Speak directly to the analyst to clarify any post sales queries you may have.

Canada has around 111 operational colocation data centers as of December 2024. The number of colocation data centers is expected to increase over time, as both existing and new companies plan investments in the country.

Toronto and Montreal remain the primary centers for data center growth in Canada, driven by the development of advanced facilities and dedicated cloud infrastructure. For instance, Toronto hosts around 35 existing data center facilities, followed by Montreal with 29 data center facilities. Some of the leading colocation operators in the market include Cologix, Compass Datacenters, Digital Realty, eStruxture Data Centers (Fengate Asset Management), Equinix, Telehouse, Urbacon Data Centre Solutions, Vantage Data Centers, and others.

WHAT'S INCLUDED?

- A transparent research methodology and insights on the colocation demand and supply aspect of the market.

- Market size available in terms of utilized white floor area, IT power capacity, and racks.

- Market size available in terms of Core & Shell Vs Installed Vs Utilized IT Power Capacity, along with the occupancy %.

- An assessment and snapshot of the colocation investment in Canada.

- The study of the existing Canada data center colocation market landscape, and insightful predictions about the Canada data center colocation market size during the forecast period.

- An analysis of the current and future colocation demand in Canada by several industries.

- Impact of AI on the Data Center Industry in Canada.

- The study on the sustainability status in Canada.

- Analysis of current and future cloud operations in Canada.

- The snapshot of upcoming submarine cables and existing cloud-on-ramps services in Canada.

- Snapshot of existing and upcoming third-party data center facilities in Canada

- Facilities Covered (Existing): 111

- Facilities Identified (Upcoming): 29

- Coverage: 20+ locations

- Existing vs. Upcoming (White Floor Area)

- Existing vs. Upcoming (IT Load Capacity)

- Data center colocation market in Canada

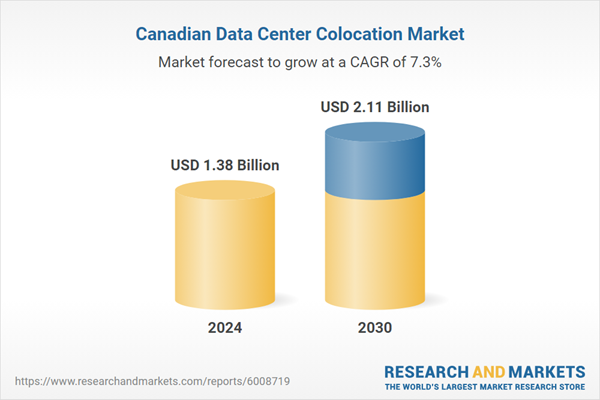

- Colocation Market Revenue & Forecast (2024-2030)

- Retail Colocation Revenue (2024-2030)

- Wholesale Colocation Revenue (2024-2030)

- Retail Colocation Pricing along with Addons

- Wholesale Colocation Pricing, along with the pricing trends.

- An analysis of the latest trends, potential opportunities, growth restraints, and prospects for the colocation data center industry in Canada.

- Competitive landscape, including market share analysis by the colocation operators based on IT power capacity and revenue.

- Vendor landscape of each existing and upcoming colocation operators based on existing/ upcoming count of data centers, white floor area, IT power capacity, and data center location.

THE REPORT INCLUDES:

- Colocation Supply (MW, Area, Rack Capacity)

- Colocation Demand (MW, Area, Rack Capacity) and by End-User (Cloud/IT, BFSI, etc.)

- Colocation Revenue (Retail & Wholesale Colocation Services)

- Competitive Scenario (Share Analysis by Revenue & MW Capacity)

VENDOR LANDSCAPE

Existing Colocation Operators

- eStruxture Data Centers

- Cologix

- Vantage Data Centers

- Equinix

- Compass Datacenters

- Urbacon Data Centre Solutions

- Digital Realty

- Fibre Centre

- Telehouse

- CORE Data Centres

- Qscale

- Enovum Data Centres

- IREN (IRIS ENERGY)

- Wesco (Ascent)

- Serverfarm

- Hut 8 (TeraGo)

- STACK Infrastructure

- CenterSquare (Cyxtera Technologies)

- Bell AI Fabric

New Operators

- Beacon AI Centers

- AVAIO Capital

- Yondr

- Nordik Data Centers & Accelsius

- Prairie Sky Data Solutions

- O’leary Ventures

- Woodland Cree First Nation

KEY QUESTIONS ANSWERED:

1. Who are the new entrants in the Canadian data center industry?2. What is the count of existing and upcoming colocation data center facilities in Canada?

3. What factors are driving the Canada data center colocation market?

4. How much MW of IT power capacity is likely to be utilized in Canada by 2030?

Table of Contents

Companies Mentioned

- eStruxture Data Centers

- Cologix

- Vantage Data Centers

- Equinix

- Compass Datacenters

- Urbacon Data Centre Solutions

- Digital Realty

- Fibre Centre

- Telehouse

- CORE Data Centres

- Qscale

- Enovum Data Centres

- IREN (IRIS ENERGY)

- Wesco (Ascent)

- Serverfarm

- Hut 8 (TeraGo)

- STACK Infrastructure

- CenterSquare (Cyxtera Technologies)

- Bell AI Fabric

- Beacon AI Centers

- AVAIO Capital

- Yondr

- Nordik Data Centers & Accelsius

- Prairie Sky Data Solutions

- O’leary Ventures

- Woodland Cree First Nation

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 64 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.38 Billion |

| Forecasted Market Value ( USD | $ 2.11 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Canada |

| No. of Companies Mentioned | 26 |