The COVID-19 pandemic had a significant impact on the market in 2020. The adverse effects of the pandemic include supply chain bottlenecks, decreased sales & marketing initiatives, and dampened demand. However, pet ownership and expenditure continued to rise in the country during 2020. Even during the pandemic, online sales of the pet industry showed accelerated growth after an initial slump, as reported by China Daily. Key factors identified for this growth include increasing per capita GDP and pet humanization. For instance, according to the World Bank estimates, per capita GDP in China, in 2020, was USD 10,500, notably greater than the per capita GDP of USD 8,066 in 2015 and USD 4,550 in 2010.

The rising pet population in China is a key factor driving the market growth. The RADII Media reported that in 2020, the popularity of cats as pets was growing rapidly across China. The main reason identified for this trend was cats being relatively low-maintenance pets as compared to pet dogs. As per the Shanghai United Media Group, the preference for exotic and other companion animals is increasing among the young population in the country. Key factors fueling this growth include certain pets needing less upkeep as compared to dogs or horses. For example, geckos or small mammals require much less space, energy, and time from the pet owner as compared to mainstream pets.

Increasing usage of online channels for purchasing pet products is anticipated to propel the market in the coming years. China Daily reported that in 2019, online sales of the pet industry crossed 30 billion Yuan, or about USD 4.3 billion. 70% of the total sales were accounted for by e-commerce giants, such as Tmall and Taobao, as reported at Pet Fair Asia 2020. Key market players leveraged this opportunity to strengthen their market presence. In February 2019, Boehringer Ingelheim, for instance, launched the first-of-its-kind flagship store by a multinational animal health company on Tmall for pet parasiticides. The store was launched to provide customers with a reliable and convenient online purchasing channel for the company’s full range of pet parasiticides.

China Companion Animal Health Market Report Highlights

- The companion animal medicine segment accounted for the highest share of the market in 2024 owing to the increased awareness about pet health and the high prevalence of diseases in pets

- Dogs represented the largest segment by animal type for both companion animal medicine as well as diagnostics markets in 2020

- By indication, non-infectious diseases dominated the China pet medicine as well as diagnostics markets in 2024

- The growth can be credited to the high awareness about animal health & diseases and increased pet expenditure & pet humanization

- Global trends, such as the One Health initiative, are expected to further propel awareness about animal health and boost the demand for medicines and diagnostics products for pets

- In June 2020, the World Bank Group approved a loan of USD 300 million to help strengthen select national and provincial systems in China to lower the risk of zoonoses and other emerging health threats as part of the Emerging Infectious Diseases Prevention, Preparedness and Response Project

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Boehringer Ingelheim International GmbH

- Elanco

- Merck & Co., Inc.

- Zoetis

- Ceva

- Virbac

- Bimeda, Inc.

- IDEXX Laboratories

- Thermo Fisher Scientific

- Randox Laboratories

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | January 2025 |

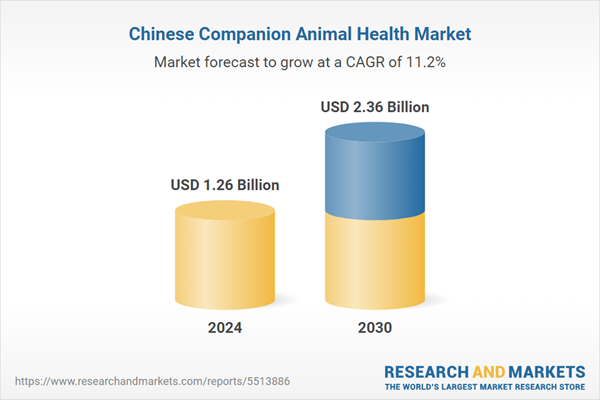

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.26 Billion |

| Forecasted Market Value ( USD | $ 2.36 Billion |

| Compound Annual Growth Rate | 11.2% |

| Regions Covered | China |

| No. of Companies Mentioned | 10 |