The rising demand for premium bottled water over beverages like coffee, tea, and soft drinks is driven by factors such as its perceived naturalness, superior taste compared to tap water, added mineral content, and purity. Additionally, the shift in consumer preference toward healthier drink options has contributed to increased bottled water consumption over carbonated soft drinks, a trend expected to continue throughout the forecast period.

According to a 2024 report by the International Bottled Water Association (IBWA), based on Beverage Marketing Corp. (BMC) data, bottled water remained the leading beverage by volume in the U.S. for the ninth consecutive year. It recorded a consumption of 16.4 billion gallons in 2024, reflecting a 2.9% growth, outpacing all other beverage categories, most of which saw a decline in volume.

Bottled water is favored for its convenience and portability, making it ideal for on-the-go consumption. Its widespread availability through stores, vending machines, and multiple distribution channels ensures easy regional access. The strong presence of supermarkets and hypermarkets further enhances this accessibility, offering consumers a wide variety of premium bottled water options in one place, enabling easy comparison of brands, types, and prices. Moreover, the availability of various sizes, from single-serve bottles to larger multi-packs, caters to diverse consumer preferences and usage needs.

U.S. And Canada Premium Bottled Water Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, the analyst has segmented the U.S. and Canada premium bottled water market report based on product, distribution channel:Product Outlook (Revenue, USD Billion, 2021 - 2033)

- Spring Water

- Sparkling Water

- Mineral Water

- Others

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Others

Country Outlook (Revenue, USD Billion, 2021 - 2033)

- U.S.

- Canada

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Danone Waters of America (Evian)

- FIJI Water Company LLC

- Sanpellegrino S.p.A.

- Perrier International

- Acqua Panna

- CORE Nutrition LLC

- The Coca‑Cola Company

- Voss USA, Inc.

- Flow Hydration

- Icelandic Glacial, Inc.

Table Information

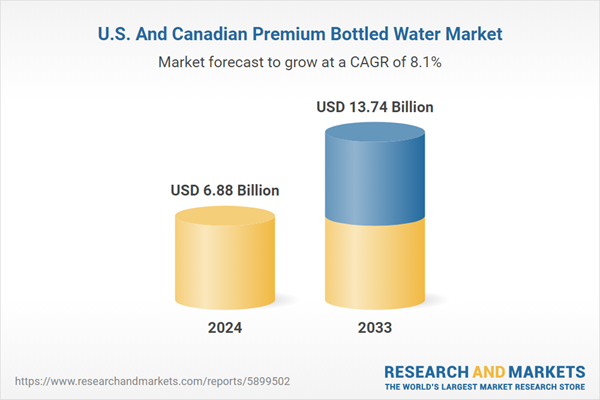

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | July 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 6.88 Billion |

| Forecasted Market Value ( USD | $ 13.74 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Canada, United States |

| No. of Companies Mentioned | 10 |