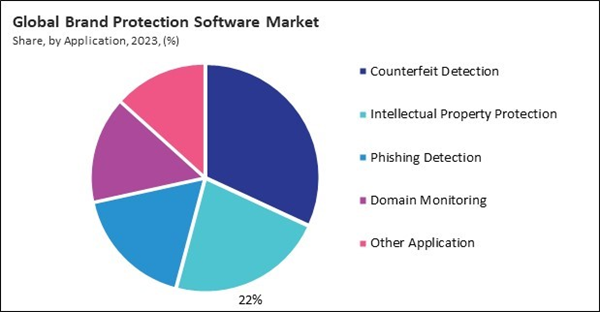

Phishing detection software is essential for organizations to identify and prevent phishing attacks, which are increasingly sophisticated and pose significant threats to brand security. This software helps companies protect their customers, data, and overall brand image by detecting and mitigating phishing attempts. Hence, in 2023, the phishing detection segment held a 17% revenue share in the market. The rising incidence of cyber threats has made phishing detection a critical component of brand protection strategies. Organizations are also focusing on educating their employees about phishing risks and integrating phishing detection tools into their broader cybersecurity frameworks.

Governments and industry organizations have been instrumental in promoting the significance of intellectual property protection through educational initiatives. These efforts have highlighted the financial and reputational damage from IP theft, prompting businesses to take proactive measures to safeguard their intellectual property. Brand protection software provides the tools to monitor and enforce IP rights, helping companies detect and respond to infringements promptly, thus mitigating potential losses and preserving brand value. Additionally, Brand protection software offers advanced features such as real-time monitoring, automated detection, and data analytics to identify and mitigate counterfeit activities.

These tools enable businesses to track down counterfeiters, gather evidence for legal actions, and implement measures to prevent future infringements. Therefore, the rising incidences of counterfeiting activities and fraudulent practices and increasing awareness and adoption of intellectual property rights have driven the demand for brand protection software.

However, implementing brand protection software often requires substantial time and resources. Businesses may need to engage specialized staff or train existing employees to manage the software effectively. This can be particularly challenging for smaller companies that may lack the necessary expertise or resources to handle the complexities of brand protection software. The additional costs of hiring and training staff can further strain the budgets of SMEs, making it difficult for them to adopt these advanced solutions. Thus, brand protection software's high implementation and maintenance costs can be a significant restraint.

Driving and Restraining Factors

Drivers

- Increasing Awareness and Adoption of Intellectual Property Rights

- Proliferation Of Social Media and Digital Marketing Channels

- Rising Incidences of Counterfeiting Activities and Fraudulent Practices

Restraints

- High Implementation and Maintenance Costs of Brand Protection Software

- Data Privacy and Security Concerns

Opportunities

- Growing Demand for Cloud-Based Brand Protection Solutions

- Growing E-Commerce Sector and Online Retail Market

Challenges

- High Competition from Traditional Brand Protection Methods

- Challenges in Measuring Return on Investment (ROI)

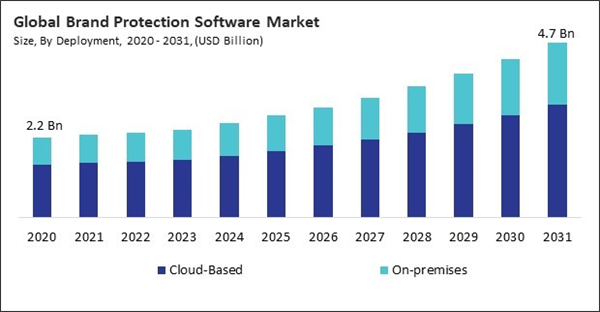

Deployment Outlook

On the basis of deployment, the market is segmented into cloud-based and on-premises. In 2023, the on-premises segment attained 34% revenue share in the market. On-premises solutions are favored by organizations that require greater control over their data and infrastructure, often due to regulatory compliance or internal security policies. These deployments offer customization to meet specific business needs and ensure sensitive information remains within the company's local network.Application Outlook

Based on application, the market is divided into counterfeit detection, intellectual property protection, phishing detection, domain monitoring, and others. The intellectual property protection segment procured 22% revenue share in the market in 2023. Companies need to implement intellectual property protection to safeguard their patents, trademarks, and copyrights from infringement. The demand for software that can efficiently manage and enforce intellectual property rights is driven by the need to protect innovation and maintain a competitive advantage in the market. With the rise of digital content and the global nature of business, protecting intellectual property has become more complex and essential.End-user Industry Outlook

By end-user industry, the market is divided into e-commerce, healthcare, finance & banking, manufacturing, entertainment, and others. In 2023, the e-commerce segment registered a 27% revenue share in the market. This significant share underscores the critical need for robust brand protection in the rapidly growing e-commerce sector. Counterfeiters and fraudsters are increasingly targeting e-commerce platforms due to the widespread adoption of online purchasing. Brand protection software helps these platforms safeguard their reputation, ensure customer trust, and protect against revenue losses due to counterfeit goods and fraudulent activities.Enterprise Size Outlook

Based on enterprise size, the market is categorized into large enterprises and SMEs. In 2023, the large enterprises segment registered 67% revenue share in the market. Large enterprises often have extensive brand portfolios and operate in multiple regions, making them more susceptible to brand-related risks such as counterfeiting and intellectual property theft. Consequently, these organizations invest heavily in comprehensive brand protection solutions to safeguard their assets and maintain their market reputation.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 36% revenue share in the market in 2023. This dominant market share results from the region's stringent brand protection regulations and the high adoption rate of advanced technologies. North American companies, particularly in the United States and Canada, heavily invest in brand protection software to combat the growing threats of counterfeiting, phishing, and intellectual property theft.List of Key Companies Profiled

- Wolters Kluwer N.V.

- Fortra, LLC

- Red Points

- Coresearch Inc. (Audax Group)

- Resolver Inc. (Kroll, LLC)

- Microsoft Corporation

- RUVIXX, Inc.

- BrandShield Ltd.

- Brand24 Global Inc.

- Hubstream Inc.

Market Report Segmentation

By Deployment

- Cloud-Based

- On-premises

By Enterprise Size

- Large Enterprises

- SMEs

By Application

- Counterfeit Detection

- Intellectual Property Protection

- Phishing Detection

- Domain Monitoring

- Other Application

By End-User Industry

- E-commerce

- Healthcare

- Finance & Banking

- Manufacturing

- Entertainment

- Other End-User Industry

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Wolters Kluwer N.V.

- Fortra, LLC

- Red Points

- Coresearch Inc. (Audax Group)

- Resolver Inc. (Kroll, LLC)

- Microsoft Corporation

- RUVIXX, Inc.

- BrandShield Ltd.

- Brand24 Global Inc.

- Hubstream Inc.