Speak directly to the analyst to clarify any post sales queries you may have.

A concise orientation to coiled tubing technology, material choices, and operational roles that sets the stage for strategic decision-making across drilling and intervention workflows

The coiled tubing sector stands at the intersection of technological refinement and operational necessity, delivering critical capability across drilling, well intervention, and workover activities. Over recent years, improvements in material science, intervention tooling, and surface control systems have broadened the role of coiled tubing from routine well maintenance to complex well construction and enhanced recovery campaigns. As a result, operators and service providers are re-evaluating asset strategies to balance lifecycle cost, operational flexibility, and safety demands.Importantly, the industry is characterized by a heterogeneous technology stack. Based on Type, the market is studied across electric, hydraulic, and mechanical variants, each presenting distinct advantages for different operational envelopes and depth regimes. Likewise, material choices carry long-term implications: based on Material, the market is studied across composite and steel, with composite options further differentiated into carbon fiber and fiberglass and steel choices split between alloy steel and carbon steel. These options influence fatigue performance, corrosion resistance, and transport economics.

Transitioning from legacy practices toward integrated well intervention planning requires cross-disciplinary coordination. Stakeholders increasingly prioritize interoperability between surface control equipment, downhole tools, and data analytics. This introduction establishes the foundation for the subsequent sections, which examine structural shifts, tariff implications, segmentation intelligence, regional dynamics, and actionable recommendations to guide executive-level decisions.

How material innovation, electrification, and digital integration are collectively redefining coiled tubing operations, procurement, and long-term asset strategies

The landscape for coiled tubing is transforming in multiple, interlocking ways that reshape capability expectations and procurement strategies. Advances in materials science are unlocking lighter, higher-strength options that change mobilization calculus and enable deeper or more complex interventions. Concurrently, the adoption of electric actuation and hybrid surface systems is expanding operational windows by improving control precision and reducing dependency on hydraulic infrastructure, which alters fleet composition and service offerings.Digitalization is another major axis of transformation. Real-time telemetry, predictive fatigue modeling, and integrated planning tools are converting coiled tubing operations from reactive service events into data-informed campaigns. Operators are using sensor fusion and analytics to anticipate tool life, optimize deployment profiles, and minimize non-productive time, thereby shifting value from raw equipment supply toward service intelligence.

Regulatory and commercial forces are also driving change. Health, safety, and environmental expectations have elevated the importance of materials and procedure selection, while commercial pressures incentivize modular solutions that reduce mobilization costs. Collectively, these shifts encourage a move toward systems thinking where materials, surface equipment, tooling, and analytics are procured and managed as interoperable assets rather than isolated components. As a result, success increasingly favors organizations that can integrate cross-functional capabilities and translate technical improvements into repeatable operational gains.

Assessing the supply chain resilience and procurement implications of 2025 tariff actions and how trade measures are reshaping sourcing, inventory, and contracts

The imposition of tariffs and related trade policy actions in 2025 introduces tangible friction into the supply chains that support coiled tubing manufacturing, distribution, and aftermarket services. Tariff measures raise the direct cost of imported raw materials and finished assemblies, compelling manufacturers and service providers to reassess sourcing strategies and supplier geographies. For many stakeholders, the immediate response is a re-evaluation of inventory strategies, with shorter lead times and near-term stockpiling used to mitigate supply interruptions.Over time, tariffs encourage an increased focus on localization and supplier diversification. Firms that maintain flexible production footprints and that can shift fabrication between plant sites will benefit from reduced exposure to border measures. For equipment that depends on specialized inputs-such as composite preforms, advanced adhesives, or proprietary downhole sensors-the impact is more nuanced; companies reliant on niche foreign suppliers may accelerate development of domestic substitutes or pursue strategic partnerships to secure continuity of supply.

Tariffs also reshape commercial negotiations and contract design. Operators and service providers may insert protective clauses around raw material price pass-throughs, lead times, and change-of-law provisions. Procurement teams will place a premium on transparency in supplier cost structures and will increasingly demand scenario-based pricing that accounts for trade-policy volatility. In the aggregate, tariffs do not change the fundamental technical drivers of coiled tubing adoption, but they do alter the economics of supply, prompting a realignment of sourcing, inventory, and contracting practices that favor resilience and geographic flexibility.

Segment-focused insights that link type, material, application, and end-use distinctions to engineering trade-offs and commercial positioning across diverse operational demands

A clear-eyed segmentation analysis reveals differentiated needs and performance expectations across types, materials, applications, and end uses-each axis informing product design, service models, and aftermarket support strategies. Based on Type, the market is studied across electric, hydraulic, and mechanical options; electric systems typically emphasize precision and integration with digital control suites, hydraulic options provide established force and depth capability for heavy-duty tasks, and mechanical configurations deliver simplicity and robustness where infrastructure constraints limit complexity.Material selection further bifurcates product strategies. Based on Material, the market is studied across composite and steel; composite alternatives, which include carbon fiber and fiberglass variants, offer weight and fatigue advantages that enhance transportability and fatigue life for cyclic operations, while steel options, including alloy steel and carbon steel, remain favored for cost-effectiveness and proven performance in abrasive or high-temperature environments. Application-driven differentiation is also essential: based on Application, the market is studied across drilling, well intervention, and workover. Drilling operations encompass directional drilling, horizontal drilling, and straight drilling and demand stiffness and fatigue resistance appropriate to wellbore geometry. Well intervention involves jetting, milling, and stimulation methods that require compatibility with downhole tooling and fluid systems. Workover activities such as acidizing, fishing, and logging place unique demands on run-in and retrieval dynamics, and they often prioritize service reliability and tool-change efficiency.

End-use considerations complete the segmentation picture. Based on End Use, the market is studied across geothermal, mining, and oilfield sectors; geothermal applications can prioritize high-temperature materials and thermal stability, mining deployments may emphasize abrasion resistance and modularity for confined spaces, and oilfield use cases frequently balance cost, availability, and integration with legacy workflows. Understanding these intersecting segments enables suppliers and operators to align product roadmaps and service offerings with the specific performance metrics and regulatory considerations that govern each use case.

How regional operating environments and regulatory expectations shape adoption, local content strategies, and aftersales support priorities across global coiled tubing markets

Regional dynamics exert a strong influence on how coiled tubing technologies are adopted, supported, and regulated, with each geographic cluster presenting distinct operational priorities and commercial structures. In the Americas, operators often favor scale and rapid mobilization; surface infrastructure and logistics networks support large fleets, and service models are optimized for long campaigns with integrated data and maintenance programs. Conversely, in Europe, Middle East & Africa, regulatory complexity and diverse operating environments drive demand for adaptability, with a premium on versatile equipment that can meet stringent safety and environmental standards while performing in high-temperature or corrosive settings.Asia-Pacific presents a different set of dynamics characterized by rapid infrastructure development, varied geology, and a mix of large national operators alongside emerging independents. This region frequently prioritizes cost-efficiency and local content, which incentivizes manufacturers to develop localized supply chains and partnerships. Across all regions, aftersales support and training are critical differentiators; proximity of service centers, availability of OEM-certified technicians, and the presence of regional testing facilities significantly influence procurement decisions. Additionally, the pace of technology adoption differs by region, with some markets quickly embracing digital solutions and advanced composites, while others favor proven steel-based systems supported by well-established service networks.

Understanding these regional distinctions enables more effective allocation of R&D investment, aftermarket resource placement, and partnership strategies, ensuring that product offerings align with local operating practices and regulatory expectations.

Competitive positioning rooted in systems integration, localized service networks, and digital-enabled offerings that drive sustainable differentiation

The competitive landscape is defined less by single-product dominance and more by the ability to combine engineering excellence with service delivery, supply chain management, and digital enablement. Market leaders typically excel at integrating surface control systems, advanced downhole tools, and telemetry packages while maintaining robust global service networks that ensure rapid mobilization and continuity of operations. These organizations leverage multidisciplinary engineering teams to optimize material selection and fatigue management, providing clients with equipment that balances performance with lifecycle cost.Smaller, specialized firms play an equally important role by focusing on niche technology areas such as composite fabrication, high-temperature tool design, or advanced logging and sensing packages. These specialists often partner with larger service providers to embed their innovations into broader offerings, accelerating adoption while managing commercialization risk. Additionally, channel partners and regional service organizations strengthen competitive positions by delivering localized maintenance, certification, and training programs, which are pivotal in long-term contract performance.

Strategic differentiation increasingly comes from data and digital services. Providers that couple physical products with analytics platforms, predictive maintenance services, and training modules are able to create recurring revenue streams and higher client stickiness. Finally, firms that invest in flexible manufacturing and supplier diversification mitigate exposure to trade policy and input volatility, which enhances reliability for customers operating in challenging geopolitical environments.

Actionable strategic steps for suppliers and operators to enhance resilience, accelerate technology adoption, and convert technical advances into service-based revenue streams

Industry leaders should adopt a strategic posture that balances near-term operational resilience with long-term technology positioning. First, prioritize supply chain diversification and flexible sourcing strategies to reduce exposure to trade-policy shocks and raw material concentration. Cultivate dual sourcing where feasible for critical inputs, and evaluate nearshoring options for key fabrication stages to shorten lead times and improve responsiveness.Second, invest in modular product architectures that enhance cross-compatibility between electric, hydraulic, and mechanical systems, enabling customers to tailor deployments without extensive retrofitting. This approach reduces capital friction for operators and broadens the addressable market for suppliers. Third, expand digital capabilities by integrating telemetry, fatigue modeling, and predictive maintenance into core service offerings. These capabilities convert episodic service events into data-driven contracts and create opportunities for performance-based commercial models.

Fourth, align R&D with application-specific needs identified through segmentation: prioritize high-temperature composite solutions for geothermal, abrasion-resistant steels for mining, and adaptable tooling platforms for complex oilfield interventions. Fifth, strengthen aftermarket and training networks in priority regions to improve uptime and client retention. Finally, incorporate tariff scenario planning into commercial contracts, ensuring transparent mechanisms for cost pass-through, lead-time adjustments, and change-of-law protections to preserve margin and client trust under volatile policy conditions.

A rigorous multi-source research approach combining primary interviews, engineering performance analysis, and scenario-based supply chain testing to validate operational applicability

This research applies a structured, multi-source methodology designed to ensure analytical rigor and relevance to decision-makers. Primary inputs include interviews with technical leaders, operations managers, and procurement specialists across multiple geographies, combined with engineering assessments and detailed product specification analysis. These qualitative insights are cross-validated with secondary technical literature, standards documentation, and publicly available engineering studies to ensure alignment with established performance principles and recent innovation trajectories.The analytical approach integrates comparative material-performance evaluation, scenario-based supply chain stress testing, and segmentation-driven capability mapping. Material performance reviews consider fatigue life, thermal stability, corrosion resistance, and manufacturability. Supply chain analysis models the impact of tariff scenarios on lead times, raw material sourcing, and contract structures, while capability mapping ties product attributes to specific application demands across drilling, well intervention, and workover domains.

Throughout the study, findings were evaluated against operational realities by reviewing case examples and field reports to confirm technical feasibility and commercial applicability. Limitations and areas of uncertainty are explicitly noted where proprietary data or market-sensitive variables could influence outcomes. Where appropriate, the methodology emphasizes transparency, reproducibility, and pragmatism to ensure that decision-makers can adapt the analytical templates to their internal data and operational constraints.

Synthesis of technical, commercial, and regional dynamics that highlights strategic pathways for converting innovation and resilience into sustained operational advantage

The coiled tubing ecosystem is entering a phase where incremental technical improvements yield strategic advantage when combined with resilient supply chains and service-led business models. Material innovations and electrification provide pathways to new operational capabilities, but their commercial impact depends on the ability of suppliers to integrate these advances with analytics, robust aftermarket support, and flexible manufacturing. At the same time, trade-policy developments in 2025 underscore the need for procurement strategies that prioritize supplier diversity and contractual clarity to manage cost and continuity risk.Segmentation analysis shows that different applications and end uses require tailored approaches: composite solutions unlock advantages in weight-sensitive or fatigue-critical environments, while steel variants retain relevance where cost and abrasion performance dominate. Regional dynamics further condition adoption, making local service presence and regulatory compliance essential components of competitive strategy. Ultimately, organizations that align engineering roadmaps with commercial mechanisms-such as performance-based contracts and digital services-will be best positioned to capture value and reduce operational exposure.

In closing, the path forward blends engineering excellence with commercial innovation. By embracing modularity, digitalization, and supply chain resilience, industry stakeholders can translate technological promise into repeatable operational performance and sustainable commercial outcomes.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Coiled Tubing Market

Companies Mentioned

The key companies profiled in this Coiled Tubing market report include:- ArcelorMittal S.A.

- Forum Energy Technologies, Inc.

- Gautam Tube Corporation

- Global Tubing LLC

- HandyTube International Inc.

- HandyTube LLC

- JFE Steel Corporation

- John Lawrie Group

- Kinnari Steel

- Nippon Steel Corporation

- Nucor Corporation

- POSCO Holdings Inc.

- Precision Tubes

- Quality Tubing Inc.

- Sandvik AB

- Stewart & Stevenson, LLC

- T&H Lemont Corporation

- Tata Steel Limited

- Tenaris Coiled Tubes

- Tenaris S.A.

- Trident Steel Corporation

- Vallourec S.A.

- Webco Industries, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | January 2026 |

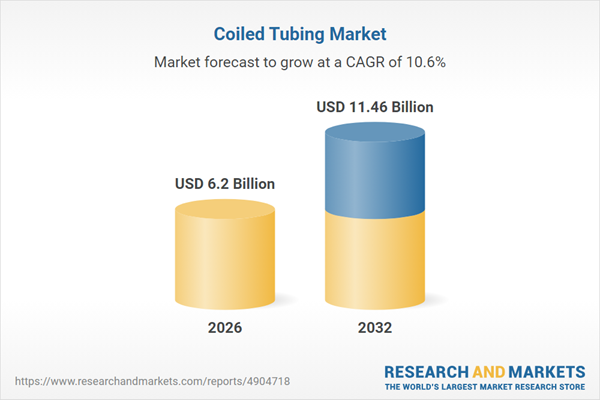

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 6.2 Billion |

| Forecasted Market Value ( USD | $ 11.46 Billion |

| Compound Annual Growth Rate | 10.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |