A popular trend of e-bikes rental & sharing services in the country is also anticipated to provide numerous growth opportunities for marketers in the coming years. Government incentives and tax rebate programs at provincial and municipal levels are further facilitating the uptake of e-bikes for commercial and personal use in Canada. These initiatives are aimed at reducing the cost of e-bikes to enhance affordability for target consumers and increase product sales, thereby committing to the government’s greener transportation targets. For instance, in July 2022, the Government of Prince Edward Island announced a point-of-sales rebate scheme for the purchase of e-bikes from a list of participating retailers generated by the government.

The rebate offered has a maximum cap of USD 387.8. Similarly, the Banff Residential e-Bike Rebate also offers a financial rebate of USD 551.5-USD 735.4 to Banff residents for purchasing e-bikes. The public sharing programs for e-bikes are another trend observed in Canada, which is contributing to the uptake of e-bikes for commercial use. The number of e-bikes sharing service providers has grown significantly since the post-COVID-19 era. Thus, the service providers have managed to engage a large chunk of the customer base actively using e-bike-sharing services. As per the September 2022 statistics, Vancouver’s bike sharing has engaged over 400,000 users.

Such programs are typically based on rental subscription or one-time payment models-based usage and duration of the e-bikes. The growing popularity of public sharing e-bikes programs is anticipated to create numerous opportunities in the e-bike sharing services market, thereby contributing to the growth in the sale of e-bikes. For instance, in September 2022, Mobi by Shaw Go launched its new fleet of 500 electric bikes and 50 charging stations, adding 2,500 e-bikes and 250 stations to their existing fleets of e-bikes for the public bike-share system in the city of Vancouver. The market is observed to be at an emerging stage anticipated to offer numerous growth opportunities in the e-bike sharing, electric vehicle batteries, and electric mobility markets.

Industry players resort to organic and inorganic growth strategies, such as product launches, mergers & acquisitions, and partnerships, to establish and strengthen their foothold in the market. For instance, in August 2022, ENVO Drive Systems, a British Columbia-based engineering company focused on micro electric mobility, announced the launch of an all-season e-bike named Flex for the U.S. and Canadian markets. These new e-bikes are equipped with adaptable add-on attachments and convertible features. The single frame and flexible structure assure to allow dealers to quadruple their inventory and offer consumers extensive customization with minimal inventory investment. All Flex products include multiple battery options with a range of up to 200 kilometers and a folding aluminum unisex step-through frame concept.

The increasing use of e-bikes for sports activities is forcing manufacturers to develop a product line for off-road biking, including high torque motors, longer-range battery life, power braking, and tougher frames for an enhanced driving experience. Similarly, last-mile delivery through e-bikes and intra-city travel is gaining traction in the country, which is prompting government and charging services providers to set up a robust network of charging stations to support the adoption of e-bikes for different applications, such as city travel and cargo carrying. The growing traction of the shared mobility rental e-bikes model presents the end-user segment with growth opportunities in the commercial segment.

Canada E-bikes Market Report Highlights

- The lithium-ion battery segment is expected to register the fastest CAGR over the forecast period owing to the development in battery technology, such as alternation in battery chemistry to produce lithium-ion air or liquid batteries

- The enhancement of battery technology will facilitate the development of batteries with high energy storage capacity ensuring a longer range

- The belt drive segment is expected to offer numerous growth opportunities for stakeholders in the market over the forecast period. As belt drives require less maintenance & are difficult to replace and with rising consumer preference for low-maintenance products, the segment is projected to create substantial opportunities in the coming years

- The increasing use of torque sensors is expected to create new growth opportunities for the propulsion segment. The torque sensor measures the intensity of force applied to the pedals to determine the amount of power the motor should produce

- The inclusion of torque sensors in the pedal- and throttle-assisted e-bikes enables real-time measurement to adjust for increasing and decreasing the output

- Renting e-bikes is a more affordable option for frequent users by taking subscription plans. Shared mobility and renting e-bikes enable easy access to users, which further supports the market growth

Table of Contents

Companies Mentioned

- BH Bikes

- Brompton Bicycle Limited

- Dorel Industries Inc.

- Envo Drive Systems Inc.

- myStromer AG

- Royal Dutch Gazelle

- Rize Bikes Inc.

- Riese & Müller GmbH

- Specialized Bicycle Components Holding Company, Inc.

- VoltBike Electric Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | July 2023 |

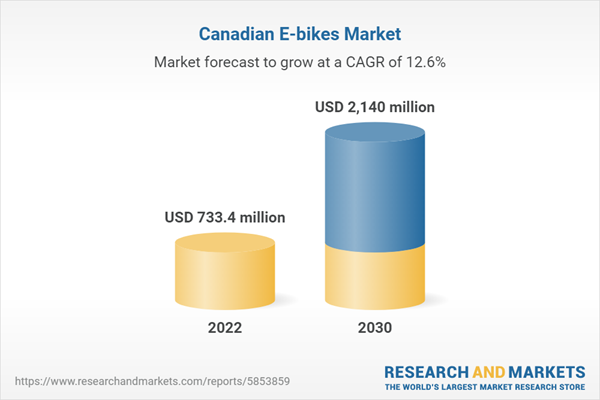

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 733.4 million |

| Forecasted Market Value ( USD | $ 2140 million |

| Compound Annual Growth Rate | 12.6% |

| Regions Covered | Canada |

| No. of Companies Mentioned | 10 |