Inc.

- Cisco Systems, Inc.

- Lenovo Group Limited

- IBM Corporation

- Fujitsu Limited

- Oracle Corporation

- Inspur Group Co., Ltd.

- Super Micro Computer, Inc.

- NEC Corporation

Report Scope

In this report, the Global Blade Server Market has been segmented into the following categories:Blade Server Market, by Data Center Type:

- Tier 1

- Tier 2

- Tier 3

- Tier 4

Blade Server Market, by Services:

- Consulting

- Installation and support

- Professional

Blade Server Market, by End User:

- Small and Medium size organization

- Large size organization

Blade Server Market, by Industry Vertical:

- BFSI

- IT & Telecommunications

- Retail & E-Commerce

- Healthcare

- Media & Entertainment

- Travel & Hospitality

- Others

Blade Server Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Blade Server Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Blade Server market report include:- Hewlett Packard Enterprise

- Dell Technologies Inc.

- Cisco Systems, Inc.

- Lenovo Group Limited

- IBM Corporation

- Fujitsu Limited

- Oracle Corporation

- Inspur Group Co., Ltd.

- Super Micro Computer, Inc.

- NEC Corporation

Table Information

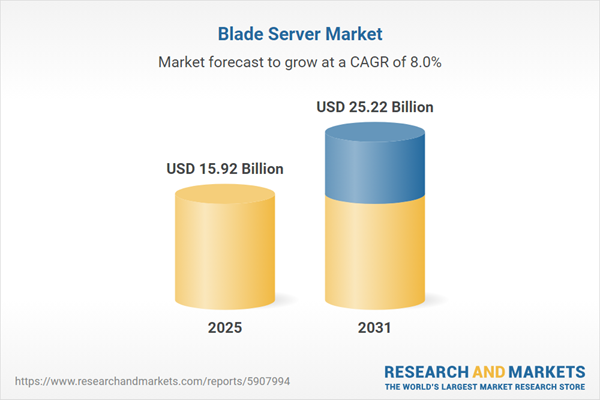

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 15.92 Billion |

| Forecasted Market Value ( USD | $ 25.22 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |