Global Butyl Acetate Market - Key Trends & Drivers Summarized

How Is Butyl Acetate Integral to Various Industrial Applications?

Butyl acetate, an organic compound primarily used as a solvent, plays a crucial role in various industrial sectors, including paints, coatings, adhesives, and personal care products. Its primary function is as a solvent in the production of lacquers and paints due to its excellent ability to dissolve resins and polymers, enhancing the smooth application of coatings. Additionally, butyl acetate is widely used in the manufacture of printing inks and adhesives, where its rapid evaporation rate and low odor are valuable attributes. Beyond industrial applications, butyl acetate also finds uses in the production of nail polishes, perfumes, and fragrances due to its pleasant, fruity scent. The compound's versatility, solubility properties, and relatively low toxicity make it a preferred choice in several key industries, where its presence helps to improve product quality and performance.What Technological Advancements Are Shaping the Butyl Acetate Market?

Technological advancements in production processes and environmental safety standards are having a profound impact on the butyl acetate market. Innovations in chemical manufacturing are improving the efficiency of butyl acetate production, reducing waste and lowering energy consumption. The development of greener, more sustainable production techniques, such as bio-based butyl acetate derived from renewable sources, is gaining traction as industries seek to reduce their carbon footprint and comply with stricter environmental regulations. Moreover, advanced formulations of butyl acetate are being developed to meet specific needs in high-performance coatings and adhesives, offering improved evaporation rates and compatibility with other materials. The adoption of these innovative methods and products ensures that butyl acetate remains a key solvent in industries that require high efficiency, low toxicity, and adherence to environmental standards. As these technologies evolve, they are pushing the butyl acetate market towards more sustainable and environmentally friendly practices.How Is Consumer Demand Influencing the Butyl Acetate Market?

Consumer demand for more environmentally sustainable and less toxic products is significantly influencing the butyl acetate market. In response to growing environmental concerns, industries such as paints, coatings, and cosmetics are increasingly looking for solvents that meet regulatory guidelines for volatile organic compounds (VOCs) while maintaining product quality. Butyl acetate, with its lower toxicity and effective solvent properties, is being embraced as a preferred alternative to more harmful solvents. The rise in demand for eco-friendly and water-based paints, especially in residential and commercial construction, has contributed to an increase in the use of butyl acetate as a solvent in these formulations. Similarly, in the personal care industry, there is a shift toward using safer, low-odor solvents in products like nail polish removers and perfumes, driven by consumer preferences for clean, non-toxic ingredients. As industries adapt to these shifting consumer preferences, butyl acetate's role as a safer, versatile solvent is expanding.What Factors Are Driving Growth in the Butyl Acetate Market?

The growth in the butyl acetate market is driven by several factors related to technological advancements, expanding end-use applications, and evolving regulatory requirements. One of the primary drivers is the increasing demand for high-performance solvents in industries such as paints, coatings, adhesives, and printing inks, where butyl acetate's excellent solvent properties are essential. Technological innovations, such as the development of bio-based butyl acetate, are providing more sustainable alternatives that appeal to environmentally conscious consumers and comply with stringent regulations on VOC emissions. Additionally, the rise in construction activities and the growing automotive sector are boosting the demand for coatings and adhesives, further expanding the need for butyl acetate as a key ingredient in these products. End-use applications are also diversifying, particularly in the personal care and pharmaceutical sectors, where butyl acetate is increasingly used due to its low toxicity and pleasant scent. The combination of technological advancements, regulatory pressures, and expanding use cases is driving robust growth in the butyl acetate market across multiple industries.Report Scope

The report analyzes the Butyl Acetate market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Automotive & Transportation End-Use, Building & Construction End-Use, Healthcare End-Use, Food & Beverages End-Use).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automotive & Transportation End-Use segment, which is expected to reach US$481.8 Million by 2030 with a CAGR of a 2.7%. The Building & Construction End-Use segment is also set to grow at 2.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $331.7 Million in 2024, and China, forecasted to grow at an impressive 3.9% CAGR to reach $263.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Butyl Acetate Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Butyl Acetate Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Butyl Acetate Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ataman Kimya A.S., BASF SE, Celanese Corporation, Dow, Inc., Eastman Chemical Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 49 companies featured in this Butyl Acetate market report include:

- Ataman Kimya A.S.

- BASF SE

- Celanese Corporation

- Dow, Inc.

- Eastman Chemical Company

- Fengchen Group Co., Ltd.

- INEOS Group

- KH Neochem Co., Ltd.

- Mitsubishi Chemical Corporation

- Monfel Industries SA de CV

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ataman Kimya A.S.

- BASF SE

- Celanese Corporation

- Dow, Inc.

- Eastman Chemical Company

- Fengchen Group Co., Ltd.

- INEOS Group

- KH Neochem Co., Ltd.

- Mitsubishi Chemical Corporation

- Monfel Industries SA de CV

Table Information

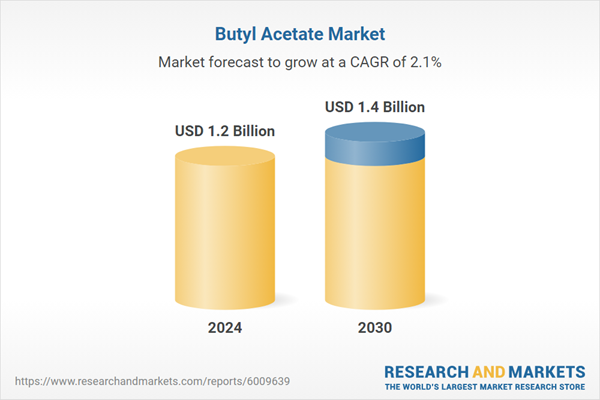

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 1.4 Billion |

| Compound Annual Growth Rate | 2.1% |

| Regions Covered | Global |