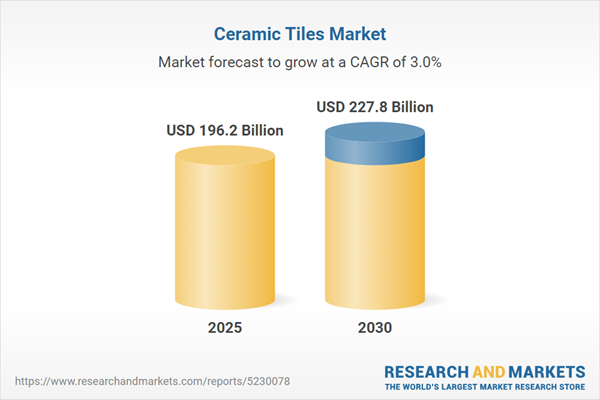

The global ceramic tiles market size is projected to grow from USD 196.2 billion in 2025 to USD 227.8 billion by 2030, at a CAGR of 3.0% during the forecast period.

The ceramic tiles market is expanding due to technological innovations in manufacturing, urbanization, infrastructure development, and increasing consumer demand for durable, stylish, and low-maintenance building materials. Additionally, the focus on sustainable construction practices and rising household incomes are further propelling market growth.

The ceramic tiles market is expanding due to technological innovations in manufacturing, urbanization, infrastructure development, and increasing consumer demand for durable, stylish, and low-maintenance building materials. Additionally, the focus on sustainable construction practices and rising household incomes are further propelling market growth.

By type, porcelain segment to account for major market share during forecast period

Porcelain tiles outshine ceramic tiles in the market because of their superior durability, water resistance, and versatility. They are made from denser clay and fired at higher temperatures. These tiles are less porous and more resistant to moisture, stains, and wear, making them perfect for high-traffic areas and both indoor and outdoor uses. Their strength and longevity attract consumers looking for long-term flooring and surface solutions.By application, flooring segment accounted for major market share in 2024

In 2024, the flooring segment dominated the ceramic tiles market. This dominance is due to the inherent durability and ease of maintenance, which make them a preferred choice for high-traffic areas. Their resistance to moisture, stains, and scratches makes them especially advantageous for kitchens, bathrooms, and commercial spaces where durability and hygiene are vital.By end-use sector, residential segment to account for the largest market share during forecast period

The residential sector leads the ceramic tiles market because of the strong demand for attractive and functional flooring and wall options in homes. People often choose ceramic tiles for their durability, easy upkeep, and wide variety of designs. These tiles are perfect for spaces like kitchens, bathrooms, and living rooms. The rising trend of home renovation projects significantly boosts demand, as consumers aim to refresh and customize their living areas. Additionally, the affordability and accessibility of ceramic tiles make them an attractive choice for many households. The focus on creating comfortable and stylish home interiors propels the market forward.By region, Middle East & Africa to register highest growth rate during forecast period

The Middle East & Africa is the fastest-growing market for ceramic tiles. The construction sector in MEA is thriving, with significant projects underway in countries like Saudi Arabia and the UAE. These nations are investing heavily in infrastructure development, urban expansion, and large-scale projects. These include luxury residential complexes, commercial spaces, and public facilities. This surge in construction activity drives high demand for ceramic tiles, valued for their durability, aesthetic appeal, and versatility. The region’s focus on modernizing urban areas and enhancing living standards further strengthens the ceramic tiles market.- By Company: Tier1: 40%, Tier 2: 25%, Tier3: 4: 35%

- By Designation: C-Level: 35%, Director Level: 30%, Others: 35%

- By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, South America: 5%, and Middle East & Africa: 5%.

Companies Covered:

Mohawk Industries Inc. (US), Grupo Lamosa (Mexico), Pamesa Ceramica (Spain), RAK Ceramics (UAE), Siam Cement Public Company Limited (Thailand), Kajaria Ceramics (India), Ceramica Carmelo For (Brazil), and others are key players in the ceramic tiles market.Research Coverage

The market study examines the ceramic tiles industry across various segments. It aims to estimate the market size and growth potential in different segments based on type, application, end-use sector, finish, construction type, and region. The study also provides a detailed competitive analysis of key market players, including their company profiles, insights into their products and services, recent developments, and major growth strategies to strengthen their position in the ceramic tiles market.Key Benefits of Buying Report

The report is expected to assist market leaders and new entrants in approximating the revenue figures of the overall ceramic tiles market, along with its segments and sub-segments. It aims to help stakeholders understand the competitive landscape, gain insights to enhance their business positions, and develop appropriate go-to-market strategies. Additionally, the report seeks to provide stakeholders with an understanding of the market’s dynamics, including key drivers, challenges, and opportunities.The report provides insights into the following points:

- Analysis of key drivers (Urbanization and infrastructure development, increasing population), restraints (Volatile raw material prices), opportunities (Strong demand from Asia Pacific, rising demand in emerging markets), and challenges (Intense competition) influencing the growth of the ceramic tiles market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the ceramic tiles market

- Market Development: Comprehensive information about lucrative markets - the report analyses the ceramic tiles market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the ceramic tiles market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Mohawk Industries Inc. (US), Grupo Lamosa (Mexico), Pamesa Ceramica (Spain), RAK Ceramics (UAE), Siam Cement Public Company Limited (Thailand), Kajaria Ceramics (India), Ceramica Carmelo For (Brazil) among others in the ceramic tiles market. The report also helps stakeholders understand the pulse of the ceramic tiles market and provides them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Base Number Calculation

2.4 Market Forecast Approach

2.4.1 Supply Side

2.4.2 Demand Side

2.5 Data Triangulation

2.6 Factor Analysis

2.7 Research Assumptions

2.8 Risks Assessment

2.9 Research Limitations

2.10 Growth Rate Assumptions/Forecast

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Base Number Calculation

2.4 Market Forecast Approach

2.4.1 Supply Side

2.4.2 Demand Side

2.5 Data Triangulation

2.6 Factor Analysis

2.7 Research Assumptions

2.8 Risks Assessment

2.9 Research Limitations

2.10 Growth Rate Assumptions/Forecast

4 Premium Insights

4.1 Attractive Opportunities for Players in Ceramic Tiles Market

4.2 Ceramic Tiles Market, by Type

4.3 Ceramic Tiles Market, by Application

4.4 Ceramic Tiles Market, by End-use Sector

4.5 Ceramic Tiles Market, by Region and Type

4.6 Ceramic Tiles Market, by Country

4.2 Ceramic Tiles Market, by Type

4.3 Ceramic Tiles Market, by Application

4.4 Ceramic Tiles Market, by End-use Sector

4.5 Ceramic Tiles Market, by Region and Type

4.6 Ceramic Tiles Market, by Country

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Aesthetic Appeal and Functional Durability Fuel Demand for Large-Format Tiles

5.2.1.2 Increasing Population & Urbanization

5.2.1.3 Growing Investments in Construction Industry

5.2.1.4 Rising Number of Renovation Activities

5.2.1.5 Increasing Industrialization

5.2.2 Restraints

5.2.2.1 Volatile Raw Material Prices

5.2.2.2 Increasing Regulations, Tariffs, and Anti-Dumping Measures

5.2.2.3 Combined Effect of Recession and Russia-Ukraine Conflict in Europe

5.2.3 Opportunities

5.2.3.1 Rising Trend of Office-To-Residential Conversion

5.2.3.2 Introduction of 3D Tiles and Digital Printing Technologies

5.2.3.3 Rapidly Progressing Organized Retail Sector

5.2.3.4 Increase in Demand from Emerging Economies

5.2.4 Challenges

5.2.4.1 Extremely Competitive Market

5.2.4.2 Gas Crisis in Different Regions

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Aesthetic Appeal and Functional Durability Fuel Demand for Large-Format Tiles

5.2.1.2 Increasing Population & Urbanization

5.2.1.3 Growing Investments in Construction Industry

5.2.1.4 Rising Number of Renovation Activities

5.2.1.5 Increasing Industrialization

5.2.2 Restraints

5.2.2.1 Volatile Raw Material Prices

5.2.2.2 Increasing Regulations, Tariffs, and Anti-Dumping Measures

5.2.2.3 Combined Effect of Recession and Russia-Ukraine Conflict in Europe

5.2.3 Opportunities

5.2.3.1 Rising Trend of Office-To-Residential Conversion

5.2.3.2 Introduction of 3D Tiles and Digital Printing Technologies

5.2.3.3 Rapidly Progressing Organized Retail Sector

5.2.3.4 Increase in Demand from Emerging Economies

5.2.4 Challenges

5.2.4.1 Extremely Competitive Market

5.2.4.2 Gas Crisis in Different Regions

6 Industry Trends

6.1 Trends/Disruptions Impacting Customer Business

6.2 Pricing Analysis

6.2.1 Average Selling Price of Key Players, by Type

6.2.2 Average Selling Price Trend, by Region

6.3 Value Chain Analysis

6.4 Ecosystem Analysis

6.5 Technology Analysis

6.5.1 Key Technologies

6.5.1.1 Digital Printing

6.5.1.2 Spray Drying

6.5.2 Complementary Technologies

6.5.2.1 Adhesives and Grouts

6.5.2.2 Smart Tiles

6.5.3 Adjacent Technologies

6.5.3.1 3D Printing

6.5.3.2 Germ-Free Tiles

6.6 Patent Analysis

6.6.1 Introduction

6.6.2 Methodology

6.6.3 Patents Related to Ceramic Tiles

6.7 Trade Analysis

6.7.1 Export Scenario (HS Code 6904)

6.7.2 Import Scenario (HS Code 6904)

6.7.3 Export Scenario (HS Code 6907)

6.7.4 Import Scenario (HS Code 6907)

6.8 Key Conferences and Events, 2025-2026

6.9 Tariff and Regulatory Landscape

6.9.1 Tariff Analysis

6.9.2 Regulatory Bodies, Government Agencies, and Other Organizations

6.9.3 Regulations in Ceramic Tiles Market

6.9.3.1 En 14411 - (Ce Certification for Ceramic Tiles)

6.9.3.2 Ansi A137

6.10 Porter's Five Forces Analysis

6.10.1 Threat of New Entrants

6.10.2 Threat of Substitutes

6.10.3 Bargaining Power of Suppliers

6.10.4 Bargaining Power of Buyers

6.10.5 Intensity of Competitive Rivalry

6.11 Key Stakeholders and Buying Criteria

6.11.1 Key Stakeholders in Buying Process

6.11.2 Buying Criteria

6.12 Case Study Analysis

6.12.1 Case Study 1: Deakinbio's Sustainable Bio-based Tiles

6.12.2 Case Study 2: Design with 1M X 1M Large Porcelain Tiles

6.12.3 Case Study 3: Enhanced Outdoor Spaces with Outdoor Porcelain Tiles

6.13 Investment and Funding Scenario

6.14 Impact of Gen AI/AI on Ceramic Tiles Market

6.14.1 Introduction

6.15 Macroeconomic Indicators

6.15.1 Introduction

6.15.2 GDP Trends and Forecasts

6.15.3 Industry (Including Construction), Value Added (% of GDP)

6.2 Pricing Analysis

6.2.1 Average Selling Price of Key Players, by Type

6.2.2 Average Selling Price Trend, by Region

6.3 Value Chain Analysis

6.4 Ecosystem Analysis

6.5 Technology Analysis

6.5.1 Key Technologies

6.5.1.1 Digital Printing

6.5.1.2 Spray Drying

6.5.2 Complementary Technologies

6.5.2.1 Adhesives and Grouts

6.5.2.2 Smart Tiles

6.5.3 Adjacent Technologies

6.5.3.1 3D Printing

6.5.3.2 Germ-Free Tiles

6.6 Patent Analysis

6.6.1 Introduction

6.6.2 Methodology

6.6.3 Patents Related to Ceramic Tiles

6.7 Trade Analysis

6.7.1 Export Scenario (HS Code 6904)

6.7.2 Import Scenario (HS Code 6904)

6.7.3 Export Scenario (HS Code 6907)

6.7.4 Import Scenario (HS Code 6907)

6.8 Key Conferences and Events, 2025-2026

6.9 Tariff and Regulatory Landscape

6.9.1 Tariff Analysis

6.9.2 Regulatory Bodies, Government Agencies, and Other Organizations

6.9.3 Regulations in Ceramic Tiles Market

6.9.3.1 En 14411 - (Ce Certification for Ceramic Tiles)

6.9.3.2 Ansi A137

6.10 Porter's Five Forces Analysis

6.10.1 Threat of New Entrants

6.10.2 Threat of Substitutes

6.10.3 Bargaining Power of Suppliers

6.10.4 Bargaining Power of Buyers

6.10.5 Intensity of Competitive Rivalry

6.11 Key Stakeholders and Buying Criteria

6.11.1 Key Stakeholders in Buying Process

6.11.2 Buying Criteria

6.12 Case Study Analysis

6.12.1 Case Study 1: Deakinbio's Sustainable Bio-based Tiles

6.12.2 Case Study 2: Design with 1M X 1M Large Porcelain Tiles

6.12.3 Case Study 3: Enhanced Outdoor Spaces with Outdoor Porcelain Tiles

6.13 Investment and Funding Scenario

6.14 Impact of Gen AI/AI on Ceramic Tiles Market

6.14.1 Introduction

6.15 Macroeconomic Indicators

6.15.1 Introduction

6.15.2 GDP Trends and Forecasts

6.15.3 Industry (Including Construction), Value Added (% of GDP)

7 Ceramic Tiles Market, by Finish

7.1 Introduction

7.2 Matt

7.3 Gloss

7.2 Matt

7.3 Gloss

8 Ceramic Tiles Market, by Construction Type

8.1 Introduction

8.2 New Construction

8.3 Renovation

8.2 New Construction

8.3 Renovation

9 Ceramic Tiles Market, by Application

9.1 Introduction

9.2 Flooring

9.2.1 Low Maintenance Requirements and High Durability to Drive Demand

9.3 Internal Walls

9.3.1 Wide-Scale Use in Homes, Offices, Hospitals, and Laboratories to Drive Market

9.4 External Walls

9.4.1 Use of Ceramic Tiles in Exterior Claddings to Drive Market

9.5 Other Applications

9.2 Flooring

9.2.1 Low Maintenance Requirements and High Durability to Drive Demand

9.3 Internal Walls

9.3.1 Wide-Scale Use in Homes, Offices, Hospitals, and Laboratories to Drive Market

9.4 External Walls

9.4.1 Use of Ceramic Tiles in Exterior Claddings to Drive Market

9.5 Other Applications

10 Ceramic Tiles Market, by Type

10.1 Introduction

10.2 Porcelain

10.2.1 Low Water Absorption Rate of 0.5% or Below to Drive Demand

10.3 Ceramic

10.3.1 Associated Cost-Effectiveness and Durability to Fuel Demand

10.2 Porcelain

10.2.1 Low Water Absorption Rate of 0.5% or Below to Drive Demand

10.3 Ceramic

10.3.1 Associated Cost-Effectiveness and Durability to Fuel Demand

11 Ceramic Tiles Market, by End-use Sector

11.1 Introduction

11.2 Residential

11.2.1 Expanding Residential Sector to Drive Demand

11.3 Non-Residential

11.3.1 Increasing Spending on Construction of Offices and Other Commercial & Institutional Spaces to Fuel Demand

11.3.1.1 Commercial

11.3.1.2 Institutional and Healthcare Spaces

11.3.1.3 Public Facilities

11.2 Residential

11.2.1 Expanding Residential Sector to Drive Demand

11.3 Non-Residential

11.3.1 Increasing Spending on Construction of Offices and Other Commercial & Institutional Spaces to Fuel Demand

11.3.1.1 Commercial

11.3.1.2 Institutional and Healthcare Spaces

11.3.1.3 Public Facilities

12 Ceramic Tiles Market, by Region

12.1 Introduction

12.2 Asia-Pacific

12.2.1 China

12.2.1.1 Expanding Construction Industry to Drive Demand

12.2.2 India

12.2.2.1 Government-Led Initiatives to Promote Sanitation and Infrastructure Development to Fuel Demand

12.2.3 Japan

12.2.3.1 Government Initiatives and Private Investments to Revitalize Construction Industry to Drive Demand

12.2.4 Vietnam

12.2.4.1 Easy Availability of Raw Materials to Drive Market

12.2.5 Thailand

12.2.5.1 Economic Stability and Increasing Residential Construction to Fuel Demand

12.2.6 Indonesia

12.2.6.1 High Growth of Construction Industry to Propel Market

12.2.7 Rest of Asia-Pacific

12.3 Europe

12.3.1 Germany

12.3.1.1 Rise in Non-Residential Construction to Drive Demand

12.3.2 UK

12.3.2.1 Decline in Residential and Non-Residential Construction Projects to Hamper Demand

12.3.3 France

12.3.3.1 Bleak Prospects for Market Growth due to Housing Crisis

12.3.4 Russia

12.3.4.1 Growing Construction Industry to Drive Market

12.3.5 Spain

12.3.5.1 High Export of Ceramic Tiles to Fuel Market Growth

12.3.6 Italy

12.3.6.1 Increase in New Non-Residential Surface Construction to Fuel Market Growth

12.3.7 Rest of Europe

12.4 North America

12.4.1 US

12.4.1.1 High Infrastructure Development and Technological Advancements to Drive Market

12.4.2 Canada

12.4.2.1 Rising Spending on Residential and Non-Residential Construction Activities to Fuel Demand

12.4.3 Mexico

12.4.3.1 Slow Growth of Construction Industry due to Slow Economic Recovery to Hamper Market Growth

12.5 Middle East & Africa

12.5.1 GCC Countries

12.5.1.1 UAE

12.5.1.1.1 Rise in Construction Activities to Drive Market

12.5.1.2 Saudi Arabia

12.5.1.2.1 Government-Led Initiatives for Infrastructure Development to Propel Market

12.5.1.3 Other GCC Countries

12.5.2 Turkey

12.5.2.1 Rising Use of Advanced Tile Production Technologies to Drive Market

12.5.3 Egypt

12.5.3.1 Increasing Investments in Reconstruction Activities to Drive Market

12.5.4 Iran

12.5.4.1 Delayed Construction Projects to Restrain Demand

12.5.5 Rest of Middle East & Africa

12.6 South America

12.6.1 Brazil

12.6.1.1 High Adoption of Porcelain Tiles and Recovery of Construction Industry to Fuel Market Growth

12.6.2 Argentina

12.6.2.1 Rising Public-Private Partnerships in Construction Industry to Drive Demand

12.6.3 Rest of South America

12.2 Asia-Pacific

12.2.1 China

12.2.1.1 Expanding Construction Industry to Drive Demand

12.2.2 India

12.2.2.1 Government-Led Initiatives to Promote Sanitation and Infrastructure Development to Fuel Demand

12.2.3 Japan

12.2.3.1 Government Initiatives and Private Investments to Revitalize Construction Industry to Drive Demand

12.2.4 Vietnam

12.2.4.1 Easy Availability of Raw Materials to Drive Market

12.2.5 Thailand

12.2.5.1 Economic Stability and Increasing Residential Construction to Fuel Demand

12.2.6 Indonesia

12.2.6.1 High Growth of Construction Industry to Propel Market

12.2.7 Rest of Asia-Pacific

12.3 Europe

12.3.1 Germany

12.3.1.1 Rise in Non-Residential Construction to Drive Demand

12.3.2 UK

12.3.2.1 Decline in Residential and Non-Residential Construction Projects to Hamper Demand

12.3.3 France

12.3.3.1 Bleak Prospects for Market Growth due to Housing Crisis

12.3.4 Russia

12.3.4.1 Growing Construction Industry to Drive Market

12.3.5 Spain

12.3.5.1 High Export of Ceramic Tiles to Fuel Market Growth

12.3.6 Italy

12.3.6.1 Increase in New Non-Residential Surface Construction to Fuel Market Growth

12.3.7 Rest of Europe

12.4 North America

12.4.1 US

12.4.1.1 High Infrastructure Development and Technological Advancements to Drive Market

12.4.2 Canada

12.4.2.1 Rising Spending on Residential and Non-Residential Construction Activities to Fuel Demand

12.4.3 Mexico

12.4.3.1 Slow Growth of Construction Industry due to Slow Economic Recovery to Hamper Market Growth

12.5 Middle East & Africa

12.5.1 GCC Countries

12.5.1.1 UAE

12.5.1.1.1 Rise in Construction Activities to Drive Market

12.5.1.2 Saudi Arabia

12.5.1.2.1 Government-Led Initiatives for Infrastructure Development to Propel Market

12.5.1.3 Other GCC Countries

12.5.2 Turkey

12.5.2.1 Rising Use of Advanced Tile Production Technologies to Drive Market

12.5.3 Egypt

12.5.3.1 Increasing Investments in Reconstruction Activities to Drive Market

12.5.4 Iran

12.5.4.1 Delayed Construction Projects to Restrain Demand

12.5.5 Rest of Middle East & Africa

12.6 South America

12.6.1 Brazil

12.6.1.1 High Adoption of Porcelain Tiles and Recovery of Construction Industry to Fuel Market Growth

12.6.2 Argentina

12.6.2.1 Rising Public-Private Partnerships in Construction Industry to Drive Demand

12.6.3 Rest of South America

13 Competitive Landscape

13.1 Overview

13.2 Key Player Strategies

13.3 Market Share Analysis

13.4 Revenue Analysis

13.5 Company Valuation and Financial Metrics

13.6 Product/Brand Comparison

13.7 Company Evaluation Matrix: Key Players, 2024

13.7.1 Stars

13.7.2 Emerging Leaders

13.7.3 Pervasive Players

13.7.4 Participants

13.7.5 Company Footprint: Key Players, 2024

13.7.5.1 Company Footprint

13.7.5.2 Region Footprint

13.7.5.3 Type Footprint

13.7.5.4 Application Footprint

13.7.5.5 End-use Sector Footprint

13.7.5.6 Finish Footprint

13.7.5.7 Construction Type Footprint

13.8 Company Evaluation Matrix: Startups/SMEs, 2024

13.8.1 Progressive Companies

13.8.2 Responsive Companies

13.8.3 Dynamic Companies

13.8.4 Starting Blocks

13.8.5 Competitive Benchmarking: Key Startup/SMEs, 2024

13.8.5.1 Detailed List of Key Startups/SMEs

13.8.5.2 Competitive Benchmarking of Startups/SMEs

13.9 Competitive Scenarios and Trends

13.9.1 Product Launches

13.9.2 Deals

13.9.3 Expansions

13.9.4 Other Developments

13.2 Key Player Strategies

13.3 Market Share Analysis

13.4 Revenue Analysis

13.5 Company Valuation and Financial Metrics

13.6 Product/Brand Comparison

13.7 Company Evaluation Matrix: Key Players, 2024

13.7.1 Stars

13.7.2 Emerging Leaders

13.7.3 Pervasive Players

13.7.4 Participants

13.7.5 Company Footprint: Key Players, 2024

13.7.5.1 Company Footprint

13.7.5.2 Region Footprint

13.7.5.3 Type Footprint

13.7.5.4 Application Footprint

13.7.5.5 End-use Sector Footprint

13.7.5.6 Finish Footprint

13.7.5.7 Construction Type Footprint

13.8 Company Evaluation Matrix: Startups/SMEs, 2024

13.8.1 Progressive Companies

13.8.2 Responsive Companies

13.8.3 Dynamic Companies

13.8.4 Starting Blocks

13.8.5 Competitive Benchmarking: Key Startup/SMEs, 2024

13.8.5.1 Detailed List of Key Startups/SMEs

13.8.5.2 Competitive Benchmarking of Startups/SMEs

13.9 Competitive Scenarios and Trends

13.9.1 Product Launches

13.9.2 Deals

13.9.3 Expansions

13.9.4 Other Developments

14 Company Profiles

14.1 Key Players

14.1.1 Mohawk Industries, Inc.

14.1.1.1 Business Overview

14.1.1.2 Products/Solutions/Services Offered

14.1.1.3 Recent Developments

14.1.1.3.1 Product Launches

14.1.1.3.2 Deals

14.1.1.3.3 Expansions

14.1.1.3.4 Other Developments

14.1.1.4 Analyst's View

14.1.1.4.1 Right to Win

14.1.1.4.2 Strategic Choices

14.1.1.4.3 Weaknesses & Competitive Threats

14.1.2 Grupo Lamosa

14.1.2.1 Business Overview

14.1.2.2 Products/Solutions/Services Offered

14.1.2.3 Recent Developments

14.1.2.3.1 Deals

14.1.2.4 Analyst's View

14.1.2.4.1 Right to Win

14.1.2.4.2 Strategic Choices

14.1.2.4.3 Weaknesses & Competitive Threats

14.1.3 Rak Ceramics

14.1.3.1 Business Overview

14.1.3.2 Products/Solutions/Services Offered

14.1.3.3 Recent Developments

14.1.3.3.1 Product Launches

14.1.3.3.2 Deals

14.1.3.3.3 Expansions

14.1.3.3.4 Other Developments

14.1.3.4 Analyst's View

14.1.3.4.1 Right to Win

14.1.3.4.2 Strategic Choices

14.1.3.4.3 Weaknesses & Competitive Threats

14.1.4 Siam Cement Public Company Limited

14.1.4.1 Business Overview

14.1.4.2 Products/Solutions/Services Offered

14.1.4.3 Brands Offered

14.1.4.4 Recent Developments

14.1.4.5 Expansions

14.1.4.6 Analyst's View

14.1.4.6.1 Right to Win

14.1.4.6.2 Strategic Choices

14.1.4.6.3 Weaknesses & Competitive Threats

14.1.5 Prism Johnson Limited

14.1.5.1 Business Overview

14.1.5.2 Products/Solutions/Services Offered

14.1.5.3 Recent Developments

14.1.5.3.1 Expansions

14.1.5.4 Analyst's View

14.1.5.4.1 Right to Win

14.1.5.4.2 Strategic Choices

14.1.5.4.3 Weaknesses & Competitive Threats

14.1.6 Kajaria Ceramics

14.1.6.1 Business Overview

14.1.6.2 Products/Solutions/Services Offered

14.1.6.3 Recent Developments

14.1.6.3.1 Product Launches

14.1.6.3.2 Expansions

14.1.6.4 Analyst's View

14.1.6.4.1 Right to Win

14.1.6.4.2 Strategic Choices

14.1.6.4.3 Weaknesses & Competitive Threats

14.1.7 Pamesa Ceramica

14.1.7.1 Business Overview

14.1.7.2 Products/Solutions/Services Offered

14.1.7.3 Recent Developments

14.1.7.3.1 Deals

14.1.7.4 Expansions

14.1.7.5 Analyst's View

14.1.8 Somany Ceramics Limited

14.1.8.1 Business Overview

14.1.8.2 Products/Solutions/Services Offered

14.1.8.3 Recent Developments

14.1.8.3.1 Product Launches

14.1.8.3.2 Expansions

14.1.8.4 Analyst's View

14.1.9 Ceramica Carmelo Fior

14.1.9.1 Business Overview

14.1.9.2 Products/Solutions/Services Offered

14.1.9.3 Recent Developments

14.1.9.3.1 Product Launches

14.1.9.3.2 Expansions

14.1.9.4 Analyst's View

14.1.10 Cedasa Group

14.1.10.1 Business Overview

14.1.10.2 Products/Solutions/Services Offered

14.1.10.3 Recent Developments

14.1.10.3.1 Product Launches

14.1.10.4 Analyst's View

14.1.11 Asian Granito India Ltd. (Agl)

14.1.11.1 Business Overview

14.1.11.2 Products/Solutions/Services Offered

14.1.11.3 Recent Developments

14.1.11.3.1 Product Launches

14.1.11.3.2 Deals

14.1.11.3.3 Expansions

14.1.11.4 Analyst's View

14.2 Other Players

14.2.1 Stn Ceramica

14.2.2 Pt Arwana Citramulia Tbk

14.2.3 Cersanit SA

14.2.4 Lasselsberger Group GmbH

14.2.5 Nitco

14.2.6 White Horse Ceramic Industries Sdn Bhd

14.2.7 Ceramic Industries Limited

14.2.8 Kale Group

14.2.9 Elizabeth Group

14.2.10 Saudi Ceramics

14.2.11 Interceramic

14.2.12 Victoria PLC

14.2.13 Halcon Ceramicas

14.2.14 Portobello SA

14.2.15 Viglacera Corporation

14.3 Startups/Technology Providers

14.3.1 Tiles Wale

14.3.2 Kore Italia

14.3.3 Sacmi Group

14.1.1 Mohawk Industries, Inc.

14.1.1.1 Business Overview

14.1.1.2 Products/Solutions/Services Offered

14.1.1.3 Recent Developments

14.1.1.3.1 Product Launches

14.1.1.3.2 Deals

14.1.1.3.3 Expansions

14.1.1.3.4 Other Developments

14.1.1.4 Analyst's View

14.1.1.4.1 Right to Win

14.1.1.4.2 Strategic Choices

14.1.1.4.3 Weaknesses & Competitive Threats

14.1.2 Grupo Lamosa

14.1.2.1 Business Overview

14.1.2.2 Products/Solutions/Services Offered

14.1.2.3 Recent Developments

14.1.2.3.1 Deals

14.1.2.4 Analyst's View

14.1.2.4.1 Right to Win

14.1.2.4.2 Strategic Choices

14.1.2.4.3 Weaknesses & Competitive Threats

14.1.3 Rak Ceramics

14.1.3.1 Business Overview

14.1.3.2 Products/Solutions/Services Offered

14.1.3.3 Recent Developments

14.1.3.3.1 Product Launches

14.1.3.3.2 Deals

14.1.3.3.3 Expansions

14.1.3.3.4 Other Developments

14.1.3.4 Analyst's View

14.1.3.4.1 Right to Win

14.1.3.4.2 Strategic Choices

14.1.3.4.3 Weaknesses & Competitive Threats

14.1.4 Siam Cement Public Company Limited

14.1.4.1 Business Overview

14.1.4.2 Products/Solutions/Services Offered

14.1.4.3 Brands Offered

14.1.4.4 Recent Developments

14.1.4.5 Expansions

14.1.4.6 Analyst's View

14.1.4.6.1 Right to Win

14.1.4.6.2 Strategic Choices

14.1.4.6.3 Weaknesses & Competitive Threats

14.1.5 Prism Johnson Limited

14.1.5.1 Business Overview

14.1.5.2 Products/Solutions/Services Offered

14.1.5.3 Recent Developments

14.1.5.3.1 Expansions

14.1.5.4 Analyst's View

14.1.5.4.1 Right to Win

14.1.5.4.2 Strategic Choices

14.1.5.4.3 Weaknesses & Competitive Threats

14.1.6 Kajaria Ceramics

14.1.6.1 Business Overview

14.1.6.2 Products/Solutions/Services Offered

14.1.6.3 Recent Developments

14.1.6.3.1 Product Launches

14.1.6.3.2 Expansions

14.1.6.4 Analyst's View

14.1.6.4.1 Right to Win

14.1.6.4.2 Strategic Choices

14.1.6.4.3 Weaknesses & Competitive Threats

14.1.7 Pamesa Ceramica

14.1.7.1 Business Overview

14.1.7.2 Products/Solutions/Services Offered

14.1.7.3 Recent Developments

14.1.7.3.1 Deals

14.1.7.4 Expansions

14.1.7.5 Analyst's View

14.1.8 Somany Ceramics Limited

14.1.8.1 Business Overview

14.1.8.2 Products/Solutions/Services Offered

14.1.8.3 Recent Developments

14.1.8.3.1 Product Launches

14.1.8.3.2 Expansions

14.1.8.4 Analyst's View

14.1.9 Ceramica Carmelo Fior

14.1.9.1 Business Overview

14.1.9.2 Products/Solutions/Services Offered

14.1.9.3 Recent Developments

14.1.9.3.1 Product Launches

14.1.9.3.2 Expansions

14.1.9.4 Analyst's View

14.1.10 Cedasa Group

14.1.10.1 Business Overview

14.1.10.2 Products/Solutions/Services Offered

14.1.10.3 Recent Developments

14.1.10.3.1 Product Launches

14.1.10.4 Analyst's View

14.1.11 Asian Granito India Ltd. (Agl)

14.1.11.1 Business Overview

14.1.11.2 Products/Solutions/Services Offered

14.1.11.3 Recent Developments

14.1.11.3.1 Product Launches

14.1.11.3.2 Deals

14.1.11.3.3 Expansions

14.1.11.4 Analyst's View

14.2 Other Players

14.2.1 Stn Ceramica

14.2.2 Pt Arwana Citramulia Tbk

14.2.3 Cersanit SA

14.2.4 Lasselsberger Group GmbH

14.2.5 Nitco

14.2.6 White Horse Ceramic Industries Sdn Bhd

14.2.7 Ceramic Industries Limited

14.2.8 Kale Group

14.2.9 Elizabeth Group

14.2.10 Saudi Ceramics

14.2.11 Interceramic

14.2.12 Victoria PLC

14.2.13 Halcon Ceramicas

14.2.14 Portobello SA

14.2.15 Viglacera Corporation

14.3 Startups/Technology Providers

14.3.1 Tiles Wale

14.3.2 Kore Italia

14.3.3 Sacmi Group

15 Adjacent & Related Market

15.1 Introduction

15.2 Luxury Vinyl Tiles Market

15.2.1 Market Definition

15.2.2 Market Overview

15.2.3 Luxury Vinyl Tiles Market, by Type

15.3 Luxury Vinyl Tiles Market, by End-use Sector

15.4 Luxury Vinyl Tiles Market, by Distribution Channel

15.5 Luxury Vinyl Tiles Market, by Product Type

15.5.1 Luxury Vinyl Tiles Market, by Region

15.2 Luxury Vinyl Tiles Market

15.2.1 Market Definition

15.2.2 Market Overview

15.2.3 Luxury Vinyl Tiles Market, by Type

15.3 Luxury Vinyl Tiles Market, by End-use Sector

15.4 Luxury Vinyl Tiles Market, by Distribution Channel

15.5 Luxury Vinyl Tiles Market, by Product Type

15.5.1 Luxury Vinyl Tiles Market, by Region

16 Appendix

16.1 Discussion Guide

16.2 Knowledgestore: The Subscription Portal

16.3 Customization Options

16.2 Knowledgestore: The Subscription Portal

16.3 Customization Options

List of Tables

Table 1 Ceramic Tiles Market: Inclusions and Exclusions

Table 2 Average Selling Price of Ceramic Tiles Offered by Key Players, by Type, 2024 (USD/Square Meter)

Table 3 Average Selling Price Trend of Ceramic Tiles, by Region, 2021-2024 (USD/Square Meter)

Table 4 Roles of Companies in Ceramic Tiles Ecosystem

Table 5 Ceramic Tiles: Key Patents

Table 6 Export Data Related to HS Code 6904-Compliant Products, by Country, 2020-2024 (USD Million)

Table 7 Import Data Related to HS Code 6904-Compliant Products, by Country, 2020-2024 (USD Million)

Table 8 Export Data Related to HS Code 6907-Compliant Products, by Country, 2020-2024 (USD Million)

Table 9 Import Data Related to HS Code 6907-Compliant Products, by Country, 2020-2024 (USD Million)

Table 10 Ceramic Tiles Market: Key Conferences and Events, 2025-2026

Table 11 Tariff Related to HS Code 6907

Table 12 North America: Regulatory Bodies, Government Agencies, and Other Organizations

Table 13 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

Table 14 Asia-Pacific: Regulatory Bodies, Government Agencies, and Other Organizations

Table 15 Middle East & Africa: Regulatory Bodies, Government Agencies, and Other Organizations

Table 16 Specifications Related to Ceramic Tiles

Table 17 Ceramic Tiles Market: Porter's Five Forces Analysis

Table 18 Influence of Stakeholders on Buying Process, by End-use Sector

Table 19 Key Buying Criteria for Ceramic Tiles in End-use Sectors

Table 20 World GDP Growth Projection, 2021-2028 (USD Trillion)

Table 21 Industry (Including Construction), Value Added (% of GDP)

Table 22 Ceramic Tiles Market, by Application, 2021-2023 (USD Million)

Table 23 Ceramic Tiles Market, by Application, 2024-2030 (USD Million)

Table 24 Ceramic Tiles Market, by Application, 2021-2023 (Million Square Meter)

Table 25 Ceramic Tiles Market, by Application, 2024-2030 (Million Square Meter)

Table 26 Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 27 Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 28 Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 29 Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 30 Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 31 Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 32 Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 33 Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 34 Ceramic Tiles Market, by Region, 2021-2023 (USD Million)

Table 35 Ceramic Tiles Market, by Region, 2024-2030 (USD Million)

Table 36 Ceramic Tiles Market, by Region, 2021-2023 (Million Square Meter)

Table 37 Ceramic Tiles Market, by Region, 2024-2030 (Million Square Meter)

Table 38 Asia-Pacific: Ceramic Tiles Market, by Country, 2021-2023 (USD Million)

Table 39 Asia-Pacific: Ceramic Tiles Market, by Country, 2021-2023 (Million Square Meter)

Table 40 Asia-Pacific: Ceramic Tiles Market, by Country, 2024-2030 (USD Million)

Table 41 Asia-Pacific: Ceramic Tiles Market, by Country, 2024-2030 (Million Square Meter)

Table 42 Asia-Pacific: Ceramic Tiles Market, by Application, 2021-2023 (USD Million)

Table 43 Asia-Pacific: Ceramic Tiles Market, by Application, 2021-2023 (Million Square Meter)

Table 44 Asia-Pacific: Ceramic Tiles Market, by Application, 2024-2030 (USD Million)

Table 45 Asia-Pacific: Ceramic Tiles Market, by Application, 2024-2030 (Million Square Meter)

Table 46 Asia-Pacific: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 47 Asia-Pacific: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 48 Asia-Pacific: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 49 Asia-Pacific: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 50 Asia-Pacific: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 51 Asia-Pacific: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 52 Asia-Pacific: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 53 Asia-Pacific: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 54 China: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 55 China: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 56 China: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 57 China: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 58 China: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 59 China: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 60 China: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 61 China: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 62 India: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 63 India: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 64 India: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 65 India: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 66 India: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 67 India: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 68 India: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 69 India: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 70 Japan: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 71 Japan: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 72 Japan: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 73 Japan: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 74 Japan: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 75 Japan: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 76 Japan: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 77 Japan: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 78 Vietnam: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 79 Vietnam: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 80 Vietnam: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 81 Vietnam: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 82 Vietnam: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 83 Vietnam: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 84 Vietnam: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 85 Vietnam: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 86 Thailand: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 87 Thailand: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 88 Thailand: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 89 Thailand: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 90 Thailand: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 91 Thailand: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 92 Thailand: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 93 Thailand: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 94 Indonesia: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 95 Indonesia: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 96 Indonesia: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 97 Indonesia: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 98 Indonesia: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 99 Indonesia: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 100 Indonesia: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 101 Indonesia: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 102 Rest of Asia-Pacific: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 103 Rest of Asia-Pacific: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 104 Rest of Asia-Pacific: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 105 Rest of Asia-Pacific: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 106 Rest of Asia-Pacific: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 107 Rest of Asia-Pacific: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 108 Rest of Asia-Pacific: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 109 Rest of Asia-Pacific: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 110 Europe: Ceramic Tiles Market, by Country, 2021-2023 (USD Million)

Table 111 Europe: Ceramic Tiles Market, by Country, 2021-2023 (Million Square Meter)

Table 112 Europe: Ceramic Tiles Market, by Country, 2024-2030 (USD Million)

Table 113 Europe: Ceramic Tiles Market, by Country, 2024-2030 (Million Square Meter)

Table 114 Europe: Ceramic Tiles Market, by Application, 2021-2023 (USD Million)

Table 115 Europe: Ceramic Tiles Market, by Application, 2021-2023 (Million Square Meter)

Table 116 Europe: Ceramic Tiles Market, by Application, 2024-2030 (USD Million)

Table 117 Europe: Ceramic Tiles Market, by Application, 2024-2030 (Million Square Meter)

Table 118 Europe: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 119 Europe: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 120 Europe: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 121 Europe: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 122 Europe: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 123 Europe: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 124 Europe: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 125 Europe: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 126 Germany: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 127 Germany: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 128 Germany: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 129 Germany: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 130 Germany: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 131 Germany: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 132 Germany: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 133 Germany: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 134 UK: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 135 UK: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 136 UK: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 137 UK: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 138 UK: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 139 UK: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 140 UK: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 141 UK: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 142 France: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 143 France: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 144 France: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 145 France: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 146 France: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 147 France: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 148 France: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 149 France: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 150 Russia: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 151 Russia: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 152 Russia: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 153 Russia: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 154 Russia: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 155 Russia: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 156 Russia: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 157 Russia: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 158 Spain: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 159 Spain: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 160 Spain: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 161 Spain: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 162 Spain: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 163 Spain: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 164 Spain: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 165 Spain: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 166 Italy: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 167 Italy: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 168 Italy: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 169 Italy: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 170 Italy: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 171 Italy: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 172 Italy: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 173 Italy: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 174 Rest of Europe: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 175 Rest of Europe: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 176 Rest of Europe: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 177 Rest of Europe: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 178 Rest of Europe: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 179 Rest of Europe: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 180 Rest of Europe: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 181 Rest of Europe: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 182 North America: Ceramic Tiles Market, by Country, 2021-2023 (USD Million)

Table 183 North America: Ceramic Tiles Market, by Country, 2021-2023 (Million Square Meter)

Table 184 North America: Ceramic Tiles Market, by Country, 2024-2030 (USD Million)

Table 185 North America: Ceramic Tiles Market, by Country, 2024-2030 (Million Square Meter)

Table 186 North America: Ceramic Tiles Market, by Application, 2021-2023 (USD Million)

Table 187 North America: Ceramic Tiles Market, by Application, 2021-2023 (Million Square Meter)

Table 188 North America: Ceramic Tiles Market, by Application, 2024-2030 (USD Million)

Table 189 North America: Ceramic Tiles Market, by Application, 2024-2030 (Million Square Meter)

Table 190 North America: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 191 North America: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 192 North America: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 193 North America: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 194 North America: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 195 North America: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 196 North America: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 197 North America: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 198 US: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 199 US: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 200 US: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 201 US: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 202 US: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 203 US: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 204 US: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 205 US: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 206 Canada: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 207 Canada: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 208 Canada: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 209 Canada: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 210 Canada: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 211 Canada: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 212 Canada: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 213 Canada: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 214 Mexico: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 215 Mexico: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 216 Mexico: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 217 Mexico: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 218 Mexico: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 219 Mexico: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 220 Mexico: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 221 Mexico: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 222 Middle East & Africa: Ceramic Tiles Market, by Country, 2021-2023 (USD Million)

Table 223 Middle East & Africa: Ceramic Tiles Market, by Country, 2021-2023 (Million Square Meter)

Table 224 Middle East & Africa: Ceramic Tiles Market, by Country, 2024-2030 (USD Million)

Table 225 Middle East & Africa: Ceramic Tiles Market, by Country, 2024-2030 (Million Square Meter)

Table 226 Middle East & Africa: Ceramic Tiles Market, by Application, 2021-2023 (USD Million)

Table 227 Middle East & Africa: Ceramic Tiles Market, by Application, 2021-2023 (Million Square Meter)

Table 228 Middle East & Africa: Ceramic Tiles Market, by Application, 2024-2030 (USD Million)

Table 229 Middle East & Africa: Ceramic Tiles Market, by Application, 2024-2030 (Million Square Meter)

Table 230 Middle East & Africa: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 231 Middle East & Africa: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 232 Middle East & Africa: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 233 Middle East & Africa: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 234 Middle East & Africa: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 235 Middle East & Africa: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 236 Middle East & Africa: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 237 Middle East & Africa: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 238 GCC Countries: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 239 GCC Countries: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 240 GCC Countries: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 241 GCC Countries: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 242 GCC Countries: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 243 GCC Countries: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 244 GCC Countries: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 245 GCC Countries: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 246 UAE: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 247 UAE: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 248 UAE: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 249 UAE: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 250 UAE: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 251 UAE: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 252 UAE: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 253 UAE: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 254 Saudi Arabia: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 255 Saudi Arabia: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 256 Saudi Arabia: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 257 Saudi Arabia: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 258 Saudi Arabia: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 259 Saudi Arabia: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 260 Saudi Arabia: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 261 Saudi Arabia: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 262 Other GCC Countries: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 263 Other GCC Countries: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 264 Other GCC Countries: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 265 Other GCC Countries: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 266 Other GCC Countries: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 267 Other GCC Countries: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 268 Other GCC Countries: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 269 Other GCC Countries: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 270 Turkey: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 271 Turkey: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 272 Turkey: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 273 Turkey: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 274 Turkey: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 275 Turkey: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 276 Turkey: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 277 Turkey: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 278 Egypt: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 279 Egypt: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 280 Egypt: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 281 Egypt: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 282 Egypt: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 283 Egypt: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 284 Egypt: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 285 Egypt: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 286 Iran: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 287 Iran: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 288 Iran: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 289 Iran: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 290 Iran: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 291 Iran: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 292 Iran: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 293 Iran: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 294 Rest of Middle East & Africa: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 295 Rest of Middle East & Africa: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 296 Rest of Middle East & Africa: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 297 Rest of Middle East & Africa: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 298 Rest of Middle East & Africa: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 299 Rest of Middle East & Africa: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 300 Rest of Middle East & Africa: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 301 Rest of Middle East & Africa: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 302 South America: Ceramic Tiles Market, by Country, 2021-2023 (USD Million)

Table 303 South America: Ceramic Tiles Market, by Country, 2021-2023 (Million Square Meter)

Table 304 South America: Ceramic Tiles Market, by Country, 2024-2030 (USD Million)

Table 305 South America: Ceramic Tiles Market, by Country, 2024-2030 (Million Square Meter)

Table 306 South America: Ceramic Tiles Market, by Application, 2021-2023 (USD Million)

Table 307 South America: Ceramic Tiles Market, by Application, 2021-2023 (Million Square Meter)

Table 308 South America: Ceramic Tiles Market, by Application, 2024-2030 (USD Million)

Table 309 South America: Ceramic Tiles Market, by Application, 2024-2030 (Million Square Meter)

Table 310 South America: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 311 South America: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 312 South America: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 313 South America: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 314 South America: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 315 South America: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 316 South America: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 317 South America: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 318 Brazil: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 319 Brazil: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 320 Brazil: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 321 Brazil: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 322 Brazil: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 323 Brazil: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 324 Brazil: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 325 Brazil: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 326 Argentina: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 327 Argentina: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 328 Argentina: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 329 Argentina: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 330 Argentina: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 331 Argentina: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 332 Argentina: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 333 Argentina: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 334 Rest of South America: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 335 Rest of South America: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 336 Rest of South America: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 337 Rest of South America: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 338 Rest of South America: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 339 Rest of South America: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 340 Rest of South America: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 341 Rest of South America: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 342 Ceramic Tiles Market: Overview of Major Strategies Adopted by Major Players, January 2020-June 2025

Table 343 Ceramic Tiles Market: Degree of Competition, 2024

Table 344 Ceramic Tiles Market: Region Footprint, 2024

Table 345 Ceramic Tiles Market: Type Footprint, 2024

Table 346 Ceramic Tiles Market: Application Footprint, 2024

Table 347 Ceramic Tiles Market: End-use Sector Footprint, 2024

Table 348 Ceramic Tiles Market: Finish Footprint, 2024

Table 349 Ceramic Tiles Market: Construction Type Footprint, 2024

Table 350 Ceramic Tiles Market: Detailed List of Key Startups/SMEs

Table 351 Ceramic Tiles Market: Competitive Benchmarking of Startups/SMEs

Table 352 Ceramic Tiles Market: Product Launches, January 2020-July 2025

Table 353 Ceramic Tiles Market: Deals, January 2020-July 2025

Table 354 Ceramic Tiles Market: Expansions January 2020-July 2025

Table 355 Ceramic Tiles Market: Other Developments January 2020-July 2025

Table 356 Mohawk Industries, Inc.: Company Overview

Table 357 Mohawk Industries, Inc.: Products/Solutions/Services Offered

Table 358 Mohawk Industries, Inc.: Product Launches, January 2020-July 2025

Table 359 Mohawk Industries, Inc.: Deals, January 2020-July 2025

Table 360 Mohawk Industries, Inc.: Expansions, January 2020-July 2025

Table 361 Mohawk Industries, Inc.: Other Developments, January 2020-July 2025

Table 362 Grupo Lamosa: Company Overview

Table 363 Grupo Lamosa: Products/Solutions/Services Offered

Table 364 Groupo Lamosa: Deals, January 2020-July 2025

Table 365 Rak Ceramics: Company Overview

Table 366 Rak Ceramics: Products/Solutions/Services Offered

Table 367 Rak Ceramics: Product Launches, January 2020-July 2025

Table 368 Rak Ceramics: Deals, January 2020-July 2025

Table 369 Rak Ceramics: Expansions, January 2020-July 2025

Table 370 Rak Ceramics: Other Developments, January 2020-July 2025

Table 371 Siam Cement Public Company Limited: Company Overview

Table 372 Siam Cement Public Company Limited: Products/Solutions/Services Offered

Table 373 Siam Cement Public Company Limited: Brands Offered

Table 374 Siam Cement Public Company Limited: Expansions, January 2020-June 2025

Table 375 Prism Johnson Limited: Company Overview

Table 376 Prism Johnson Limited: Products/Solutions/Services Offered

Table 377 Prism Johnson Limited: Expansions, January 2020-July 2025

Table 378 Kajaria Ceramics: Company Overview

Table 379 Kajaria Ceramics: Products/Solutions/Services Offered

Table 380 Kajaria Ceramics: Product Launches, January 2020-July 2025

Table 381 Kajaria Ceramics: Expansions, January 2020-July 2025

Table 382 Pamesa Ceramica: Company Overview

Table 383 Pamesa Ceramica: Products/Solutions/Services Offered

Table 384 Pamesa Ceramica: Deals, January 2020-July 2025

Table 385 Pamesa Ceramica: Expansions, January 2020-June 2025

Table 386 Somany Ceramics Limited: Company Overview

Table 387 Somany Ceramics Limited: Products/Solutions/Services Offered

Table 388 Somany Ceramics Limited: Product Launches, January 2020-July 2025

Table 389 Somany Ceramics Limited: Expansions, January 2020-July 2025

Table 390 Ceramica Carmelo Fior: Company Overview

Table 391 Ceramica Carmelo Fior: Products/Solutions/Services Offered

Table 392 Ceramica Carmelo Fior: Product Launches, January 2020-July 2025

Table 393 Ceramica Carmelo Fior: Expansions, January 2020-July 2025

Table 394 Cedasa Group: Company Overview

Table 395 Cedasa Group: Products/Solutions/Services Offered

Table 396 Cedasa Group: Product Launches, January 2020-July 2025

Table 397 Asian Granito India Ltd. (Agl): Company Overview

Table 398 Asian Granito India Ltd. (Agl): Products/Solutions/Services Offered

Table 399 Asian Granito India Ltd. (Agl): Product Launches, January 2020-July 2025

Table 400 Asian Granito India Ltd. (Agl): Deals, January 2020-July 2025

Table 401 Asian Granito India Ltd. (Agl): Expansions, January 2020-July 2025

Table 402 Stn Ceramica: Company Overview

Table 403 Pt Arwana Citramulia Tbk: Company Overview

Table 404 Cersanit SA: Company Overview

Table 405 The Lasselsberger Group: Company Overview

Table 406 Nitco: Company Overview

Table 407 White Horse Ceramic Industries Sdn Bhd: Company Overview

Table 408 Ceramic Industries Limited: Company Overview

Table 409 Kale Group: Company Overview

Table 410 Elizabeth Group: Company Overview

Table 411 Saudi Ceramics: Company Overview

Table 412 Interceramic: Company Overview

Table 413 Victoria PLC: Company Overview

Table 414 Halcon Ceramicas: Company Overview

Table 415 Portobello SA: Company Overview

Table 416 Viglacera Corporation: Company Overview

Table 417 Tiles Wale: Company Overview

Table 418 Kore Italia: Company Overview

Table 419 Sacmi Group: Company Overview

Table 420 Luxury Vinyl Tiles Market, by Type, 2020-2023 (USD Million)

Table 421 Luxury Vinyl Tiles Market, by Type, 2024-2030 (USD Million)

Table 422 Luxury Vinyl Tiles Market, by Type, 2020-2023 (Million Square Meter)

Table 423 Luxury Vinyl Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 424 Luxury Vinyl Tiles Market, by End-use Sector, 2020-2023 (USD Million)

Table 425 Luxury Vinyl Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 426 Luxury Vinyl Tiles Market, by End-use Sector, 2020-2023 (Million Square Meter)

Table 427 Luxury Vinyl Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 428 Luxury Vinyl Tiles Market, by Distribution Channel, 2020-2023 (USD Million)

Table 429 Luxury Vinyl Tiles Market, by Distribution Channel, 2024-2030 (USD Million)

Table 430 Luxury Vinyl Tiles Market, by Distribution Channel, 2020-2023 (Million Square Meter)

Table 431 Luxury Vinyl Tiles Market, by Distribution Channel, 2024-2030 (Million Square Meter)

Table 432 Luxury Vinyl Tiles Market, by Product Type, 2020-2023 (USD Million)

Table 433 Luxury Vinyl Tiles Market, by Product Type, 2024-2030 (USD Million)

Table 434 Luxury Vinyl Tiles Market, by Product Type, 2020-2023 (Million Square Meter)

Table 435 Luxury Vinyl Tiles Market, by Product Type, 2024-2030 (Million Square Meter)

Table 436 Luxury Vinyl Tiles Market, by Region, 2020-2023 (USD Million)

Table 437 Luxury Vinyl Tiles Market, by Region, 2024-2030 (USD Million)

Table 438 Luxury Vinyl Tiles Market, by Region, 2020-2023 (Million Square Meter)

Table 439 Luxury Vinyl Tiles Market, by Region 2024-2030 (Million Square Meter)

Table 2 Average Selling Price of Ceramic Tiles Offered by Key Players, by Type, 2024 (USD/Square Meter)

Table 3 Average Selling Price Trend of Ceramic Tiles, by Region, 2021-2024 (USD/Square Meter)

Table 4 Roles of Companies in Ceramic Tiles Ecosystem

Table 5 Ceramic Tiles: Key Patents

Table 6 Export Data Related to HS Code 6904-Compliant Products, by Country, 2020-2024 (USD Million)

Table 7 Import Data Related to HS Code 6904-Compliant Products, by Country, 2020-2024 (USD Million)

Table 8 Export Data Related to HS Code 6907-Compliant Products, by Country, 2020-2024 (USD Million)

Table 9 Import Data Related to HS Code 6907-Compliant Products, by Country, 2020-2024 (USD Million)

Table 10 Ceramic Tiles Market: Key Conferences and Events, 2025-2026

Table 11 Tariff Related to HS Code 6907

Table 12 North America: Regulatory Bodies, Government Agencies, and Other Organizations

Table 13 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

Table 14 Asia-Pacific: Regulatory Bodies, Government Agencies, and Other Organizations

Table 15 Middle East & Africa: Regulatory Bodies, Government Agencies, and Other Organizations

Table 16 Specifications Related to Ceramic Tiles

Table 17 Ceramic Tiles Market: Porter's Five Forces Analysis

Table 18 Influence of Stakeholders on Buying Process, by End-use Sector

Table 19 Key Buying Criteria for Ceramic Tiles in End-use Sectors

Table 20 World GDP Growth Projection, 2021-2028 (USD Trillion)

Table 21 Industry (Including Construction), Value Added (% of GDP)

Table 22 Ceramic Tiles Market, by Application, 2021-2023 (USD Million)

Table 23 Ceramic Tiles Market, by Application, 2024-2030 (USD Million)

Table 24 Ceramic Tiles Market, by Application, 2021-2023 (Million Square Meter)

Table 25 Ceramic Tiles Market, by Application, 2024-2030 (Million Square Meter)

Table 26 Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 27 Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 28 Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 29 Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 30 Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 31 Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 32 Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 33 Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 34 Ceramic Tiles Market, by Region, 2021-2023 (USD Million)

Table 35 Ceramic Tiles Market, by Region, 2024-2030 (USD Million)

Table 36 Ceramic Tiles Market, by Region, 2021-2023 (Million Square Meter)

Table 37 Ceramic Tiles Market, by Region, 2024-2030 (Million Square Meter)

Table 38 Asia-Pacific: Ceramic Tiles Market, by Country, 2021-2023 (USD Million)

Table 39 Asia-Pacific: Ceramic Tiles Market, by Country, 2021-2023 (Million Square Meter)

Table 40 Asia-Pacific: Ceramic Tiles Market, by Country, 2024-2030 (USD Million)

Table 41 Asia-Pacific: Ceramic Tiles Market, by Country, 2024-2030 (Million Square Meter)

Table 42 Asia-Pacific: Ceramic Tiles Market, by Application, 2021-2023 (USD Million)

Table 43 Asia-Pacific: Ceramic Tiles Market, by Application, 2021-2023 (Million Square Meter)

Table 44 Asia-Pacific: Ceramic Tiles Market, by Application, 2024-2030 (USD Million)

Table 45 Asia-Pacific: Ceramic Tiles Market, by Application, 2024-2030 (Million Square Meter)

Table 46 Asia-Pacific: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 47 Asia-Pacific: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 48 Asia-Pacific: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 49 Asia-Pacific: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 50 Asia-Pacific: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 51 Asia-Pacific: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 52 Asia-Pacific: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 53 Asia-Pacific: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 54 China: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 55 China: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 56 China: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 57 China: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 58 China: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 59 China: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 60 China: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 61 China: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 62 India: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 63 India: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 64 India: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 65 India: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 66 India: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 67 India: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 68 India: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 69 India: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 70 Japan: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 71 Japan: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 72 Japan: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 73 Japan: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 74 Japan: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 75 Japan: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 76 Japan: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 77 Japan: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 78 Vietnam: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 79 Vietnam: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 80 Vietnam: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 81 Vietnam: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 82 Vietnam: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 83 Vietnam: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 84 Vietnam: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 85 Vietnam: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 86 Thailand: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 87 Thailand: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)

Table 88 Thailand: Ceramic Tiles Market, by Type, 2024-2030 (USD Million)

Table 89 Thailand: Ceramic Tiles Market, by Type, 2024-2030 (Million Square Meter)

Table 90 Thailand: Ceramic Tiles Market, by End-use Sector, 2021-2023 (USD Million)

Table 91 Thailand: Ceramic Tiles Market, by End-use Sector, 2021-2023 (Million Square Meter)

Table 92 Thailand: Ceramic Tiles Market, by End-use Sector, 2024-2030 (USD Million)

Table 93 Thailand: Ceramic Tiles Market, by End-use Sector, 2024-2030 (Million Square Meter)

Table 94 Indonesia: Ceramic Tiles Market, by Type, 2021-2023 (USD Million)

Table 95 Indonesia: Ceramic Tiles Market, by Type, 2021-2023 (Million Square Meter)