Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market confronts substantial obstacles, most notably strict environmental regulations designed to phase out fossil-fuel-based generation systems, which require expensive infrastructure upgrades. Data from COGEN Europe indicates that in 2024, cogeneration technologies - a core element of captive power strategies - provided 12% of the total electricity consumed in the European Union. This statistic highlights the persistent reliance on decentralized generation, even as the sector faces the growing challenge of transitioning to cleaner energy sources to comply with decarbonization mandates.

Market Drivers

The increasing instability and unreliability of centralized power grid infrastructure act as a primary catalyst for the widespread implementation of captive power generation. In numerous industrial regions, frequent grid failures and unscheduled outages interrupt continuous manufacturing processes, compelling companies to secure energy autonomy to avoid expensive equipment damage and production downtime. This operational necessity drives significant capital investment into decentralized thermal and hybrid power systems. For instance, the Manufacturers Association of Nigeria reported in its April 2025 'MAN Economic Review' that manufacturers' total expenditure on alternative energy sources rose to N1.11 trillion in 2024, a 42.3% increase largely attributed to persistent public power supply challenges, underscoring how grid volatility has made captive generation a financial imperative for industrial resilience.Additionally, corporate sustainability commitments are accelerating the adoption of renewable captive power as a second critical market driver. As multinational enterprises aim to meet decarbonization mandates and hedge against future carbon taxes, there is a distinct structural shift toward on-site solar and wind generation. This trend allows businesses to lower their carbon footprint while securing long-term electricity costs. The Clean Energy Council, in its 'Clean Energy Australia 2025' report released in May 2025, noted that the sector added 3 GW of rooftop solar capacity in 2024, with businesses increasingly using these systems to manage energy expenses and environmental obligations. Furthermore, the Australian Energy Council's 'Solar Report' from January 2025 highlights that the total operational capacity of distributed photovoltaic installations exceeded 25.3 GW by the end of 2024, emphasizing the growing reliance on decentralized renewable solutions.

Market Challenges

Strict environmental regulations intended to phase out fossil-fuel-based generation systems constitute a significant barrier for the Global Captive Power Generation Market. Industrial entities, particularly within energy-intensive sectors such as mining and manufacturing, face major capital constraints as governments enforce rigorous emission standards and carbon taxes. These mandates force operators to either prematurely retire functioning coal or diesel-based captive assets or invest heavily in expensive abatement technologies, thereby diverting financial resources away from capacity expansion and discouraging new market entry.The difficulty of this transition is further exacerbated by the deep-seated reliance on conventional fuels within the broader energy infrastructure. According to the International Energy Agency (IEA), coal remained the dominant source of electricity globally in 2024, accounting for 35% of total power generation. This high level of dependency on carbon-intensive sources underscores the operational complexity businesses face in meeting decarbonization targets. Consequently, the substantial costs and technical challenges associated with replacing established fossil-fuel infrastructure with cleaner alternatives significantly hinder the market's growth potential.

Market Trends

The adoption of Battery Energy Storage Systems (BESS) for grid stability has emerged as a defining trend as industrial operators strive to manage the intermittency of on-site renewables. Beyond simple backup generation, these storage solutions are increasingly integrated into sophisticated microgrids to offer frequency regulation and ensure seamless power quality for sensitive equipment, effectively converting variable green energy into a reliable baseload resource. This shift toward flexible balancing capacity is quantifiable; Wärtsilä reported a 260% increase in order intake for balancing solutions in its December 2024 'Engine Power Plants Investor Theme Call', highlighting the critical need for technologies that stabilize industrial power systems against grid volatility.Simultaneously, the development of hydrogen-ready gas turbine infrastructure is reshaping long-term procurement strategies as entities transition away from coal-based generation. Rather than committing to standard natural gas assets that risk becoming obsolete under future carbon regulations, industrial buyers are prioritizing chemically flexible turbines capable of utilizing hydrogen blends to ensure asset longevity. This structural evolution is evident in infrastructure data; according to the Global Energy Monitor's 'Global Gas Plant Tracker' from August 2024, approximately 47% of gas turbine capacity currently under construction globally possesses the technical capability to blend at least 50% hydrogen, signaling a widespread industry pivot toward future-proof thermal generation assets.

Key Players Profiled in the Captive Power Generation Market

- Siemens AG

- General Electric Company

- Mitsubishi Electric Corporation.

- ABB Ltd.

- United Technologies Corporation

- Caterpillar Inc.

- Wartsila Corporation

- Bharat Heavy Electricals Limited

- AMP Solar Group Inc.

- Tata Power Renewable Energy Limited

Report Scope

In this report, the Global Captive Power Generation Market has been segmented into the following categories:Captive Power Generation Market, by Technology Type:

- Heat Exchanger

- Turbines

- Gas Engines

- Transformers

- Others

Captive Power Generation Market, by Fuel Type:

- Diesel

- Gas

- Coal

- Others

Captive Power Generation Market, by Ownership:

- Single

- Multiple

Captive Power Generation Market, by End Use:

- Residential

- Commercial

- Industrial

Captive Power Generation Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Captive Power Generation Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Captive Power Generation market report include:- Siemens AG

- General Electric Company

- Mitsubishi Electric Corporation.

- ABB Ltd.

- United Technologies Corporation

- Caterpillar Inc.

- Wartsila Corporation

- Bharat Heavy Electricals Limited

- AMP Solar Group Inc.

- Tata Power Renewable Energy Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

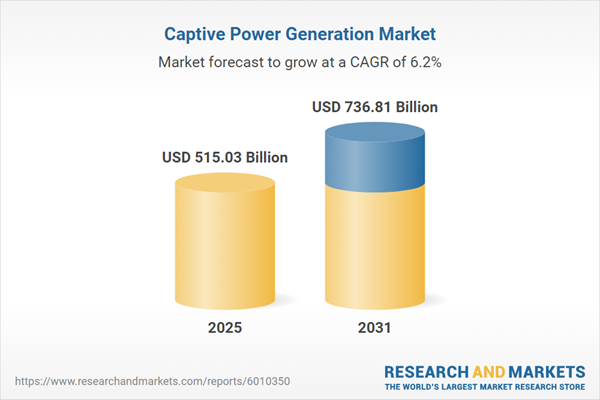

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 515.03 Billion |

| Forecasted Market Value ( USD | $ 736.81 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |