Speak directly to the analyst to clarify any post sales queries you may have.

A comprehensive primer that clarifies supply chain, formulation trade-offs, and consumer-driven imperatives shaping modern chocolate ingredient decisions

The chocolate ingredients sector sits at the intersection of culinary tradition, functional formulation, and intensifying consumer expectations. Ingredient suppliers, manufacturers, and product developers are contending with evolving preferences for ethical sourcing, clean-label formulations, and novel textures, while simultaneously responding to raw material volatility and shifting regulatory frameworks. This report opens with a contextual primer that synthesizes supply chain realities, ingredient innovation pathways, and demand-side drivers to equip commercial and technical leaders with a clear operating context.Throughout this introduction, emphasis is placed on the practical implications of ingredient choices for downstream processing, shelf life, sensory outcomes, and labeling requirements. The narrative links cocoa derivatives, milk powders, emulsifiers, and sweeteners to product development trade-offs, highlighting how formulation decisions create opportunities as well as constraints. By grounding subsequent chapters in these fundamentals, the introduction sets expectations for how stakeholders can use evidence-based strategies to manage cost, compliance, and consumer appeal in a competitive landscape.

How sustainability mandates, health-driven reformulation, and processing innovations are converging to reshape supply chains and product strategies across the chocolate ingredients ecosystem

Recent years have witnessed several transformative shifts that are reshaping how industry participants source, formulate, and market chocolate-based products. Sustainability credentials and certification programs have moved from niche differentiators to central procurement criteria, prompting manufacturers to trace ingredient provenance more rigorously and to integrate supplier verification practices into procurement contracts. Concurrently, convergence between health-and-wellness trends and indulgence positioning has spurred innovation in ingredient functionality, notably with reformulations aimed at reducing sugar, enhancing mouthfeel without palm oil, and improving protein content while retaining authentic chocolate sensory profiles.Operationally, processing technologies and ingredient formats are enabling more agile production runs and novel textural experiences, leading to closer collaboration between ingredient suppliers and product manufacturers. Regulatory updates and labeling expectations are introducing additional complexity, requiring revisited technical documentation and cross-border compliance strategies. Collectively, these shifts are prompting companies to realign sourcing strategies, invest in alternate ingredient development, and embed sustainability and transparency into brand narratives as core competitive levers.

Trade policy shifts in 2025 accelerated multi-sourcing, nearshoring considerations, and integrated procurement-R&D collaboration to mitigate tariff-driven supply chain exposures

Policy interventions and tariff adjustments can create ripple effects across sourcing, pricing negotiation strategies, and supplier diversification plans. In 2025, United States tariff measures affecting certain imported commodities and input categories prompted procurement teams to revisit long-standing supplier relationships and to accelerate contingency planning. These trade policy shifts increased the urgency of regional sourcing alternatives and compelled many firms to re-evaluate landed cost assumptions, contractual terms, and hedging mechanisms.As a result, several manufacturers prioritized vendor qualification programs that emphasize multi-sourcing and nearshoring, while ingredient distributors intensified efforts to secure buffer inventory and to offer flexible contract terms that mitigate tariff exposure. The tariff environment also catalyzed deeper engagement between procurement, finance, and R&D teams to reconcile commercial constraints with formulation feasibility. Importantly, the policy-driven dynamics highlighted the value of scenario planning and stress-testing supply chain continuity assumptions to sustain production continuity and protect brand commitments under changing trade conditions.

In-depth segmentation perspectives that illuminate functional demands, certification impacts, and buyer-specific technical requirements across ingredient types and applications

Segmentation lenses reveal nuanced opportunity spaces and operational challenges that differ across ingredient type, application, form, nature, and end use. When viewed through an ingredient type perspective, distinctions between cocoa butter, cocoa powder, emulsifier, milk powder, and sugar underscore divergent sourcing complexities, shelf stability characteristics, and functional roles in texture and flavor modulation. Application segmentation across bakery, beverages, confectionery, dairy, and ice cream illustrates how formulation constraints and processing conditions change the priority of certain ingredients, for example where emulsifier performance is paramount in confectionery but different rheological properties are prioritized in beverages.Form-based segmentation-granules, liquid, paste, and powder-highlights how handling, dosing accuracy, and solubility determine equipment investments and quality control protocols. A nature-based distinction between conventional and organic, with the organic segment further differentiated by Fair Trade and Rainforest Alliance credentials, emphasizes certification burdens and the growing commercial value of verifiable sustainability claims. Finally, end-use segmentation encompassing bakery manufacturers, beverage manufacturers, chocolate manufacturers, confectionery manufacturers, and dairy manufacturers draws attention to customer-specific technical specifications, co-development opportunities, and route-to-market strategies that ingredient suppliers must adapt to in order to capture long-term partnerships.

Regional dynamics and regulatory variations that dictate sourcing priorities, certification expectations, and product innovation approaches across global markets

Regional dynamics exert powerful influence over sourcing choices, regulatory compliance needs, and innovation pathways. In the Americas, proximity to major cocoa trading hubs and established dairy and sugar industries creates logistical advantages and diverse supplier ecosystems, while also exposing firms to commodity cycles and evolving sustainability scrutiny. Meanwhile, Europe, Middle East & Africa presents a complex regulatory mosaic with strong consumer demand for certified and ethically sourced ingredients, coupled with advanced food safety frameworks that influence formulation and labeling strategies.Asia-Pacific stands out for its dynamic consumption growth and rapid adoption of novel product formats, demanding agile ingredient solutions and scalable supply arrangements. Each region presents distinct channel structures, procurement practices, and regulatory expectations, which means that companies seeking to expand must tailor commercial models and technical support to local priorities. Strategic regional decision-making therefore requires integrated assessment of supply continuity risk, compliance intensity, and the pace of consumer-driven product innovation.

Competitive dynamics where traceability investments, technical partnership capabilities, and regional specialization determine supplier differentiation and commercial traction

The competitive environment is characterized by a blend of large ingredient conglomerates, specialized niche suppliers, and agile regional players that together shape pricing, innovation pathways, and service expectations. Leading ingredient providers are differentiating through investments in traceability, certification programs, and customized technical support that reduce development cycles for manufacturers. At the same time, smaller and regional companies are leveraging local raw material access and specialized process know-how to serve specific applications and to offer flexible commercial terms.Across company types, successful players are those that combine robust quality assurance systems with transparent sourcing narratives and responsive customer engagement models. Strategic partnerships between ingredient manufacturers and end users are becoming more commonplace, enabling co-innovation on texture, clean-label replacements, and shelf-life optimization. In this environment, suppliers that can demonstrate technical advisory capabilities alongside consistent supply performance are most likely to secure preferred-supplier status and deeper commercial collaboration.

Practical strategic actions for leaders to secure supply continuity, accelerate reformulation capabilities, and integrate sustainability into procurement and product roadmaps

Industry leaders must act decisively to translate macro trends into resilient commercial and operational plans. First, establish supplier diversification strategies that balance cost, quality, and certification imperatives, and couple those with rigorous vendor qualification and contingency playbooks to minimize single-source exposure. Next, invest in formulation capabilities and pilot-scale testing to accelerate product iterations that meet both indulgence and wellness-driven consumer expectations while keeping production feasibility front of mind.Additionally, prioritize traceability systems and third-party certification where relevant, aligning procurement and sustainability teams to create coherent supplier engagement and communication plans. Strengthen collaboration between procurement, R&D, and quality assurance to ensure pricing or sourcing changes do not inadvertently undermine product performance or compliance. Finally, adopt scenario-based planning to stress-test trade policy sensitivity and to inform contract structures that provide flexibility under shifting tariff or regulatory conditions.

A transparent, practitioner-informed methodology that combines documentary analysis, stakeholder interviews, and scenario validation to support actionable recommendations for ingredient stakeholders

The research underpinning this analysis synthesized industry literature, public regulatory releases, supplier documentation, and primary stakeholder interviews to create a robust evidence base. Qualitative interviews with procurement, R&D, and regulatory specialists informed insight on operational practice and decision criteria, while supplier technical notes and certification program requirements were mapped to identify compliance burdens and differentiation levers. Trade policy implications were assessed through scenario analysis and review of publicly available tariff schedules and customs guidance.Methodologically, the approach prioritized triangulation between documentary evidence and practitioner perspectives to surface actionable recommendations. Data quality controls included cross-verification of supplier claims against certification registries and reconciliation of technical specifications with standard processing parameters. Where assumptions were necessary, they were made explicit and stress-tested through sensitivity checks to ensure conclusions reflect plausible operational realities rather than single-source assertions.

Synthesis of strategic priorities emphasizing traceability, formulation agility, and cross-functional integration as determinants of sustained competitive advantage in the sector

The chocolate ingredient landscape is undergoing meaningful evolution driven by sustainability expectations, consumer preferences, and policy shifts. Success in this environment requires companies to align procurement, technical development, and sustainability agendas while maintaining operational flexibility to adapt to trade and supply uncertainties. Those who integrate traceability, certification, and close supplier collaboration into their commercial model will be better positioned to meet retailer and consumer demands while preserving formulation integrity.Moreover, proactive scenario planning and investment in formulation agility will enable manufacturers to capitalize on emerging product opportunities without compromising on quality or compliance. Ultimately, the ability to translate strategic insight into operational change-through supplier partnerships, technical capability building, and robust governance-will determine which companies achieve sustained advantage as the sector continues to evolve.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Chocolate Ingredients Market

Companies Mentioned

- Alfred Ritter GmbH & Co. KG

- Archer-Daniels-Midland Company

- Barry Callebaut AG

- Blommer Chocolate Company

- Bunge Limited

- Cargill, Incorporated

- Dr. August Oetker KG

- Ezaki Glico Co., Ltd.

- Fuji Oil Co., Ltd.

- Ingredion Incorporated

- Olam International Limited

- Puratos NV

- The Hershey Company

- Tootsie Roll Industries, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

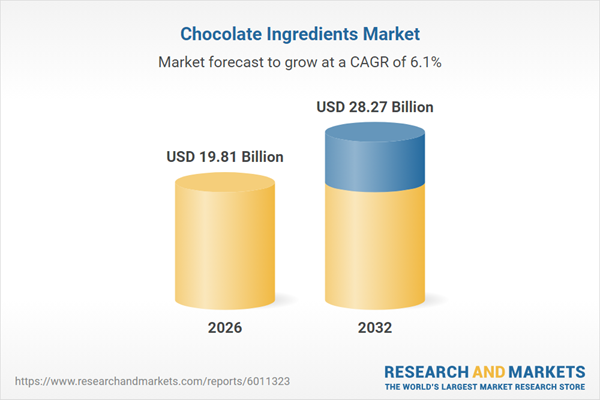

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 19.81 Billion |

| Forecasted Market Value ( USD | $ 28.27 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |