In addition, WHO data suggests, in China, there are approximately 270 million individuals suffering from hypertension, but merely 13.8% of these patients have successfully managed their condition. The rise in lifestyle-related diseases, such as obesity and diabetes, further exacerbates this issue, prompting healthcare providers and patients alike to seek reliable blood pressure management tools. Government initiatives aimed at improving public health infrastructure and promoting preventive healthcare measures contribute to the growing adoption of these devices.

Technological advancements in blood pressure monitoring devices also play a crucial role in driving market growth. Innovations such as wireless connectivity, smartphone integration, and advanced algorithms for accurate readings enhance user experience and facilitate remote patient monitoring. In February 2024, Hanvon Technology Co., Ltd. introduced the first-ever smart electronic blood pressure (BP) meter globally, employing the Korotkoff sound method. This innovative device combines cutting-edge sensor technology with artificial intelligence algorithms to surpass the accuracy limitations of conventional electronic BP meters, matching the precision of mercury sphygmomanometers. These features are particularly appealing in urban areas where busy lifestyles make regular clinic visits challenging. The increasing acceptance of telemedicine has accelerated the demand for home-based monitoring solutions, allowing patients to manage their health more effectively while reducing the burden on healthcare facilities. As a result, both consumer preferences and technological progress are shaping the landscape of blood pressure monitoring devices in China.

China Blood Pressure Monitoring Devices Market Report Highlights

- Based on product, the automated/digital blood pressure monitor segment held the largest share, over 44%, in 2023, due to heightened awareness among consumers regarding health monitoring and ease of using the devices, driving demand for automated blood pressure monitors.

- Based on product, the ambulatory blood pressure monitor segment is expected to register the fastest CAGR of 16.9% over the forecast period due to the growing inclination to use ambulatory blood pressure monitoring in clinical settings to identify white-coat hypertension and variations in blood pressure during the night.

- Based on end use, the homecare segment dominated the market in 2023. It is driven by the increasing prevalence of hypertension among the aging population and the growing trend towards remote patient monitoring.

- Based on end use, the hospital segment is expected to grow at a significant rate over the forecast period. In hospitals, the rising demand for accurate and efficient patient monitoring systems and increased chronic disease management protocols drive the market for blood pressure monitoring devices.

- In April 2024, At the China International Medical Equipment Fair (CMEF) in Shanghai, AI-powered devices, particularly blood pressure monitors, were a highlight, showcasing the synergy between technology and healthcare. The exhibition, a hub for medical technology and innovation, opened its doors at the National Exhibition and Convention Center.

The leading players in the China Blood Pressure Monitoring Devices market include:

- Omron Healthcare

- A&D Medical

- Beurer GmbH

- Xiaomi

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shenzhen Hingmed Instrument Co., Ltd

- CONTEC Medical Systems Co., Ltd.

- Yuwell

- Zebex Industries

- Tianjin Huanan Medical Equipment Co., Ltd.

- Jiangsu KTK Health Technology Co., Ltd.

- Huaian Aiyou Medical Instrument Co., Ltd.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading players in the China Blood Pressure Monitoring Devices market include:- Omron Healthcare

- A&D Medical

- Beurer GmbH

- Xiaomi

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shenzhen Hingmed Instrument Co., Ltd

- CONTEC Medical Systems Co., Ltd.

- Yuwell

- Zebex Industries

- Tianjin Huanan Medical Equipment Co., Ltd.

- Jiangsu KTK Health Technology Co., Ltd.

- Huaian Aiyou Medical Instrument Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | September 2024 |

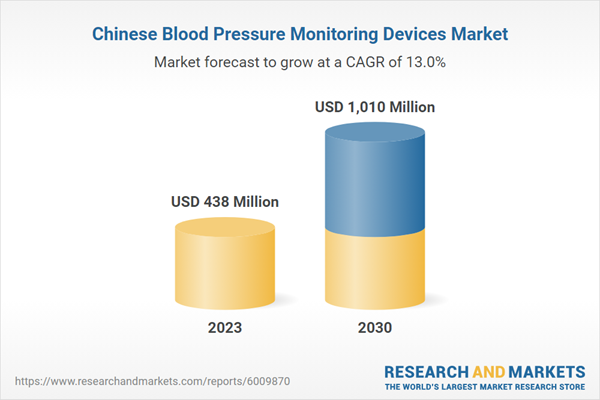

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 438 Million |

| Forecasted Market Value ( USD | $ 1010 Million |

| Compound Annual Growth Rate | 13.0% |

| Regions Covered | China |

| No. of Companies Mentioned | 13 |