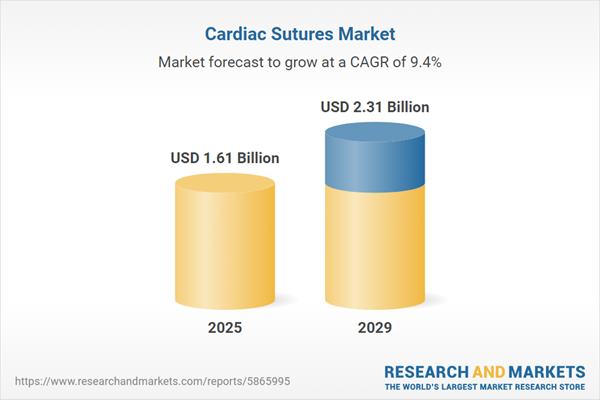

The cardiac sutures market size is expected to see strong growth in the next few years. It will grow to $2.31 billion in 2029 at a compound annual growth rate (CAGR) of 9.4%. The growth in the forecast period can be attributed to global healthcare infrastructure growth, focus on patient outcomes and recovery, surgeons' preference and specialization, regulatory compliance and stringent standards, rising demand for biodegradable sutures. Major trends in the forecast period include integration of nanotechnology, robotic-assisted surgery, sutures for structural heart procedures, biodegradable sutures, enhanced suture coatings.

The increasing prevalence of cardiovascular diseases is anticipated to drive the growth of the cardiac suture market. Cardiovascular diseases encompass various conditions that impact the heart or blood vessels. Cardiac sutures are utilized to close wounds and provide the necessary mechanical support to maintain closure following cardiovascular surgeries. For example, data published by the British Heart Foundation, a UK-based cardiovascular research charity, revealed in September 2024 that approximately 7.6 million individuals in the UK are affected by heart and circulatory diseases, including about 4 million men and 3.6 million women. These conditions account for roughly 27% of all deaths in the UK, leading to over 170,000 fatalities each year, which translates to around 480 deaths per day or one death every three minutes. Consequently, the rising prevalence of cardiovascular diseases is expected to propel the cardiac suture market.

The expanding geriatric population is expected to significantly contribute to the growth of the cardiac sutures market. The geriatric demographic, comprising individuals aged 65 and above, presents distinct challenges in cardiac suture requirements due to age-related tissue changes. This population group tends to have reduced post-operative healing capabilities, necessitating sutures that facilitate faster tissue repair and minimize scarring. According to the World Health Organization's report in October 2023, the global population aged 60 or older is projected to reach 1.4 billion by 2030 and 2.1 billion by 2050. Hence, the burgeoning geriatric population is a key driver of growth in the cardiac sutures market.

Product innovation stands out as a pivotal trend in the cardiac suture market, with major companies striving for new advancements to bolster their market standing. For instance, Able Medical Devices, a US-based medical equipment manufacturer, introduced its Valkyrie looped sternotomy sutures in January 2023, specifically tailored for post-open heart surgeries. This innovative product utilizes stainless steel sutures for closing a patient's chest post-open heart surgery. The Valkyrie sutures offer a doubled surface area compared to traditional wire sutures, ensuring a more robust sternal closure to reduce the risk of severe complications such as sternal dehiscence, often seen after sternotomy procedures. Its unique features include a looped design, high tensile strength, minimal invasiveness, and ease of use, ultimately improving patient outcomes.

Major companies in the cardiac suture market are concentrating on developing technological innovations in sutures to maintain tissue integrity and function. Sutures are medical devices used to close wounds and incisions by stitching tissues together, facilitating healing and minimizing the risk of infection. For example, in August 2023, Healthium Medtech, an India-based medical technology company, introduced TRUMAS, a line of sutures designed to tackle challenges encountered during minimal access surgeries. TRUMAS is specifically engineered to offer superior handling and knot security, enabling surgeons to achieve optimal outcomes in minimally invasive procedures. This innovative suture range utilizes advanced materials and designs to enhance tissue adhesion and reduce the likelihood of complications. By catering to the unique needs of cardiac surgeons, TRUMAS seeks to improve surgical efficiency and patient recovery times, underscoring Healthium Medtech's dedication to advancing medical technology and assisting healthcare professionals in providing high-quality care.

In April 2023, Boston Scientific Corporation, a US-based biotechnology engineering firm, acquired Apollo Endosurgery Inc. to fortify its position in the minimally invasive surgery market and expand its global market share. Apollo Endosurgery Inc., specializing in devices such as sutures and suturing devices, contributed significantly to advancing therapeutic endoscopy.

Major companies operating in the cardiac sutures market include Abbott Laboratories, Medtronic plc, Johnson & Johnson, B. Braun SE, Teleflex Incorporated, Smith & Nephew plc, Boston Scientific Corporation, CONMED Corporation, Deme TECH Corporation, Apollo Endosurgery Inc., Cryolife Inc., W. L. Gore & Associates Inc., Peters Surgical, Stryker Corporation, Ethicon Inc., Internacional Farmacéutica, Sutures India, Mellon Medical B.V., EndoEvolution LLC, Surgical Specialties Corporation, Arthrex Inc., Covidien Holding Inc., Gunze Ltd., Centennial Surgical Suture Ltd., Assut Medical Sarl, Healthium Medtech Ltd., Meril Life Sciences Pvt. Ltd., Cardiovascular Systems Inc., Gore Medical Inc., LivaNova plc.

North America was the largest region in the cardiac sutures market in 2024. The regions covered in the cardiac sutures market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cardiac sutures market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Cardiac sutures are integral medical devices employed in sealing incisions or wounds in the heart or adjacent tissues during cardiac surgeries. Utilizing a needle and thread-such as material, these sutures effectively close incisions or mend heart tissue damage.

The primary classifications of cardiac sutures include absorbable and non-absorbable types. Absorbable sutures naturally break down and are assimilated by the body as the wound undergoes healing. These sutures encompass a range of natural and synthetic materials, finding application across diverse end-users, including hospitals, clinics, ambulatory surgical centers, and various medical facilities.

The cardiac sutures market research report is one of a series of new reports that provides cardiac sutures market statistics, including cardiac sutures industry global market size, regional shares, competitors with a cardiac sutures market share, detailed cardiac sutures market segments, market trends, and opportunities, and any further data you may need to thrive in the cardiac sutures industry. The cardiac sutures market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The cardiac sutures market consists of sales of stainless steel, polypropylene, and polyester sutures and suture anchors. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cardiac Sutures Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cardiac sutures market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cardiac sutures? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cardiac sutures market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Absorbable Sutures; Non-Absorbable Sutures2) By Material Type: Natural; Synthetic

3) By End-User: Hospitals; Clinics; Ambulatory Surgical Centers; Other End-Users

Subsegments:

1) By Absorbable Sutures: Polyglactin Sutures; Polyglycolic Acid Sutures; Catgut Sutures; Monocryl Sutures; Other Absorbable Sutures2) By Non-Absorbable Sutures: Silk Sutures; Nylon Sutures; Polyester Sutures; Polypropylene Sutures; Other Non-Absorbable Sutures

Key Companies Mentioned: Abbott Laboratories; Medtronic plc; Johnson & Johnson; B. Braun SE; Teleflex Incorporated

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Abbott Laboratories

- Medtronic plc

- Johnson & Johnson

- B. Braun SE

- Teleflex Incorporated

- Smith & Nephew plc

- Boston Scientific Corporation

- CONMED Corporation

- Deme TECH Corporation

- Apollo Endosurgery Inc.

- Cryolife Inc.

- W. L. Gore & Associates Inc.

- Peters Surgical

- Stryker Corporation

- Ethicon Inc.

- Internacional Farmacéutica

- Sutures India

- Mellon Medical B.V.

- EndoEvolution LLC

- Surgical Specialties Corporation

- Arthrex Inc.

- Covidien Holding Inc.

- Gunze Ltd.

- Centennial Surgical Suture Ltd.

- Assut Medical Sarl

- Healthium Medtech Ltd.

- Meril Life Sciences Pvt. Ltd.

- Cardiovascular Systems Inc.

- Gore Medical Inc.

- LivaNova plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.61 Billion |

| Forecasted Market Value ( USD | $ 2.31 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |