Commercial Telematics Market Trends:

Increasing emphasis on fleet management

The market is significantly driven by the need for enhanced fleet management efficiency. Fleet operators are constantly seeking solutions to optimize fuel usage, minimize idle times, and improve route planning. Telematics systems offer real-time data analysis, enabling operators to make informed decisions, thus reducing operational costs and increasing productivity. Additionally, these systems provide critical insights into vehicle health, helping in preventive maintenance and reducing downtime. This focus on efficiency not only helps in cost savings but also contributes to environmental sustainability by reducing carbon footprints.Technological advancements

The proliferation of the Internet of Things (IoT) and connected technology has been a key factor propelling the commercial telematics market. Telematics devices use IoT to connect vehicles to external networks, allowing for the exchange of data between vehicles and central systems. This technology facilitates real-time monitoring of vehicle location, status, and driver behavior. The integration of advanced sensors and machine learning algorithms further enhances the capabilities of telematics solutions, making them more accurate and reliable. These technological advancements have expanded the scope of telematics beyond traditional tracking, encompassing complex analytics for decision-making.Escalating demand for real time data analytics

There is a growing demand for real-time data analytics and reporting in the commercial vehicle sector. Telematics solutions provide a wealth of data on vehicle performance, driver behavior, and logistics management. The ability to analyze this data in real-time enables businesses to make swift, informed decisions that can significantly affect operational efficiency and customer satisfaction. This demand for actionable insights from vehicle data is a key driver for the adoption of telematics technology in commercial fleets.Stringent regulations

Governments worldwide are placing a growing emphasis on two critical aspects of the transportation industry: road safety and environmental impact. To address these concerns, regulatory bodies have introduced rules and regulations mandating the integration of telematics systems into commercial vehicles. These regulations serve a dual purpose: first, to enhance driver safety by monitoring and improving driving behavior, and second, to reduce the environmental footprint of commercial fleets by optimizing routes, reducing fuel consumption, and minimizing emissions. As a result, these regulations have emerged as powerful drivers propelling the growth of the commercial telematics market, as they encourage widespread adoption of telematics solutions to meet safety and sustainability objectives in the transportation sector.Commercial Telematics Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, system type, provider type and end use industry.Breakup by Type:

- Solution

- Fleet Tracking and Monitoring

- Driver Management

- Insurance Telematics

- Safety and Compliance

- V2X Solutions

- Others

- Services

- Professional services

- Managed services

Solution represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the type. This includes solution (fleet tracking and monitoring, driver management, insurance telematics, safety and compliance, V2X solutions, and others) and services (professional services, and managed services). According to the report, solution represented the largest segment.Breakup by System Type:

- Embedded

- Tethered

- Smartphone Integrated

Embedded accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the system type. This includes embedded, tethered, smartphone integrated. According to the report, embedded represented the largest segment.Breakup by Provider Type:

- OEM

- Aftermarket

Aftermarket represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes OEM and aftermarket. According to the report, aftermarket represented the largest segment.Breakup by End Use Industry:

- Transportation and Logistics

- Media and Entertainment

- Government and Utilities

- Travel and Tourism

- Construction

- Healthcare

- Others

Transportation and logistics accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes transportation and logistics, media and entertainment, government and utilities, travel and tourism, construction, healthcare, and others. According to the report, transportation and logistics represented the largest segment.Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- South Africa

- Turkey

- Saudi Arabia

- Others

North America leads the market, accounting for the largest commercial telematics market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa (South Africa, Turkey, Saudi Arabia, and others). According to the report, North America accounted for the largest market share.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- AirIQ Inc.

- Bridgestone Corporation

- General Motors Company (GM)

- Geotab Inc.

- Michelin Group

- MiX Telematics International (Pty) Ltd

- Octo Telematics S.p.A.

- Omnitracs LLC

- Trimble Inc.

- Bell Atlantic Corporation

- Continental AG

Key Questions Answered in This Report

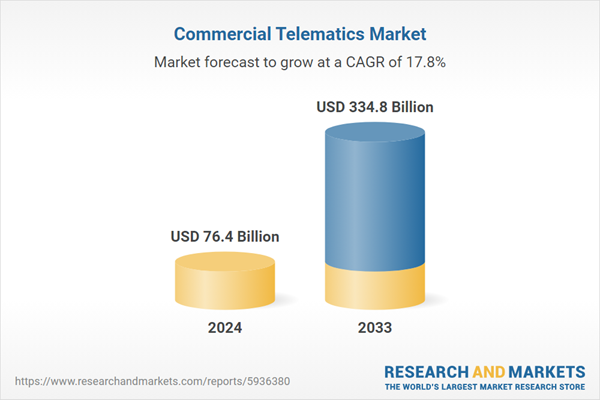

1. What was the size of the global commercial telematics market in 2024?2. What is the expected growth rate of the global commercial telematics market during 2025-2033?

3. What are the key factors driving the global commercial telematics market?

4. What has been the impact of COVID-19 on the global commercial telematics market?

5. What is the breakup of the global commercial telematics market based on the type?

6. What is the breakup of the global commercial telematics market based on the system type?

7. What is the breakup of the global commercial telematics market based on the provider type?

8. What is the breakup of the global commercial telematics market based on the end use industry?

9. What are the key regions in the global commercial telematics market?

10. Who are the key players/companies in the global commercial telematics market?

Table of Contents

Companies Mentioned

- AirIQ Inc.

- Bridgestone Corporation

- General Motors Company (GM)

- Geotab Inc.

- Michelin Group

- MiX Telematics International (Pty) Ltd

- Octo Telematics S.p.A.

- Omnitracs LLC

- Trimble Inc.

- Bell Atlantic Corporation

- Continental AG. etc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 76.4 Billion |

| Forecasted Market Value ( USD | $ 334.8 Billion |

| Compound Annual Growth Rate | 17.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |