COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the upcoming LNG projects and growing demand for gas power generation are expected to drive the growth of the market studied.

- On the other hand, the growth of renewable energy in the nation is expected to hamper the growth of Canada's LNG market during the forecast period.

- Nevertheless, as developing nations phase out coal power plants, natural gas demand increases will likely create lucrative growth opportunities for the Canadian LNG market during the forecast period.

Canada LNG Market Trends

Upcoming LNG Projects Expected to Drive the Market

- Canada aims to become one of the prominent LNG producers in global markets. This is expected to increase investments in LNG projects. Further, the export of LNG could facilitate Canadian natural gas production growth and result in significant investment and economic development.

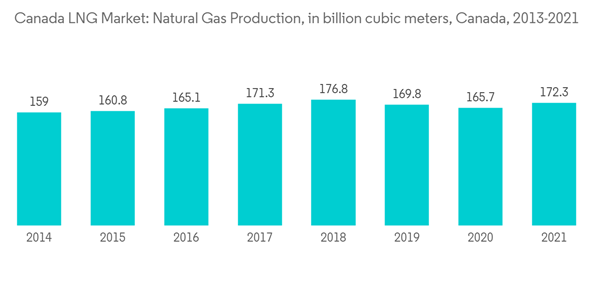

- As per BP Statistical Review of World Energy 2022 statistics, Canada's natural gas production amounted to 172.3 billion cubic meters in 2021. This is expected to drive the Canadian LNG market during the forecast period.

- In 2022, LNG Newfoundland and Labrador proposed a USD 5.5 billion project in Newfoundland and Labrador, Canada, that would liquefy gas offshore from offshore oil production to produce around 2.6 million tonnes of gas per year.

- As of April 2022, three liquefied natural gas (LNG) projects on Canada’s West Coast continue progressing. The largest, LNG Canada, is under construction, while the other two, Cedar LNG and Woodfibre LNG, are moving through the regulatory approvals process.

- The Cedar LNG terminal is a proposed floating liquefied natural gas (FLNG) facility in Kitimat, British Columbia, Canada, with the traditional territory of the Haisla Nation. The proposed project would process and liquefy natural gas to produce approximately 3 to 4 million tonnes of LNG per year and include storage capacity for up to 250,000 cubic meters of LNG.

- Therefore, the upcoming LNG projects and increasing LNG exports are expected to drive the Canadian LNG market in the coming years.

LNG Liquefaction Sector to Dominate the Market

- In 2021, Canada was the world's largest natural gas producer after the United States, Iran, China, and Russia. Canada accounts for a 4.3% share of total natural gas production. Most of Canada's gas is used domestically or exported through pipelines to the United States.

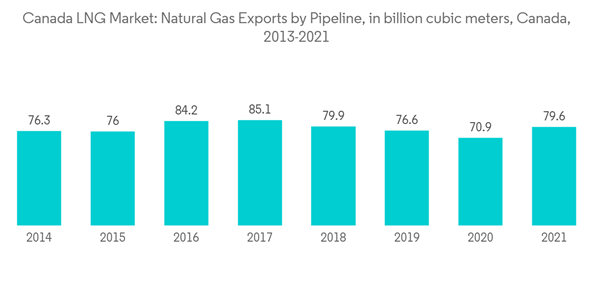

- As per Canada National Energy Board statistics, Canada exported nearly 80 billion cubic meters of natural gas by pipelines in 2021, up from 70.9 billion cubic meters in the previous year. This is expected to drive the Canadian LNG market during the forecast period.

- However, due to the ongoing Ukraine-Russia war, natural gas prices have increased globally. The development of an LNG liquefaction plant for export can help Canada maximize its profit by exporting natural gas to Europe.

- There has also been a growing focus on operator-based technologies for LNG liquefaction facilities. The Shell DMR technology will be used at LNG Canada (scheduled to run in 2025).

- Similarly, in early 2022, Repsol revived the plan to build Saint John LNG Export Terminal at its existing import facility in New Brunswick. The Repsol project is the frontrunner for early completion because there is an existing facility. However, estimates for completion still range from 3 to 5 years.

- As of October 2022, the LNG Kitimat project is under development. It is one of Canada's largest LNG export terminals, with a capacity of 14 million tons per year and an estimated project lifeline of 40 years. The project is expected to be commissioned by 2023. The first phase of the LNG project is 70% completed, and the Coastal GasLink (CGL) pipeline is 75% completed. Once complete, the terminal for the liquefaction, storage, and loading of liquefied natural gas will export LNG produced by the project’s partners in the Montney Formation gas fields near Dawson Creek.

- Overall, the global rise in natural gas prices would aid the development of LNG liquefaction facilities during the forecast period.

Canada LNG Market Competitor Analysis

The Canadian LNG market is moderately consolidated in nature. Some of the major players in the market (in no particular order) include Shell PLC, Fluor Corporation, TechnipFMC PlC, LNG Canada, and Chevron Corporation.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- LNG Canada

- TechnipFMC PLC

- Fluor Corporation

- Shell PLC

- Chevron Corporation

- ExxonMobil Corporation

- TotalEnergies SE